On Monday, MakerDAO formally released the Glow Tokenization Grand Prix, an enthusiastic competitors to onboard as much as $1 billion of tokenized properties, especially concentrating on short-duration United States Treasury Expenses.

The competitors is a campaign by SparkDAO, a subDAO of MakerDAO. It is made to analyze individuals’ capacity to provide liquidity, line up with MakerDAO’s vision, and present unique remedies within the decentralized money (DeFi) community. The entry target date is September 20, 2024, providing individuals simply over a month to settle their propositions.

OpenEden’s Compliance-Driven Technique to MakerDAO’s Challenging Requirements

In an administration post, Steakhouse Financial, a treasury monitoring company and a critical money core device of MakerDAO, supplied information concerning a competitors. The company mentioned that the competitors would certainly assess items based upon their lawful framework, price performance, and liquidity stipulations.

In addition, they emphasized the need for critical positioning with MakerDAO’s objectives. Furthermore, they concentrated on items with the ability of using appealing returns and the needed liquidity for regular rebalancing.

Find Out More: Just How To Buy Real-World Crypto Properties (RWA)?

A number of noticeable real-world properties (RWA) market gamers, consisting of Securitize, OpenEden, and Superstate, have actually gotten in the competitors. Each of these companies has actually laid out special methods that highlight their dedication to conference MakerDAO’s liquidity and funding performance standards.

Jeremy Ng, founder of OpenEden, revealed his self-confidence in the efficiency of the company’s front runner item, TBILL. According to him, TBILL’s uniformity in supplying premium quality and extraordinary liquidity will certainly make it an eye-catching choice for DAO treasury supervisors. He additionally kept in mind that OpenEden’s governing conformity will certainly place it as a solid challenger in the competitors.

” Governing conformity is a crucial factor to consider for DAO treasuries. We run a certified fund monitoring business in Singapore that manages the BVI-registered fund backing the TBILL symbols. Acquiring (and preserving) this condition is no mean task. It calls for the supervisor to go through an extensive, recurring evaluation of its capacities by the Singapore monetary regulatory authority, consisting of audits, monetary coverage, and so on,” Ng described to BeInCrypto.

Superstate’s Strategies: Leveraging DeFi Competence to Increase DAI Security

Superstate, led by chief executive officer and creator Robert Leshner, is one more noteworthy participant in MakerDAO’s Glow Tokenization Grand Prix, with its main offering, USTB. In an e-mail to BeInCrypto, Fig Dress, the Procedure Relations Lead at Superstate, disclosed that its proposition to MakerDAO concentrates on incorporating USTB right into MakerDAO’s community to boost the security of DAI– MakerDAO’s front runner stablecoin.

Besides USTB’s enticing return, reduced charges, and everyday liquidity, Dress additionally highlighted the openness of USTB’s underlying holdings. These holdings can be checked via the business’s site or with on-chain rates utilizing a Chainlink oracle. This openness, together with the upcoming real-time stability via Chainlink’s Evidence of Reserves, makes certain that MakerDAO can maintain high degrees of liquidity and security for DAI.

” With deep DeFi and standard funding markets experience, Superstate brings the know-how to sustain and create the industry-specific requirements Manufacturer and various other procedures might have. By onboarding to Superstate, Manufacturer and its SubDAOs will certainly access to present and future items released by Superstate Inc. and assimilations that create via collaborations with various other procedures to increase the energy of USTB and future items,” Dress included.

Securitize’s Vision for Tokenized Treasuries in DeFi’s Future

Securitize, one more principal in the RWA market, has actually additionally verified its engagement. In the competitors, it will certainly team up with BlackRock’s BUIDL, the biggest tokenized treasury fund to day.

Carlos Domingo, Securitize’s chief executive officer and founder, revealed his exhilaration concerning joining the Glow Tokenization Grand Prix. Moreover, he kept in mind that Securitize’s participation with MakerDAO and various other DAOs showcases the expanding acknowledgment of tokenized treasuries as a crucial element of treasury monitoring in DeFi.

” The crypto market is presently around $2.5 trillion, however stablecoins compose concerning $150 billion, and treasuries just compose $2 billion. You’ll begin to see a change extra in accordance with the standard money globe, where you have $2 of treasuries per each buck of real cash money. As even more of these DAOs place their funds right into these tokenized treasury items, we’ll begin to see a thrill right into the marketplace which will just make our present development rise significantly,” Domingo informed BeInCrypto.

MakerDAO’s Glow Tokenization Grand Prix contributes to the expanding checklist of DAOs and DeFi tasks curious about tokenized properties. BeInCrypto formerly reported that in June, the Arbitrum action Board suggested expanding 35 million ARB symbols ($ 24.5 million) from the Arbitrum DAO Treasury right into 6 chosen tokenized treasury items. In addition, in July, Ethena, the entity behind the artificial buck token USDe, allocated some funds from its get fund to yield-generating RWA offerings.

Find Out More: What is The Influence of Real Life Possession (RWA) Tokenization?

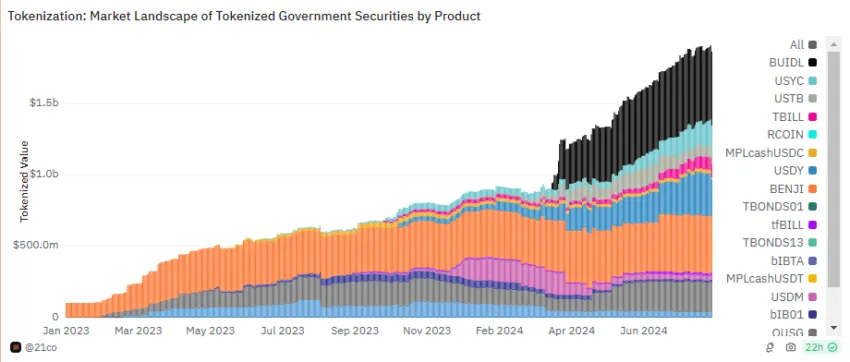

According to a current record by a 21. carbon monoxide expert, the influence of this pattern amongst DAOs and DeFi tasks is anticipated to drive the tokenized United States treasury market to get to $3 billion by the end of 2024. This forecast additionally lines up with the marketplace’s 200% development price. 21. carbon monoxide information exposes a boost in this sector’s worth from $592.63 million to $1.86 billion year-to-date.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to give exact, prompt info. Nevertheless, visitors are recommended to confirm realities separately and seek advice from an expert prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.