Chainlink (WEB LINK) has actually been floating around $10 for a number of days, mirroring a 25.91% decrease over the previous month.

In the middle of enhanced market volatility, owners stay confident for a recuperation. Nonetheless, futures investors seem banking on a various end result.

Investors Program Little Confidence in Chainlink

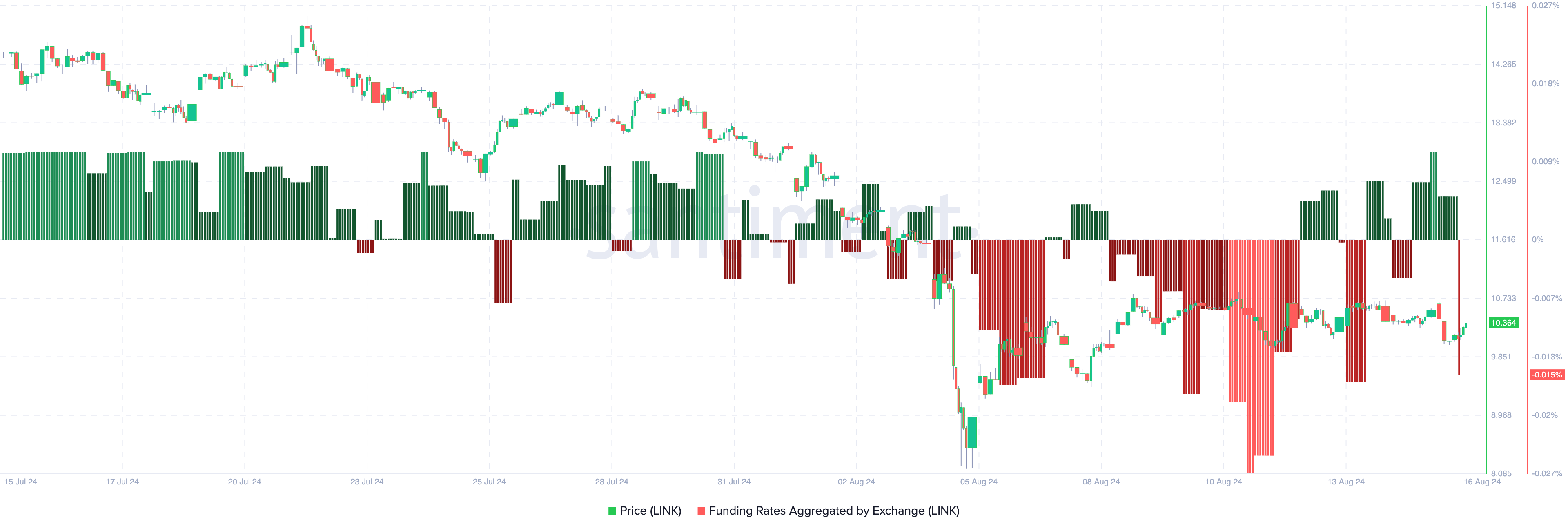

According to Santiment, Chainlink’s Financing Price dove to -0.015% earlier today. The Financing Price functions as an indication of investor belief. When favorable, it recommends that longs are paying shorts to preserve their settings, signifying positive outlook for a cost recuperation.

On the various other hand, an adverse Financing Price suggests prominence by brief settings, with wider assumptions of a cost decrease.

Formerly, the marketplace’s ordinary placement was long. Nonetheless, as displayed in current information, investors quickly changed towards shorts in between August 14 and 15. Throughout this duration, web link’s cost went down from $10.72 to $9.93 prior to experiencing a minor rebound.

Learn More: Chainlink ETF Described: What It Is and Just How It Functions

If this pattern rhymes with the last, after that it is feasible for the token’s worth to container. Nonetheless, thinking about various other indications provides even more understandings right into the prospective cost motion. To do this, BeInCrypto analyzes the Liquidation Heatmap.

