Markets are considering upcoming analyses on rising cost of living and the customer complying with an unpredictable run recently, stimulated by an unsatisfactory work report that revealed trouble is, well, trouble once more.

” Considering that the launch of the July work record, economic markets have actually been concentrated on the labor market and the effects for Federal Book plan, yet the opposite side of the reserve bank’s twin required will certainly return forward throughout the week in advance,” Oxford Business economics lead economic expert Nancy Vanden Houten created in a note to customers on Friday.

The July Customer Rate Index (CPI) will certainly work as the following large examination for rising cost of living (and for markets).

” We anticipate the July CPI to be a touch much less pleasant than the weaker-than-expected June analyses, yet do not believe the information will certainly tremble the Fed’s self-confidence that rising cost of living is relocating the best instructions,” Houten stated.

According to Bloomberg agreement quotes, heading rising cost of living, that includes the rate of food and power, is anticipated to publish a yearly gain of 3%, unmodified from June’s analysis. However the statistics is readied to increase 0.2% month over month after decreasing 0.1% in June.

On a “core” basis, which removes out the a lot more unpredictable expenses of food and power, rising cost of living is anticipated to tick up 3.2% year over year, a slowdown from the 3.3% rise seen in June. Regular monthly core rate are anticipated to have actually increased 0.2% contrasted to a 0.1% rise in June.

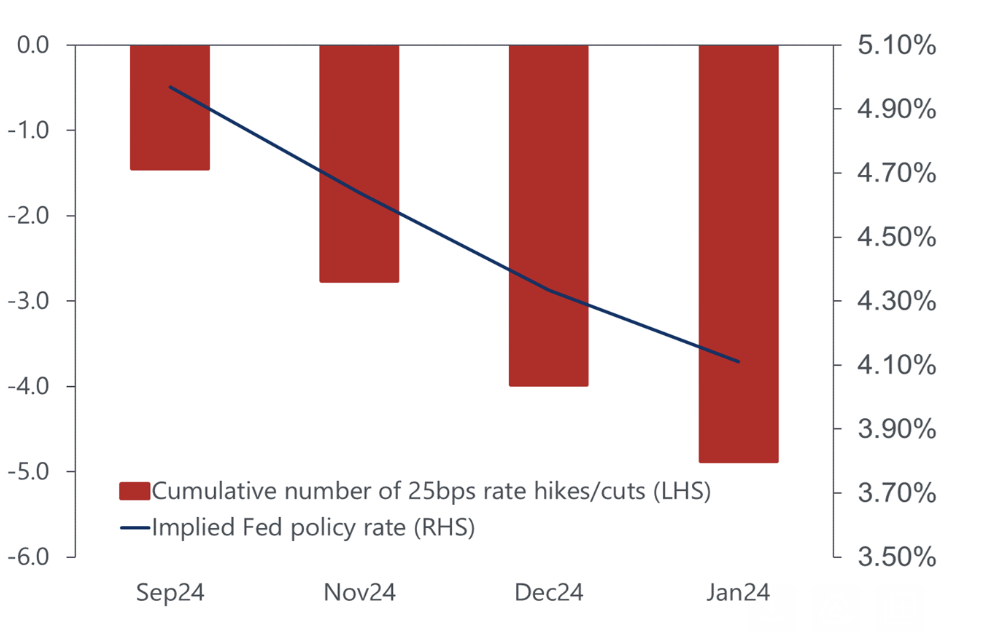

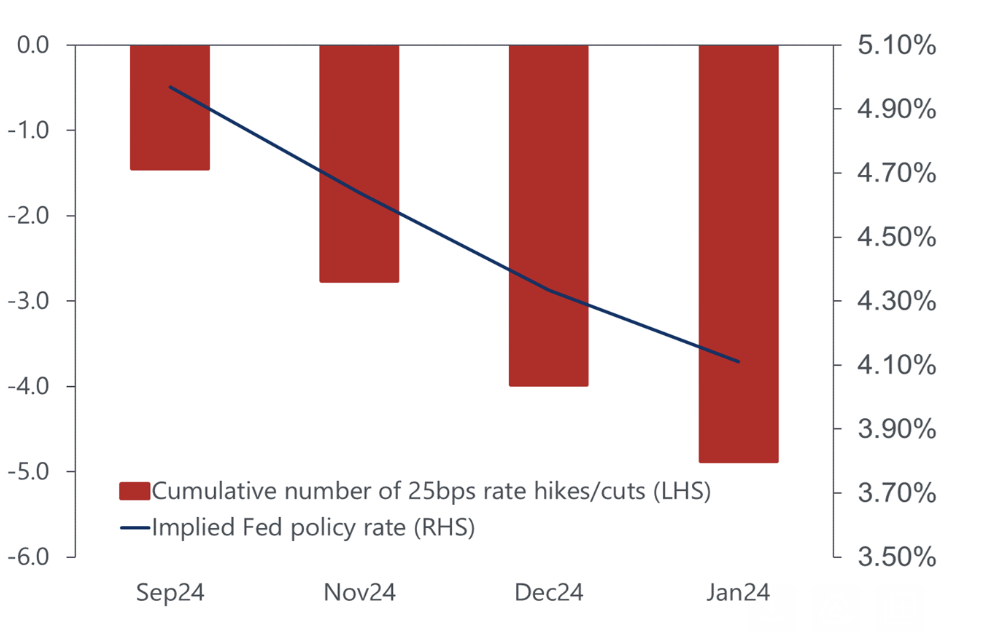

Since Monday, markets were valuing in an approximately 52% opportunity the Federal Book reduces rate of interest by 50 basis factors by the end of its September, below a 85% a week prior, per the CME Fedwatch Tool.

” In our sight, economic markets paniced to the most recent set of work stats, prices in a 50 basis factor (bp) price cut for September, and greater than 100bps in cuts for the year,” Houten created.

” Throughout the week, markets downsized assumptions, although they remain to prepare for greater than 50bps in cuts than we anticipate for the year. We recognize a boosted threat of an extra hostile speed of plan normalization if future work records are weak than anticipated, yet we fit with our standard projection.”

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.