The rate of IO, the indigenous token of leading DePIN services service provider io.net, has actually risen by 32% from its Monday low of $1.50. The altcoin had actually gone down to this reduced adhering to a basic market recession that resulted in over $1 billion in liquidations.

As the wider market recuperates, IO’s rate has actually climbed by dual figures considering that Monday. Nonetheless, this rally might be temporary.

io.net Allies With Leonardo AI, IO Skyrockets

Aside from the wider market rally, the rise in IO’s rate is likewise as a result of the buzz around io.net’s brand-new collaboration with aesthetic assets-generation system Leonardo AI. The collaboration will certainly make it possible for io.net to provide Leonardo AI with extra enterprise-grade NVIDIA GPUs, increasing the system’s computational capability and scalability.

” io.net has actually confirmed to be a very useful companion in giving the calculate Leonardo AI requires to range in order to equal our fast development. Leveraging these L40S GPUs from io.net will certainly permit our system to offer our consumers quicker than ever before making use of best-in-class innovation that has actually been enhanced for AI inferencing. With the assistance of io.net, we expect onboarding countless customers, certain that we have the calculate capability we require, also throughout durations of peak need,” Leonardo AI Founder and CFO Chris Gillis claimed.

At press time, IO is trading at $1.75. Nonetheless, crucial signs on the one-day graph recommend that the token might quickly shed the gains tape-recorded considering that Monday.

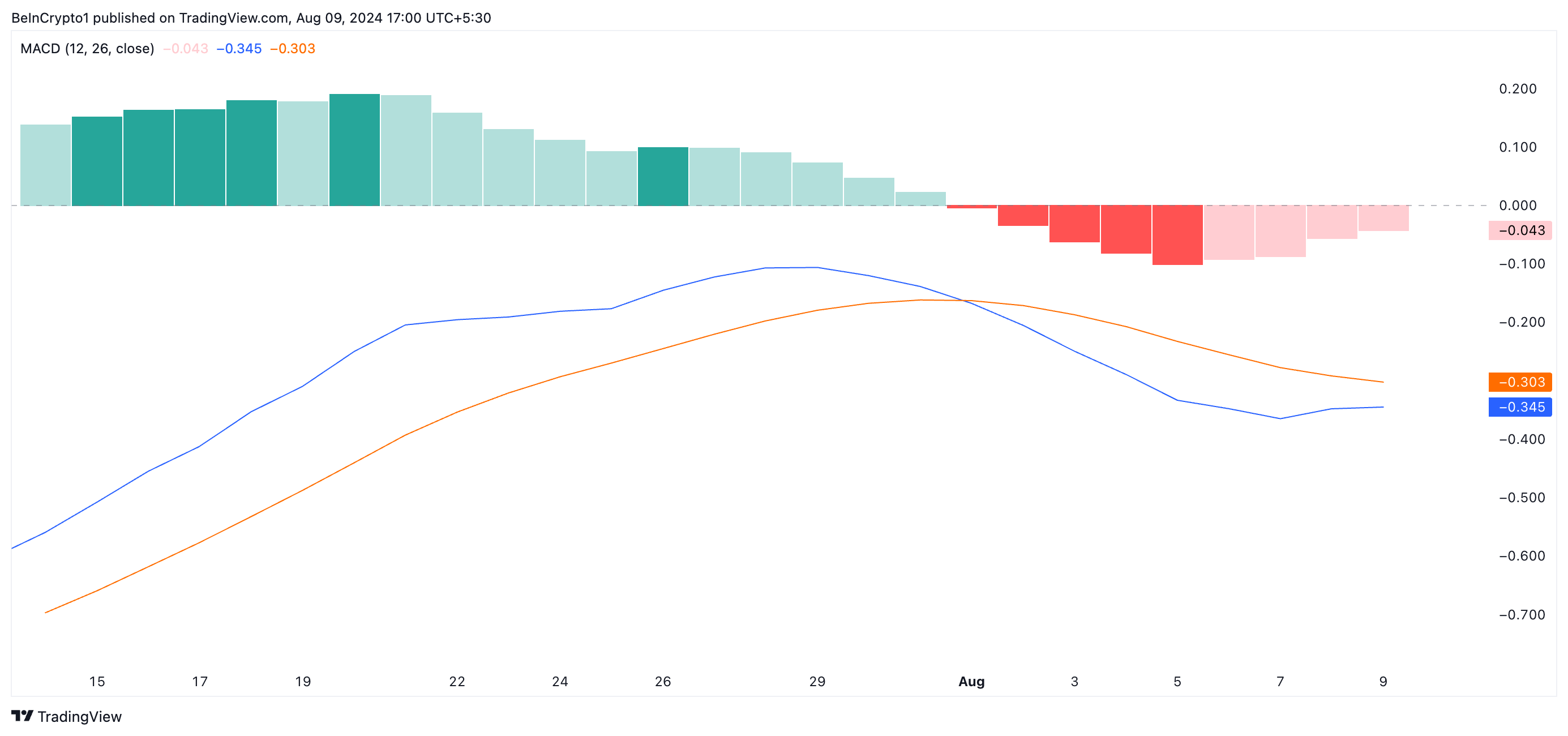

The Relocating Typical Convergence/Divergence (MACD) indication reveals that the bearish predisposition stays solid in spite of the rally. IO’s MACD line (blue) is presently listed below both its signal line (orange) and the no line.

