The crypto market’s relationship with crucial macroeconomic occasions has actually returned after dissipating for a lot of 2023. With the impact back on, crypto market individuals need to support for volatility with crucial launches aligned today.

In a sentiment-driven market, being successful of market-moving financial information launches is crucial for investors and financiers seeking to change their trading approaches.

What Can Create Market Volatility Today

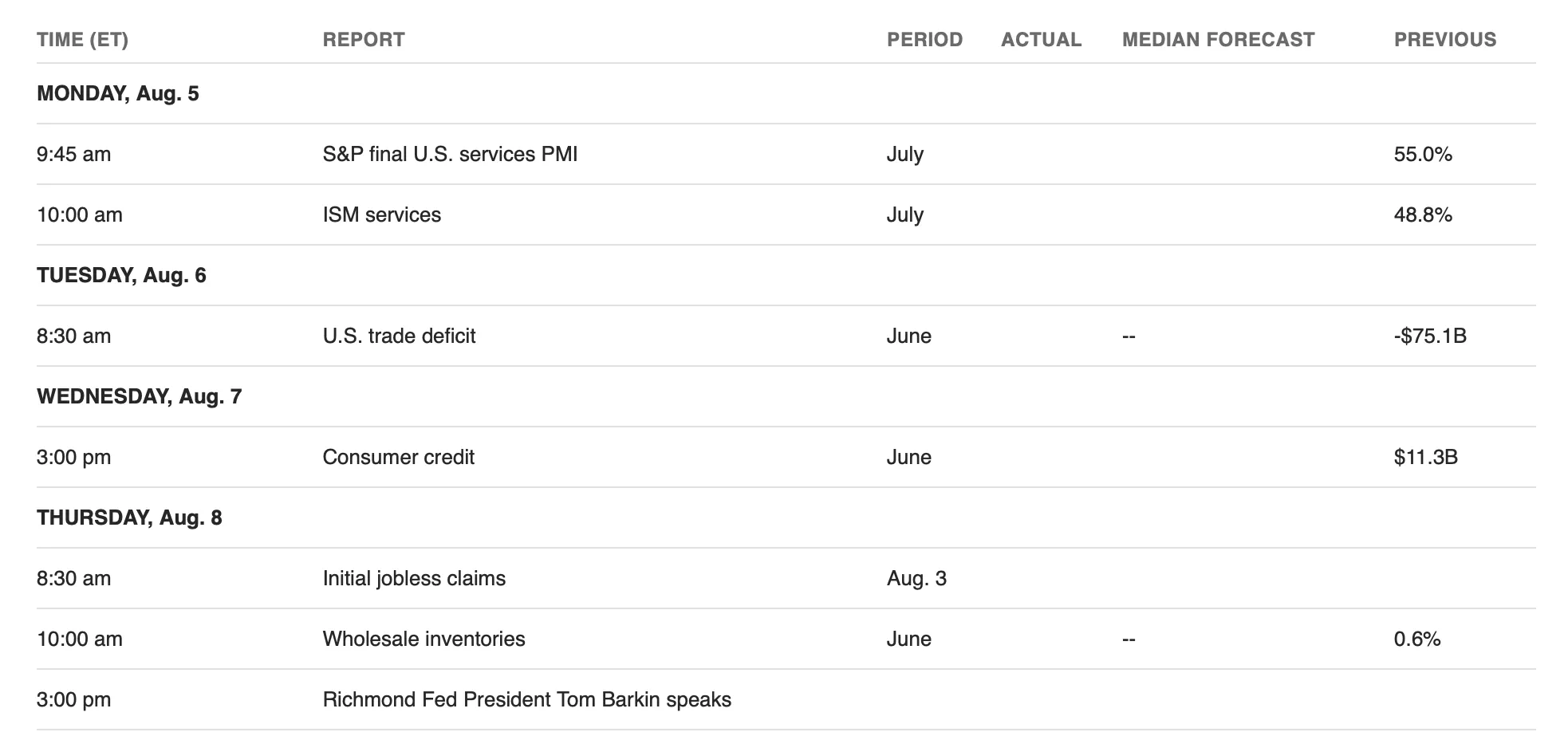

4 occasions will certainly be of passion to crypto market gamers today. They consist of:

S&P Final United States Solutions PMI

Investors will certainly see the S&P Global Services PMI on Monday, which is put together by the S&P Global. Markets covered consist of customer (omitting retail), transportation and details, interaction, money, insurance coverage, property, and organization solutions.

In July, the S&P Global Solutions PMI defeated assumptions of 55, climbing to 56 factors, greater than June’s 55.3. This suggests development in the solutions field, a favorable indicator for typical markets, revealing greater solution need.

United States Profession Shortage

Markets likewise wait for the United States profession shortage on Tuesday, which might trigger TradFi and crypto volatility today. Like the S&P Solutions PMI, the nation’s profession shortage likewise indicated enhanced solutions in June and even more cars and truck exports.

