Zcash (ZEC), the decentralized cryptocurrency produced to enhance personal privacy in the blockchain market, has actually seen its rate rise by an incredible 90% in the last 1 month.

This rise makes ZEC among the leading 3 carrying out altcoins. Trading at $41.36, this evaluation clarifies why the coin might not have the ability to maintain its energy

The Storms Are Collecting Over Zcash Stellar Rally

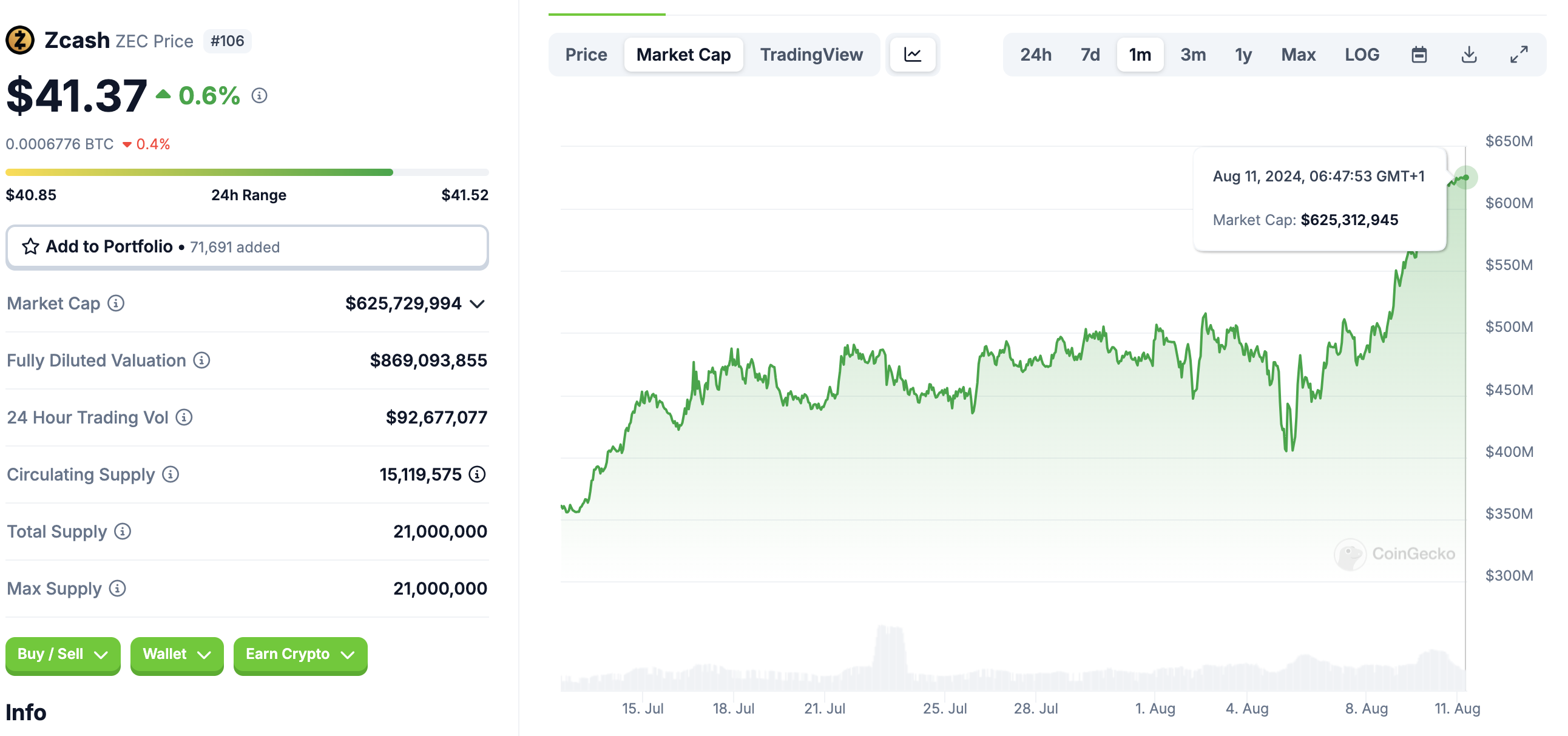

On July 12, ZEC’s rate was around $23.81, suggesting the present rate is nearly dual the worth since after that. Nonetheless, that is not the only component that has actually transformed.

According to CoinGecko, the marketplace cap has actually additionally significantly enhanced. On the exact same day, the cryptocurrency traded around the previously mentioned rate; Zcash’s market cap was $360.68 million.

For context, the marketplace cap is an item of rate and flowing supply. Although the job’s optimum supply is 21 million– the like Bitcoin (BTC), just 15.11 million remain in flow. At press time, the marketplace capitalization had actually enhanced to $625.72 million, suggesting that the rate rise was vital to this substantial dive.

