Heaps’ (STX) rate has actually risen 40% considering that striking an eight-month low of $1.10 on August 5, amidst a wider market decline.

With an 8% gain in the previous 24-hour, the altcoin shows up positioned to try a rally towards $2.

Stacks Goes Environment-friendly as Rate Of Interest Rises

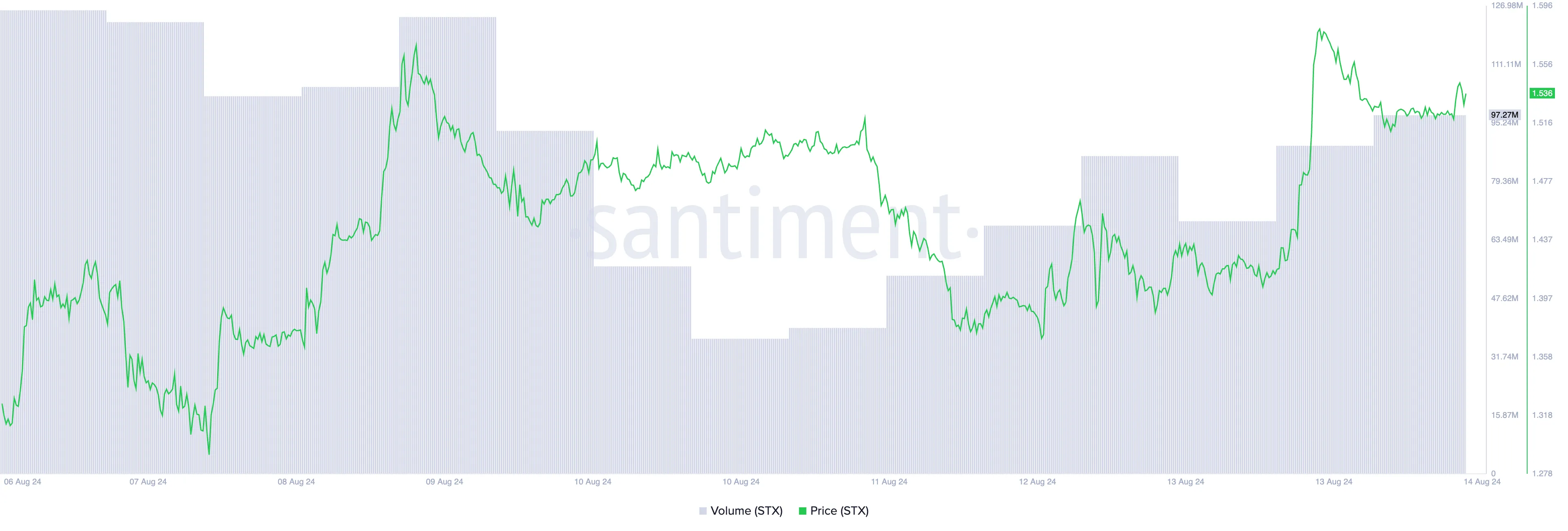

Presently, STX is trading at $1.54, sustained by an 8% rate rise in the last 24-hour. This rally is sustained by a 31% boost in trading quantity, which has actually gotten to $97 million throughout the exact same duration.

When a spike in trading quantity backs a possession’s rate rally, it recommends solid rate of interest and sentence from market individuals. This indicates that purchasing stress is high, and the marketplace view is favorable.

