Information reveals the American exchanges are observing a surge in their Bitcoin supremacy. Below’s what took place the last 2 times this pattern showed up.

Bitcoin Is Relocating From International Systems To US-Based Ones

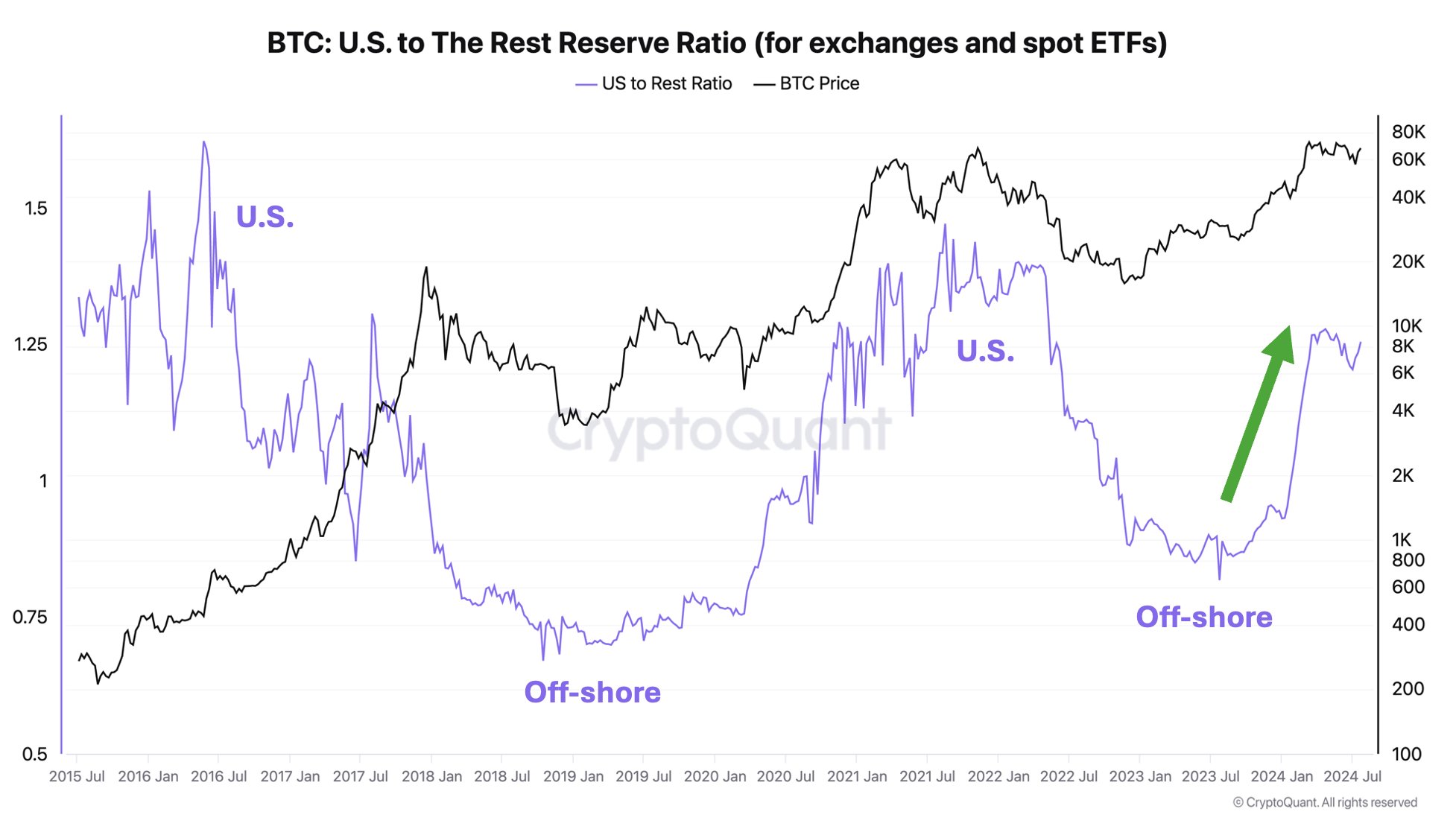

In a brand-new post on X, CryptoQuant creator and chief executive officer Ki Youthful Ju has actually gone over a pattern that has actually been arising in a Bitcoin indication lately. The statistics concerned is the proportion in between the BTC book of US-based systems and off-shore ones.

” Systems” right here not just consist of the exchanges, yet likewise the area exchange-traded funds (ETFs), which were just accepted to run in the United States in January of this year.

When the worth of this proportion increases, it implies the US-based systems are seeing their book increase about the off-shore ones. Such a pattern can recommend rate of interest is changing from the last systems to the previous ones.

On the various other hand, the statistics signing up a decrease suggests the cryptocurrency might be undergoing a transfer from United States exchanges and area ETFs to international systems.

Currently, right here is a graph that reveals the pattern in this Bitcoin indication over the previous years:

The worth of the statistics shows up to have actually observed a sharp boost lately|Resource: @ki_young_ju on X

As shown in the above chart, this proportion had actually dived to fairly reduced worths throughout the 2022 bearishness and the 2023 healing, yet this year, the indication’s worth has actually observed a sharp boost.

This would suggest that off-shore systems have actually seen a noteworthy decrease in their supremacy. A significant vehicle driver for this pattern is most likely to be the appeal the United States area ETFs have actually discovered given that their launch.

From the graph, it shows up that a comparable pattern was likewise observed in the leadup to the 2021 bull run. International exchanges controlled throughout the bearishness and the healing stage that adhered to, yet after that a change in the direction of American systems took place, which led the way for the cost rally.

The supremacy of US-based exchanges had actually likewise soared in the accumulation of the 2017 bull run, so it would certainly show up that BTC undergoes favorable durations when rate of interest in American systems is greater than for those in the remainder of the globe.

As the proportion has actually once more been creating this pattern lately, it’s feasible that the cryptocurrency can be heading in the direction of an additional significant bull run. It currently stays to be seen whether the pattern will certainly duplicate or otherwise.

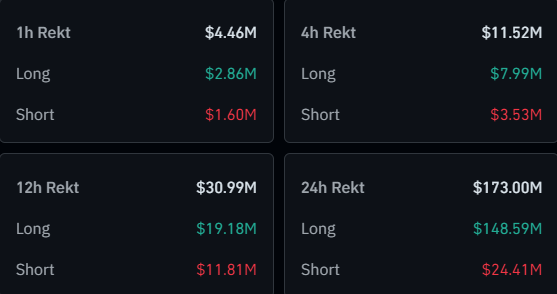

In a few other information, a multitude of lengthy financiers have actually satisfied liquidation in the by-products market throughout the last 24 hr, as Bitcoin and various other coins have actually experienced drawdowns.

The information for the mass liquidation occasion that has actually happened in the crypto market throughout the previous day|Resource: CoinGlass

As shows up over, around $173 million in cryptocurrency-related agreements have actually been sold off in this home window, of which over $148 million were long placements.

BTC Rate

Bitcoin had briefly slid under the $66,000 degree throughout its newest dive, yet the property has actually given that seen some small healing to $66,600.

Appears like the cost of the coin has actually seen a sharp dive over the previous day|Resource: BTCUSD on TradingView

Included photo from Dall-E, CryptoQuant.com, CoinGlass.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.