Both favorable information indicate sharp boosts in organization inflows, reaching their quickest rate in over a year.

” The United States is transitioning to a solutions economic climate, much less production,” Lumida Riches Chief Executive Officer Ram Ahluwalia said over favorable solutions information.

Learn More: Exactly how to Secure Yourself From Rising Cost Of Living Utilizing Cryptocurrency

These cause enhanced financial investment possibilities and boosted financial problems, increasing belief in typical markets like supplies. The effect might not be as straight or substantial on crypto contrasted to typical markets. Nonetheless, if the favorable trajectory proceeds, funding might revolve right into risk-on possessions like crypto.

Favorable financial information frequently affects financier belief in the crypto area. As typical markets enhance, financiers might come to be much more certain in the economic climate. This might raise danger hunger and cause higher passion in different possessions like cryptocurrencies.

Non-mortgage Consumer Debt

The United States Non-mortgage consumer debt information for June will certainly be launched on Wednesday, August 7. The information records exceptional credit history included people. The information assists determine problems in non-mortgage consumer debt markets and examine the results of financial plan. In May’s record, launched on July 8, non-mortgage consumer debt enhanced at a seasonally readjusted yearly price of 2.7%. Rotating credit history enhanced at a yearly price of 6.3%, while non-revolving credit history likewise enhanced at a yearly price of 1.4%.

The rise in non-mortgage consumer debt suggests that customers are obtaining and investing much more. In typical money markets, this is a favorable indicator for the economic climate. It recommends customers are much more certain regarding their economic scenario, which describes the readiness to tackle financial debt to make acquisitions.

If authorities report a comparable pattern in June, it would certainly boost financial task and drive business profits, bring about greater supply costs. Nonetheless, there is a danger connected with greater non-mortgage consumer debt degrees. If customers come to be overleveraged and battle to settle their financial obligations, it might cause defaults and economic instability.

This might adversely impact typical money markets by raising volatility and financier unpredictability. Crypto, on the various other hand, might profit indirectly from the indicated more powerful general economic climate. Raised financial security and customer task might draw in financiers to different possessions like cryptocurrencies.

Richmond Fed Head of state Tom Barkin’s Speech

The Richmond Fed Head of state Tom Barkin will certainly talk on Thursday, August 8, providing understanding right into policymakers’ reasoning and possibly motivating typical market and crypto volatility. He will certainly likewise discuss what current financial records indicate for future activity from the reserve bank. The Federal Competitive Market Board (FOMC) lately chose to maintain rates of interest the same at 5.25%– 5.50% for the 8th successive conference.

Jerome Powell, the Federal Get (Fed) chair, did not clearly signify a September price cut. He showed raising however careful positive outlook regarding disinflation development returning to in the 2nd fifty percent of 2024.

” He is plainly anticipating a modification of some kind or otherwise just can not see far better financial investments than Treasury costs. The Fed requires to go down prices. They have actually been absurd not to have actually done so currently,” X Chief Executive Officer Elon Musk said in a Sunday article.

Musk’s remarks came complying with a dull work report recently, which elevated problems regarding a financial stagnation. On The Other Hand, Wall surface Road financial institutions support for hostile rates of interest cuts amidst proof that the labor market is cooling down. Citigroup financial experts Veronica Clark and Andrew Hollenhorst, as an example, prepare for “half-point price cuts in September and November and a quarter-point cut in December.”

JPMorgan economic expert Michael Feroli resembled Clark and Hollenhorst, including that there’s “a solid situation to act” prior to the following conference on September 18. According to Feroli, Powell might not “intend to include even more sound to what has actually currently been an event-filled summer season.”

Macro Information Drives Crypto Sell-Off

At the same time, crypto volatility has markets hemorrhaging, with the overall market capitalization down a raw 12%. Bitcoin is down 12.35%, trading for $53,000 at the time of creating, while Ethereum shed 20%.

Some refer the collision to the Japanese stock exchange experiencing its worst losses because 1987. Market expert Zach Jones links the collision with Japan protecting its Yen money and unloading every one of its Treasury Holdings (US-owned financial debt).

” Japan produced a whatever bubble in the 80’s/ 90’s. The bubble obtained so large that in the 30-40 years because their stock exchange has actually never ever obtained near the highs of the bubble. The United States economic climate has a 122% financial debt to GDP proportion which is crazy. Japan has actually increased that. They were in between a rock and a difficult location, either allowing their money collapse and experience a Wonderful Depression-esque collapse or publishing cash and hyperinflating their money. They selected to publish thousands of billions of bucks each day to safeguard their money. This has actually been a certainty to anybody that focuses on markets,” Jones wrote.

Learn More: Exactly How To Get Bitcoin (BTC) and Every Little Thing You Required To Know

Somewhere else, Republic ticket candidate for the November political elections, Donald Trump, blames the current economic markets collision on Kamala Harris, Joe Biden, and “inefficient United States management.”

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to supply exact, prompt details. Nonetheless, visitors are recommended to confirm realities separately and speak with an expert prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.