A property’s MACD recognizes its pattern instructions, changes, and possible rate turnaround factors. When the MACD line goes across listed below both the signal and no lines, it indicates solid bearish view in the marketplace.

The decrease listed below the signal line shows damaging energy, while going across listed below the no line validates the toughness of the drop. Investors typically see this as a chance to leave lengthy settings and take brief ones.

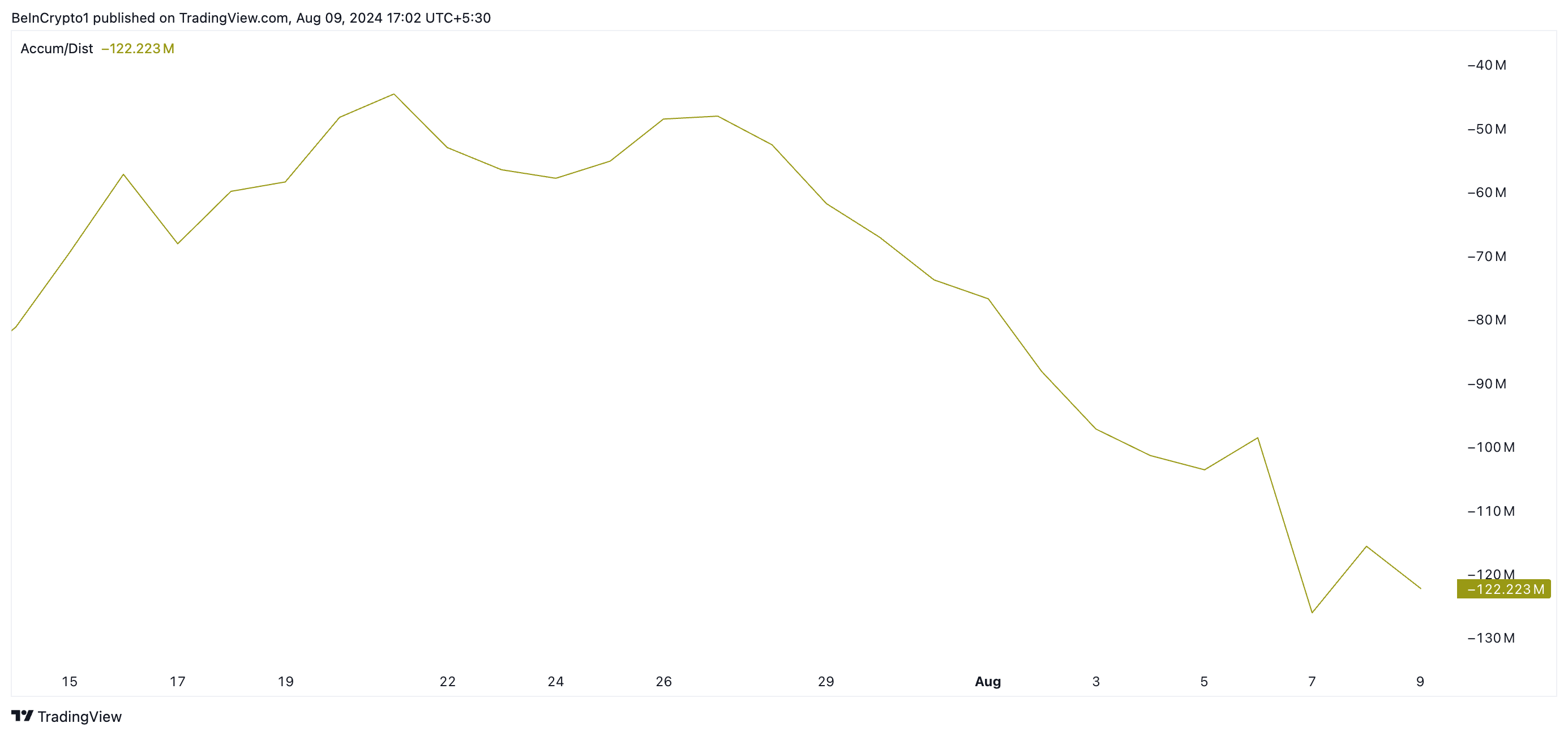

The opportunity of a rate decrease is increased by the truth that the existing rally is sustained by marginal purchasing stress. This evaluation originates from the token’s Accumulation/Distribution (A/D) Line. Although IO’s rate has actually climbed considering that Monday, the A/D Line has actually been trending downward, presently resting at -121.22 million.

Find Out More: What Is DePIN (Decentralized Physical Framework Networks)?

This indication tracks the advancing circulation of cash right into and out of a property. A decrease in the A/D Line exposes extra circulation than build-up, recommending that offering stress is subduing purchasing stress, which drives the property’s rate reduced.

IO Rate Forecast: New Losses Ahead

Investors translate the arrangements of the signs over as an indication that a property is shedding need and can experience additional decreases. This triggers them to minimize trading task, placing additional descending stress on the rate.

IO’s rate might take another look at Monday’s reduced if offering stress spikes.

Find Out More: Leading 9 Web3 Jobs That Are Changing the Market

Nonetheless, if real need for the altcoin arises, it might press its worth to $2.52.

Please Note

In accordance with the Depend on Job standards, this rate evaluation short article is for educational objectives just and need to not be thought about monetary or financial investment guidance. BeInCrypto is dedicated to exact, objective coverage, yet market problems go through transform without notification. Constantly perform your very own study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.