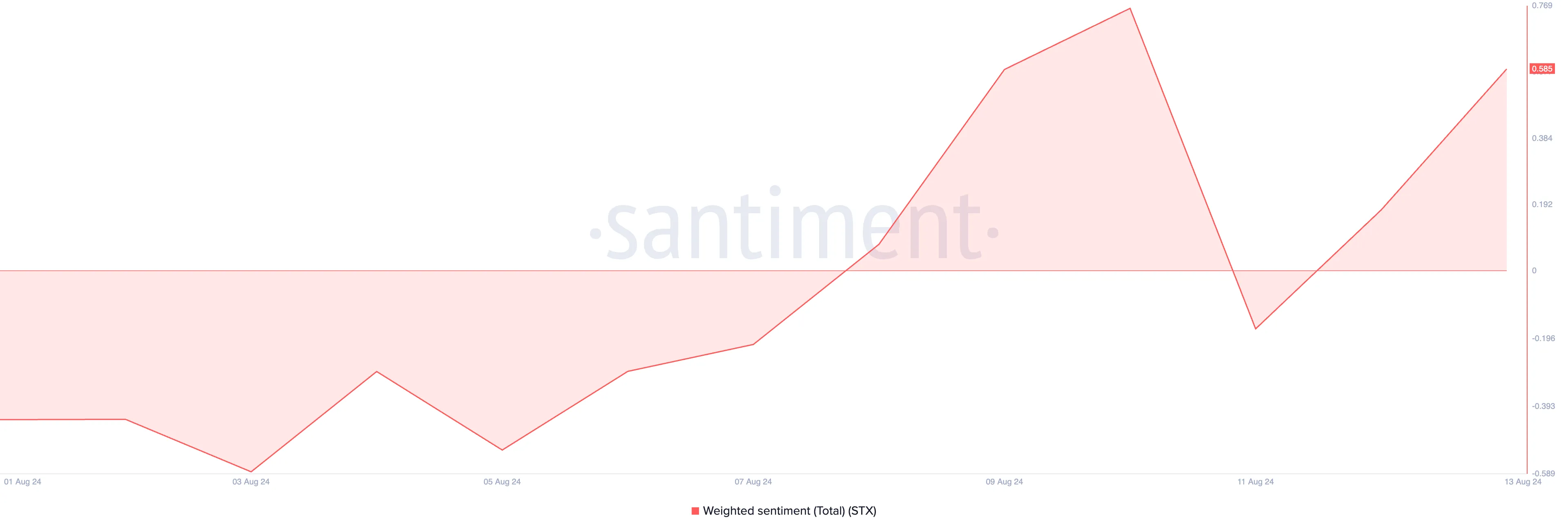

STX’s favorable heavy view validates the favorable prejudice that the altcoin presently appreciates. This statistics tracks the marketplace’s state of mind pertaining to a possession. When its worth declares, most of social media sites states, newspaper article, and various other on the internet conversations regarding the property are favorable. At press time, STX’s heavy view is 0.585.

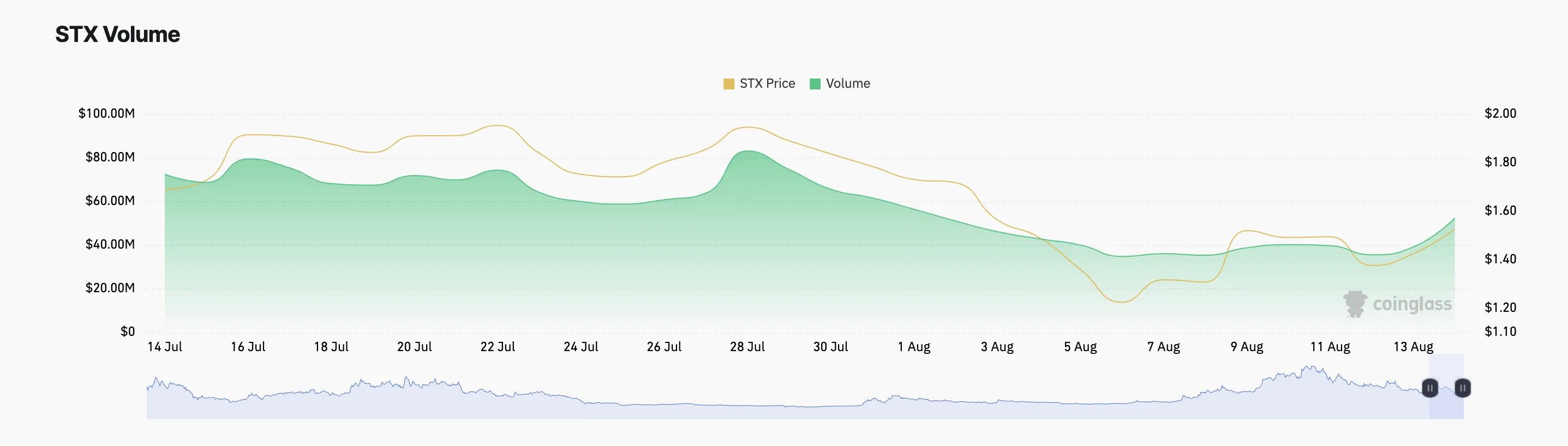

Better, STX’s rate rally has actually resulted in a rise in task in its by-products market. According to Coinglass, in the previous 24-hour, trading quantity in the token’s futures and choices market has actually completed $196.19 million, increasing by 60%. Furthermore, its open rate of interest has actually boosted by 29% throughout the exact same duration.

Learn More: What Are Decentralized Exchanges and Why Should You Try Them?

A possession’s futures open rate of interest describes the complete variety of superior futures agreements that have actually not been resolved. When it increases such as this, it indicates that even more investors are becoming part of brand-new placements.

STX Rate Forecast: Purchasing Stress Eclipses Selloffs

STX’s rate walk has actually led the way for its bulls to gain back market prominence, as shown by its Directional Motion Index (DMI). This indication, analyzed on a 12-hour graph, reveals that the token’s favorable directional indication (+ DMI) just recently went across over its unfavorable directional indication (- DMI).

A possession’s DMI determines the stamina and instructions of a fad. When the +DI is over the -DI, it recommends that the uptrend is solid. It shows the existence of favorable market problems, where acquiring stress is starting to control, and the property is most likely to proceed its uptrend.

Better, the altcoin has actually developed a rising network within which it presently patterns. This network is developed when a possession’s rate develops a collection of greater and reduced highs. It is a favorable signal and a graph of an uptrend.

Learn More: Leading 10 Aspiring Crypto Coins for 2024

If STX continues to be within this network, its rate can rally previous $1.70 and head towards $2.10. Nonetheless, if the present fad turns around, the altcoin’s rate might damage listed below the network’s assistance and decline to $1.05.

Please Note

According to the Count on Task standards, this rate evaluation write-up is for educational functions just and must not be taken into consideration economic or financial investment recommendations. BeInCrypto is dedicated to precise, objective coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.