On Wednesday, Bitcoin (BTC) traded hands for as long as $61,809 after the United States Bureau of Labor Data (BLS) launched July’s Customer Cost Index (CPI) rising cost of living information, which can be found in at 2.9%, less than what was taped in June.

Nevertheless, this verified to be a “fakeout” as the leading coin’s cost quickly dropped to trade listed below the $60,000 cost mark.

Bitcoin‘s Quick Rally to $62,000

A “fakeout” takes place when a possession’s cost relocate one instructions, commonly deceptive investors, in the past rapidly reversing its training course. This occurred with BTC, which rallied to virtually $62,000 after the BLS launched July’s CPI.

As the marketplace resolved, the leading coin reversed its pattern and went down listed below $60,000 which shows up to have actually developed an important resistance degree. Since this writing, BTC trades at $58,069, dropping 8% in the previous 24 hr.

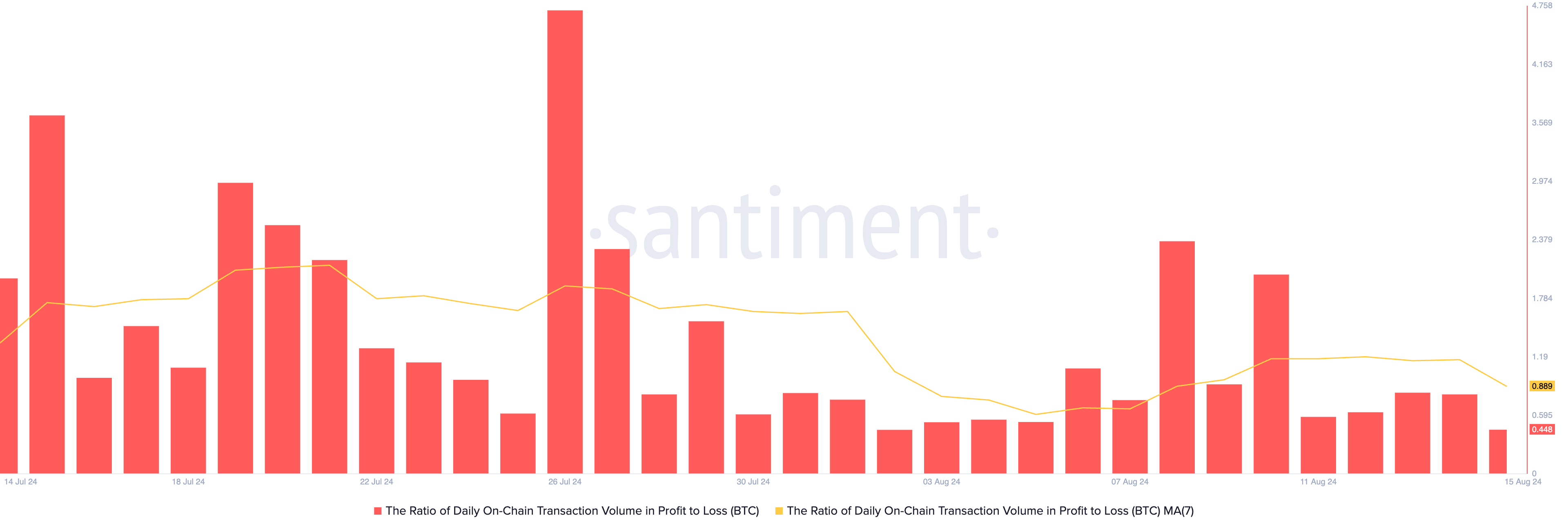

Given that it came to a head at $62,400 on August 9, the front runner crypto has actually discovered it tough to hold over $60,000, minimizing the variety of day-to-day deals that have actually led to revenue ever since. An evaluation of the coin’s proportion of day-to-day deal quantity in revenue to loss (utilizing a seven-day relocating standard) reveals that on Thursday, BTC investors taped much more losses than revenues.

At press time, the metric’s worth is 0.88, showing that for every single deal that has actually finished in a loss up until now today, just 0.88 deals have actually returned an earnings.

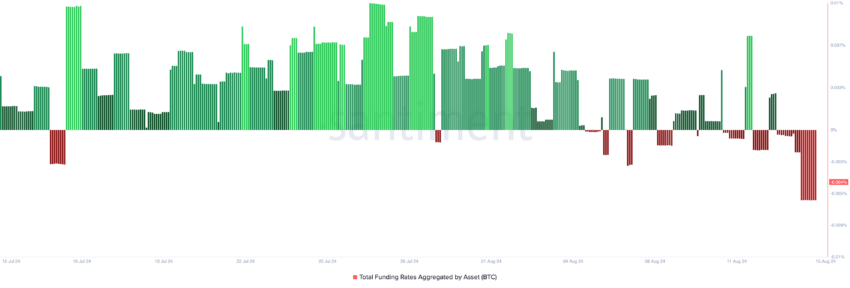

Additionally, the previous 24 hr have actually seen an uptick in the need for brief settings, as shown by its adverse financing price. Since this writing, the coin’s financing price throughout cryptocurrency exchanges is -0.004%.

Learn More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

When a possession’s financing price is adverse, there is even more need for brief settings. This indicates even more investors are getting the possession in expectancy of a rate decrease than there are investors getting the coin and expecting a rally.

BTC Cost Forecast: Coin Trades Below Secret Relocating Typical

BTC’s decrease listed below the $60,000 cost degree has actually pressed its cost listed below its 20-day rapid relocating standard (EMA). This determines the coin’s ordinary cost over the previous 20 trading days.

When a possession’s cost professions listed below this relocating standard, it indicates a bearish pattern or down energy in the short-term. This recommends the current cost activity is weak than the standard over the previous 20 days.

If BTC drops additionally from this essential relocating standard, it might dive to the following assistance degree at $54,847.

Learn More: That Possesses one of the most Bitcoin in 2024?

Nevertheless, if market belief changes from bearish to favorable, the coin’s cost might recover the $60,000 mark and profession over it at $61,388.

Please Note

According to the Depend on Task standards, this cost evaluation post is for informative functions just and ought to not be taken into consideration economic or financial investment suggestions. BeInCrypto is devoted to exact, objective coverage, however market problems undergo alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.