Denver-based Real estate professional Bret Weinstein tackled a customer whose home had actually gotten on the marketplace for 60 days.

Regardless of going down the rate to $625,000 from $650,000, it rested for one more 45 days without deals. An additional rate cut to $600,000 really did not aid either, as it caused one more 20 days of radio silence.

” We after that changed stagers, and the home marketed with numerous deals in a day,” he stated.

The bargain is a sign of exactly how information matter in a market like Denver where home-price development has actually reduced drastically after a rise in post-pandemic movement to the city location created appraisals to climb dramatically in a brief time period.

If homes are valued properly and marketed well, customers will certainly make deals. Otherwise, the listing might rest for months.

“[The buyer] obtained an offer,” Weinstein stated of the $600,000 acquisition rate. “The hosting had not been rather ideal for the home. There’s no such point as excellence, however you sure as heck need to pursue it on the listing side.”

Given that the start of the COVID-19 pandemic, Denver has actually been among the best markets in the nation having actually soaked up significant incoming movement from The golden state, New York City, Texas, and Chicago, to name a few locations. According to information from CoreLogic, Denver’s typical rate per square foot has actually increased 35% considering that 2020.

This offered vendors the advantage, however the marketplace has actually kipped down current months. Denver’s populace inflow has actually become a discharge, as the city location has actually shed citizens to locations like North Carolina that provide comparable social worths at a less expensive expense of living. John Burns Real Estate Consulting Burns information reveals Denver’s internet house development has actually transformed adverse by 2.1% year over year.