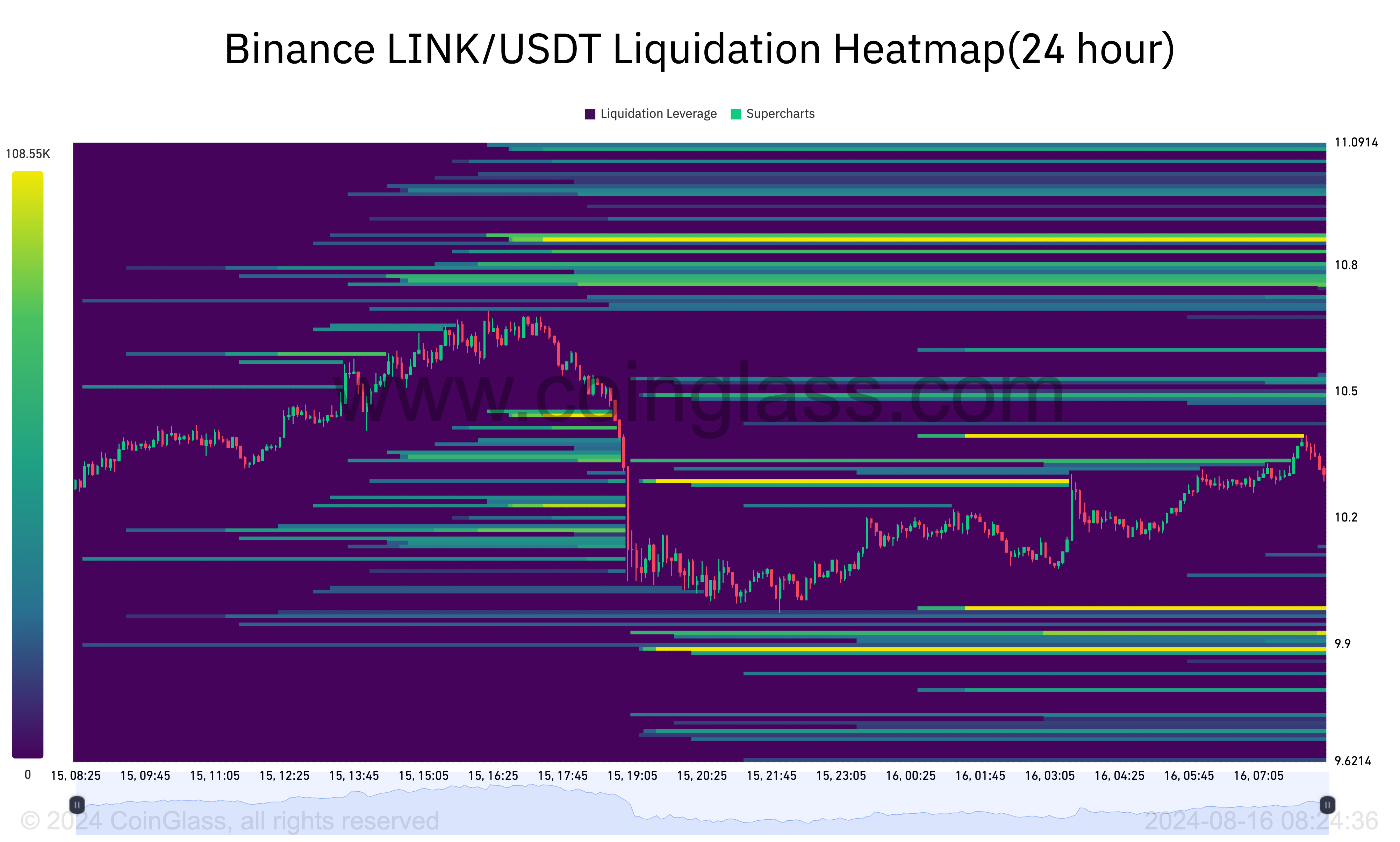

The Liquidation Heatmap recognizes area cost degrees where considerable liquidations may take place. In addition, it highlights locations of high liquidity, using investors understandings right into prospective future cost activities.

When liquidity collections at a particular array, rates typically incline that array. Commonly, the heatmap’s shade shifts from purple to yellow, showing high liquidity areas.

For Web Link, the 24-hour liquidation heatmap reveals hefty liquidity focus around $9.88 and $9.97. If offering stress escalates, web link’s cost might go down towards these degrees.

Nonetheless, on the advantage, cost degrees at $10.39 and $10.86 additionally reveal a high liquidity focus, recommending that the token might head towards these areas if customers take control.

Web Link Rate Forecast: Failing to Hold $10 Might Bring about $8

From a technological viewpoint, Chainlink has actually been trading within a coming down network given that late July. In addition, the On Equilibrium Quantity (OBV), which tracks trading stress, has actually reduced.

The decrease in OBV signals boosted circulation, recommending that even more financiers are offering than acquiring. If this fad proceeds, web link’s cost might dip even more listed below $10.32. Likewise, the Chaikin Cash Circulation (CMF) is additionally down.

Like OBV, the CMF compares build-up and circulation stages. A higher analysis suggests build-up, while a decrease indicate continuous circulation, enhancing the bearish expectation.

Learn More: Chainlink (WEB LINK) Rate Forecast 2024/2025/2030

Considered That web link is presently experiencing circulation as opposed to build-up, it suggests that the cryptocurrency is having a hard time to draw in the liquidity required to burst out of its drop. If this proceeds, web link’s cost might go down even more to $8.06.

A rise in acquiring stress could, nevertheless, turn around the existing drop. If build-up surges, web link might retest the $10.69 degree, with the opportunity of a cost reach $12.32.

Please Note

In accordance with the Count on Job standards, this cost evaluation post is for educational objectives just and need to not be taken into consideration monetary or financial investment guidance. BeInCrypto is devoted to exact, objective coverage, yet market problems go through alter without notification. Constantly perform your very own study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.