Find Out More: Leading 7 Personal Privacy Coins in 2024

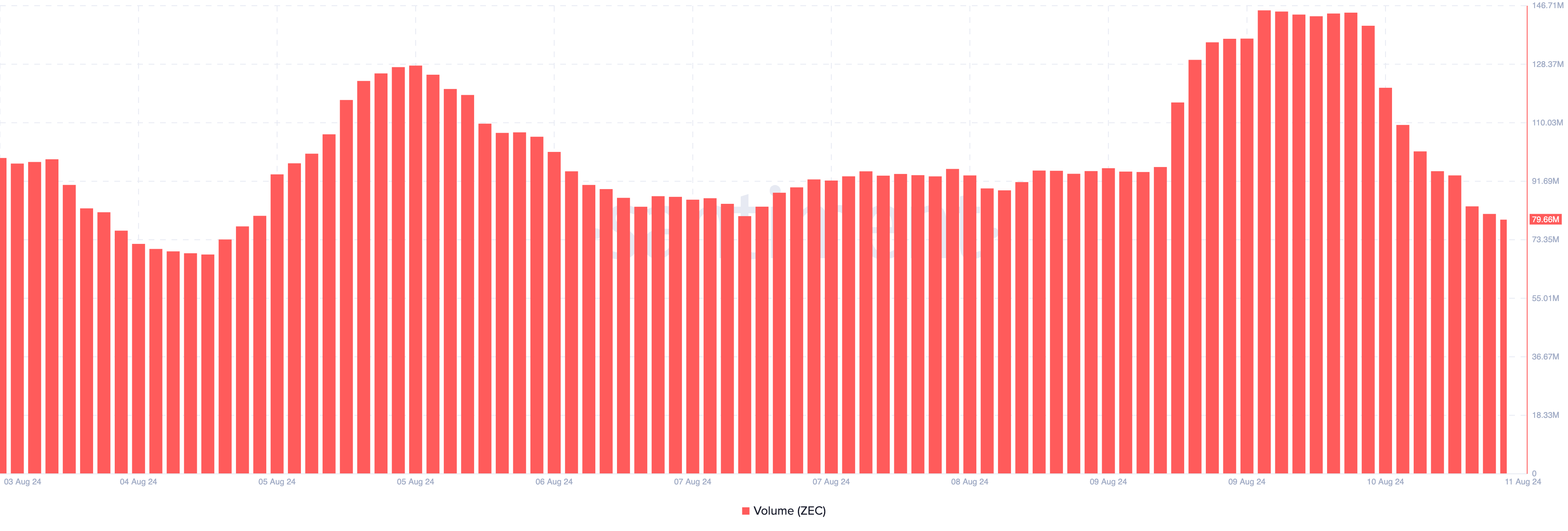

In spite of this rise, ZEC’s quantity has actually taken the various other course. On August 10, Zcash’s quantity mored than $145 million, recommending that there was a great deal of rate of interest in the cryptocurrency. However since this writing, the statistics has actually dropped by 44.99% to 79.66 million.

Generally, climbing quantity together with climbing rate is a favorable indicator, recommending that there is even more purchasing power than marketing. On the other hand, when quantity lowers in this circumstance, it suggests that bulls are shedding supremacy, and the crypto rate included threats losing several of its worth. As a result, if the quantity remains to drop, ZEC’s rate can drop listed below $41 in the short-term.

ZEC Rate Forecast: Gains Days Over, Retracement Next

ZEC’s noteworthy uptrend started in July. Throughout that duration, the coin climbed from much less than $18 to strike $34.75 on August 3. Minutes hereafter, the rate dealt with being rejected, going down to a swing low of $25.43.

Nonetheless, sustained by enhancing favorable energy, the coin got to an optimal of $42.97. On the other hand, the Family Member Toughness Index (RSI) is 77.02 at press time. The RSI is a technological indication that gauges the size of rate and rate adjustments to establish energy.

It additionally informs when a cryptocurrency is overbought or oversold. Analyses at 70.00 or over imply a coin is overbought, while those at 30.00 are oversold. When oversold, the rate of a crypto can turn around to the benefit.

For That Reason, in ZEC’s instance, a retracement can be following. Utilizing the Fibonacci retracement degrees– an indication practical in determining assistance and resistance, ZEC’s rate can go down to $37.18 in the short-term.

Find Out More: Zcash (ZEC) Rate Forecast 2024/2025/2030

Nonetheless, a bounce from this degree might stop one more slump. Rather, especially if purchasing stress boosts, ZEC might surpass $42.97 and most likely examine the $44 area.

Please Note

In accordance with the Trust fund Task standards, this rate evaluation post is for informative objectives just and must not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, yet market problems go through transform without notification. Constantly perform your very own study and seek advice from a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.