There’s enhancing unpredictability nowadays. The economic situation is beginning to reveal some indicators of slowing down, and the opportunity of an intensifying problem in the center East is producing stress and anxiety. In addition to that is the upcoming governmental political election.

All this unpredictability has financiers rattled, with the marketplace lately having its worst day considering that very early in 2015.

These elements could have you being afraid that one more bear market can be around the bend. One prospective means to aid sanctuary your profile versus a future market tornado is to protect it with high-grade, high-yielding reward supplies. WEC Power ( NYSE: WEC), Enbridge ( NYSE: ENB), and Northwest Natural Holding ( NYSE: NWN) stick out to these factors as excellent safe houses.

A monotonous energy with excellent reward development

Reuben Gregg Brewer (WEC Power): Among one of the most eye-catching features of WEC Power is that it flies under the radar. As a rather conventional controlled electrical and gas energy offering around 4.7 million clients partly of Wisconsin, Illinois, Michigan, and Minnesota, its organization is really simple.

And due to the relevance of power to modern-day life (and the syndicate WEC has actually been given in the areas it offers), its clients are mosting likely to maintain utilizing power regardless of what the marketplace is doing.

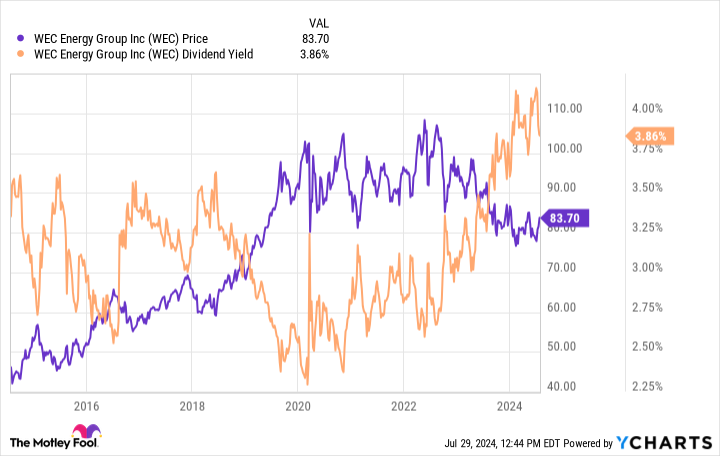

Sure, rate of interest are high, which’s mosting likely to be a headwind for WEC Power, which like the majority of energies makes hefty use financial obligation to money its organization. And it is handling a damaging governing judgment in Illinois when it come to gas. Yet these issues have actually dispirited the share rate and boosted the appearance of the supply for revenue financiers, considered that it currently produces a traditionally high 4% or two.

That reward, at the same time, is backed by 21 successive yearly boosts. The ordinary annual boost over the previous years was about 7%, which is rather eye-catching for an energy. On the other hand, administration anticipates profits development to drop in between 6.5% and 7% a year for the near future.

If background is any type of overview, the reward will certainly comply with profits greater. And provided the controlled nature of business, fortunately needs to remain to stream also via a bearishness. Yet dive rapidly or you could miss out on the possibility below.

A version of security and longevity

Matt DiLallo (Enbridge): Enbridge has among the lowest-risk organization versions in the power field. The Canadian pipe and energy driver obtains 98% of its profits from secure cost-of-service or got properties, like oil and gas pipes, gas energies, and renewable resource centers. These properties generate such foreseeable capital that Enbridge has actually attained its economic support for 18 straight years.

The firm took a remarkable action to even more boost the security of its capital over the previous year by obtaining 3 gas energies. When it secured the sell late 2023, chief executive officer Greg Ebel stated, “These purchases even more expand our organization, boost the secure capital account of our properties, and reinforce our long-lasting reward development account.”

The purchase will certainly raise its profits from secure gas energies from 12% to 22% of its overall. The firm partially moneyed that offer by marketing Aux Sable, which runs removal and fractionation centers for gas fluids.

Enbridge additionally has a solid investment-grade annual report and a conventional reward payment proportion. It has billions of bucks in yearly financial investment capability after paying its reward (which produces an appealing 7%).

That provides it the versatility to money its about $18 billion stockpile of safe funding tasks. It additionally has the capability to make opportunistic purchases and authorize even more development tasks.

The firm’s protected development motorists and efforts to lower prices and maximize its properties ought to expand its capital per share by around 3% every year via 2026 and 5% each year afterwards. Its noticeable profits development and solid annual report recommend it needs to have no problem enhancing its reward, which it has actually provided for 29 straight years.

That high-yielding and continuously climbing payment provides a really solid base return, supplying financiers with some sanctuary in the middle of a future economic tornado.

68 successive years of reward boosts, and checking

Neha Chamaria ( Northwest Natural Holding): If you have not found out about Northwest Natural, the firm’s reward record will certainly stun you. Energies usually pay normal and secure returns, and Northwest Natural is no various.

What establishes it apart, however, is that Northwest Natural has actually boosted its reward each year for the last 68 successive years. That is among the lengthiest touches amongst Reward Kings.

Northwest Natural supplies gas and water solutions via its subsidiaries, consisting of NW Natural, NW Natural Water, and NW Natural Renewables.

NW Natural supplies gas to virtually 2 million individuals in Oregon and southwest Washington State, while NW Natural Water offers around 180,000 individuals. As is normal with controlled energies, Northwest Natural can make and create secure profits and capital, which is why it not just can pay for to pay a normal reward however additionally expand it with time.

It’s a fantastic reward supply for numerous factors. The energy anticipates to spend $1.4 billion to $1.6 billion in its gas organization over the following 5 years, which can enhance its price base by 5% to 7%.

Administration thinks this financial investment, incorporated with its costs on water facilities, can enhance its profits per share by a compound yearly development price of 4% to 6% in between 2022 and 2027. Given that the firm focuses on reward development, profits development ought to suggest larger returns for investors time after time.

Its 68-year touch, obviously, is the largest statement to exactly how dependable Northwest Natural’s returns are. With its high return of 4.8%, this is the sort of supply that will certainly allow you rest also throughout bearish market.

Should you spend $1,000 in Enbridge now?

Prior to you get supply in Enbridge, consider this:

The Supply Consultant expert group simply recognized what they think are the 10 best stocks for financiers to get currently … and Enbridge had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Think About when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $657,306! *

Supply Consultant supplies financiers with an easy-to-follow plan for success, consisting of support on constructing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Supply Consultant solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

* Supply Consultant returns since July 29, 2024

Matt DiLallo has placements in Enbridge. Neha Chamaria has no setting in any one of the supplies discussed. Reuben Gregg Brewer has placements in Enbridge and WEC Power Team. The has placements in and advises Enbridge. The has a disclosure policy.

Afraid of a Bear Market? 3 High-Yield Stocks That Could Be Your Safe Haven in a Storm. was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.