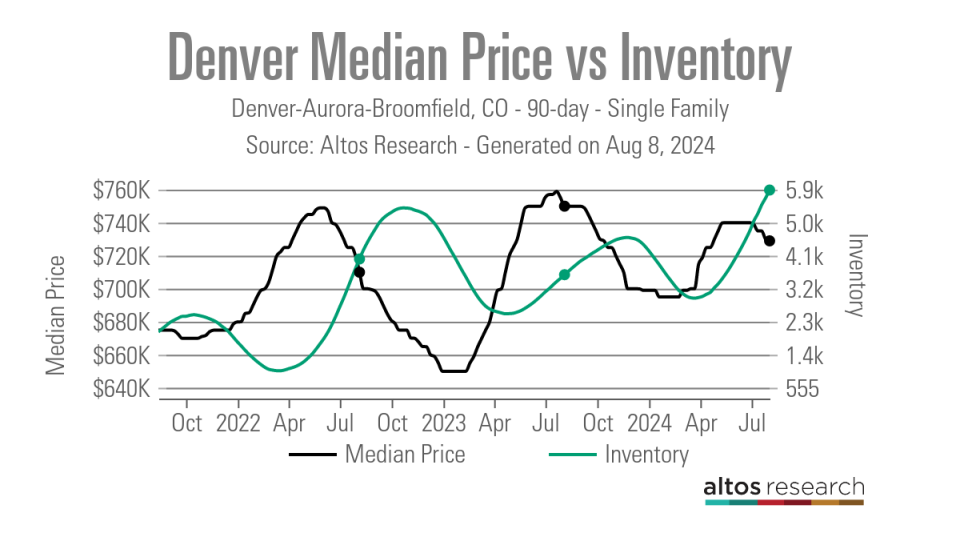

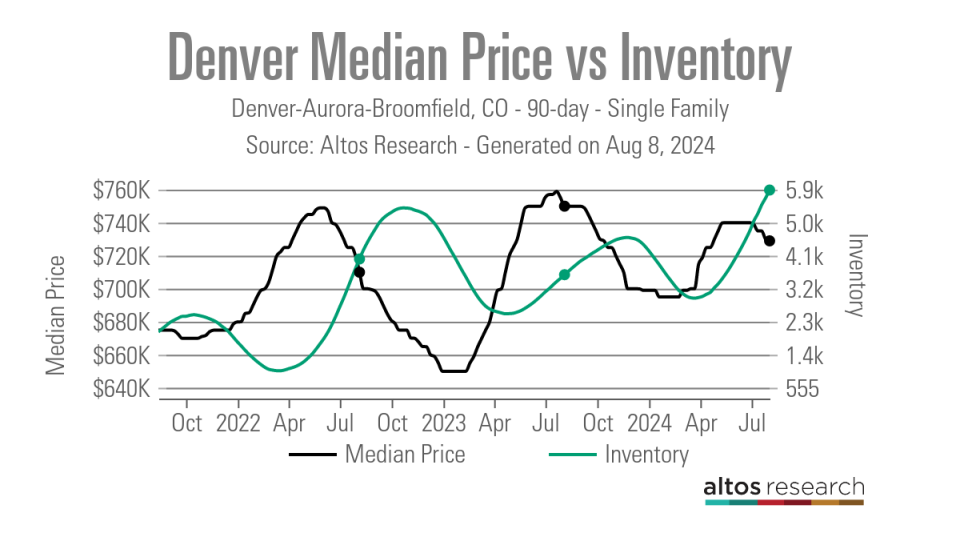

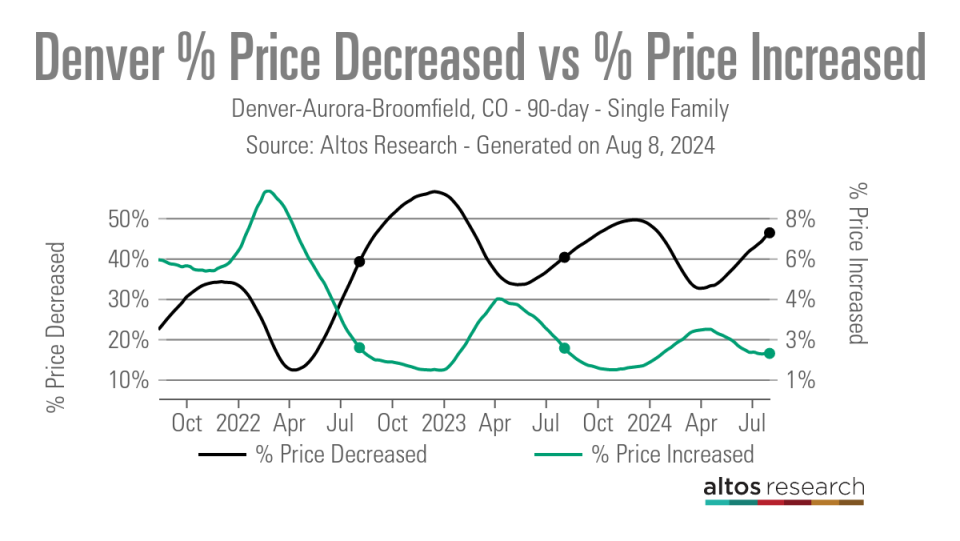

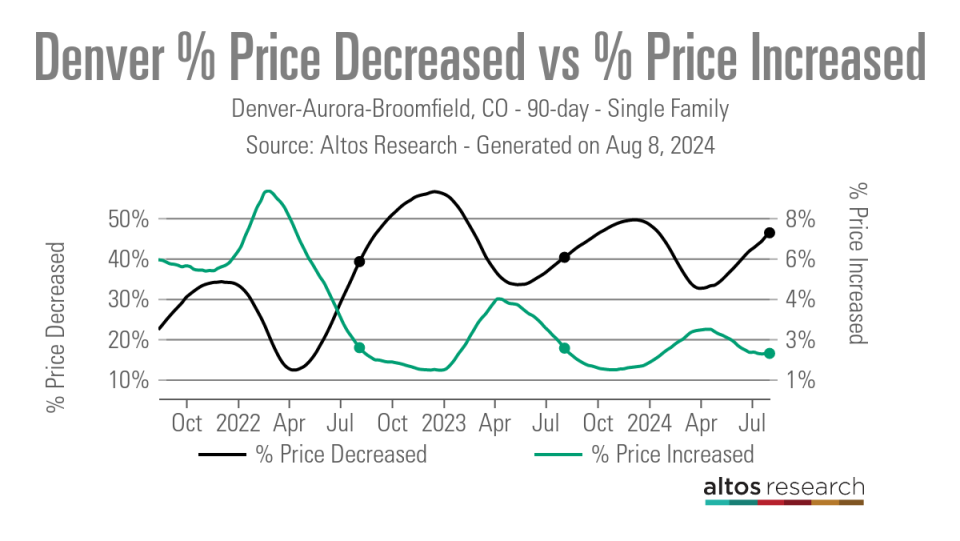

The loss of populace has actually softened real estate need, as has the quick increase in mortgage rates that started in the springtime of 2022. This has actually taken power far from vendors, that currently encounter a scarcity of possible customers.

Supply in the city has actually additionally increased dramatically, offering customers much more alternatives and even more utilize in arrangements. Additionally, a large quantity of the stock is brand-new building, and building contractors have the ability to provide much better funding terms for customers with their internal home mortgage organizations. This leaves vendors of existing homes needing to complete on rate with homebuilders.

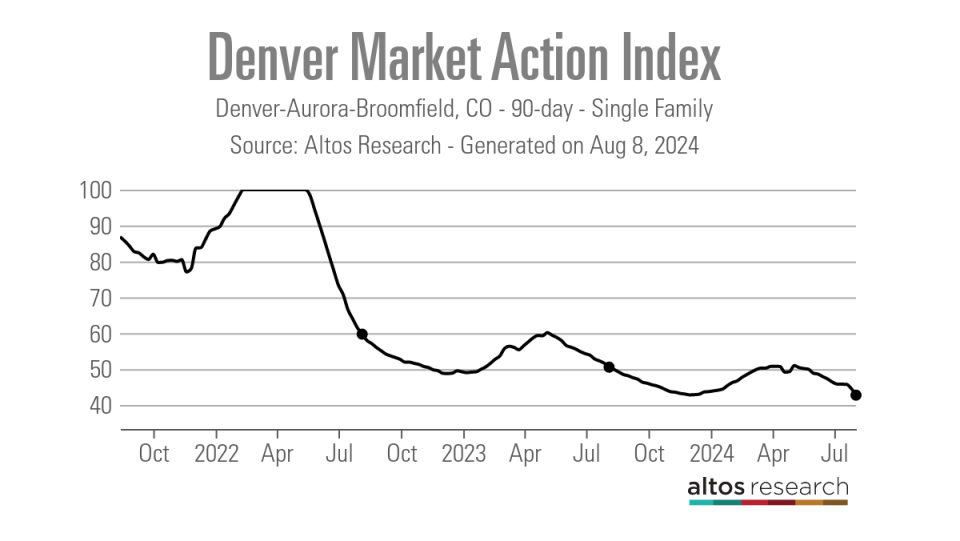

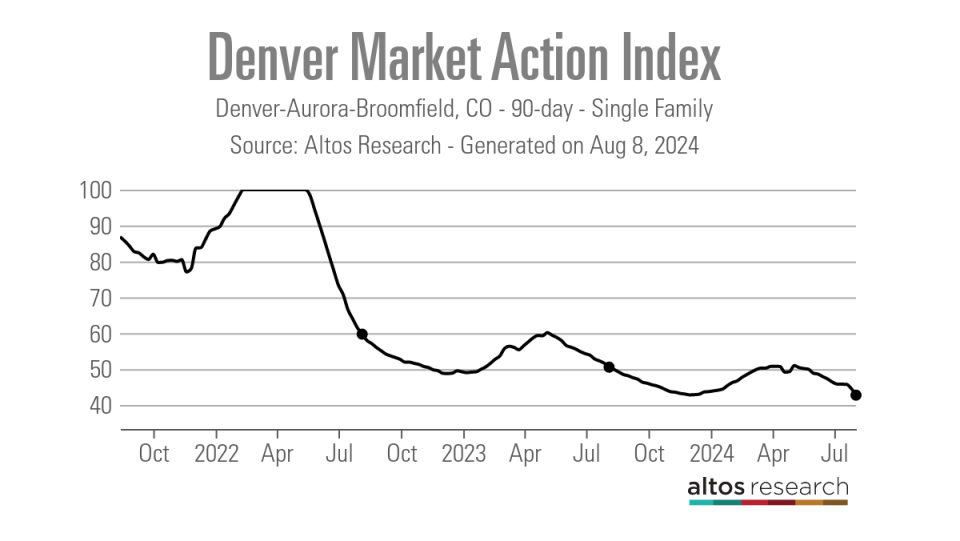

Altos Research’s Market Activity Index subjects exactly how drastically the dynamic has actually transformed in between customers and vendors over the last pair years. The index thinks about anything over 30 to be a vendors market, and it presently rests at 38. At the time home mortgage prices began increasing in 2022, the index in Denver went to 100– the optimum worth of the index.

Real estate agents on the ground claim that also in the last couple of months the marketplace has actually moved even more towards customers, however several customers are material to wait up until rate of interest go down, contributing to the problem vendors have. The customers that remain in the marketplace are buying the typical factors.

” The 5 Ds are still occurring– fatality, baby diapers, diplomas, rubies, and separation,” stated Compass-affiliated real estate agent David DiPetro. “[Buyers] are attempting to see what’s occurring with rate of interest, however that does not influence a vendor wishing to offer their home. Individuals still require to upsize or scale down.”

The customers out there have a tendency to fit a comparable account. Compass real estate agent Kelly Moye claims both customers and vendors have a tendency to be individuals in their very early to mid-30s that are experiencing a significant life occasion that needs a brand-new area to live.

” I fulfilled individuals the other day at an open home that I kept in Denver, and all 3 of them fit the specific very same account,” she stated. “They have actually currently had a home, and they are relocating currently since they intend to remain in a connection. They intend to purchase keeping that companion. So they’re individuals that have a factor to relocate, not individuals that resemble ‘Oh, it would certainly behave to have a larger lawn so allow’s action.’ Those individuals are waiting by the sidelines.”

They might not be waiting a lot longer. The market crash early today pressed home mortgage prices down, and they currently rest at 6.74%. Moreover, the Federal Book is anticipated to reduce prices in September, which several representatives think will certainly trigger a wave of brand-new need.

” If [mortgage rates] can enter into the 5% variety, our customers that are resting on the sidelines are mosting likely to go nuts,” Moye stated.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.