Concluding Q1 revenues, we take a look at the numbers and crucial takeaways for the individual treatment supplies, consisting of Nu Skin (NYSE: NUS) and its peers.

While individual treatment items items might appear even more optional than food, customers often tend to preserve and even improve their costs on the classification throughout bumpy rides. This sensation is called “the lipstick impact” by economic experts, which specifies that customers still desire some form of budget-friendly high-ends like appeal and health when the economic climate is sputtering. Customer preferences are frequently altering, and individual treatment business are presently reacting to the general public’s enhanced wish for fairly generated items by including all-natural components in their items.

The 13 individual treatment supplies we track reported a combined Q1; typically, profits defeat expert agreement price quotes by 0.8%. while following quarter’s earnings support was 7.5% listed below agreement. Rising cost of living proceeded in the direction of the Fed’s 2% objective at the end of 2023, bring about solid securities market efficiency. The beginning of 2024 has actually been a bumpier experience, as the marketplace changes in between positive outlook and pessimism around price cuts because of blended rising cost of living information, and while a few of the individual treatment supplies have actually gotten on rather much better than others, they jointly decreased, with share costs dropping 1.9% typically because the previous revenues outcomes.

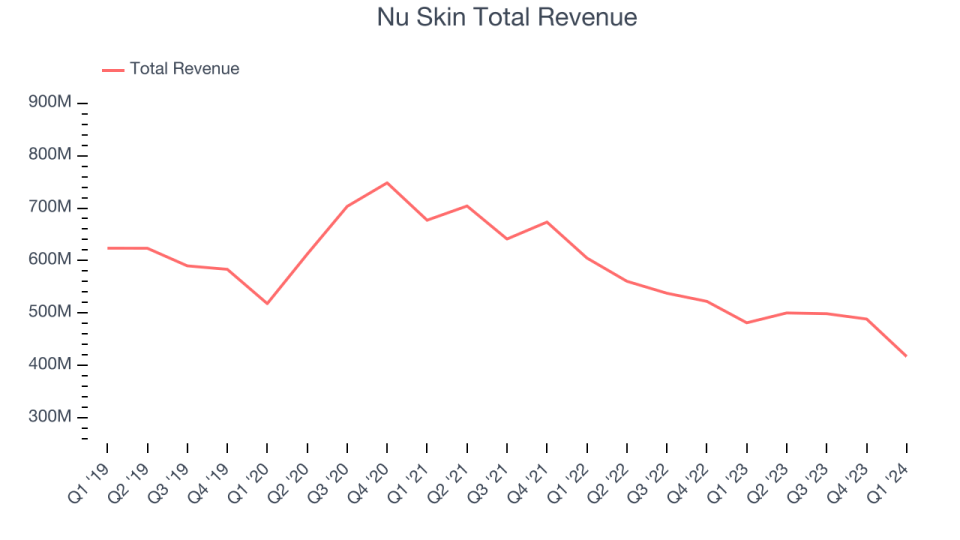

Nu Skin (NYSE: NUS)

With person-to-person advertising and sales as opposed to marketing via retailers, Nu Skin (NYSE: NUS) is an individual treatment and nutritional supplements business that participates in straight marketing.

Nu Skin reported profits of $417.3 million, down 13.3% year on year, disappointing experts’ assumptions by 3.5%. Generally, it was a slower quarter for the business with full-year earnings support missing out on experts’ assumptions and a miss out on of experts’ gross margin price quotes.

The supply is down 13.4% because reporting and presently trades at $10.75.

Read our full report on Nu Skin here, it’s free

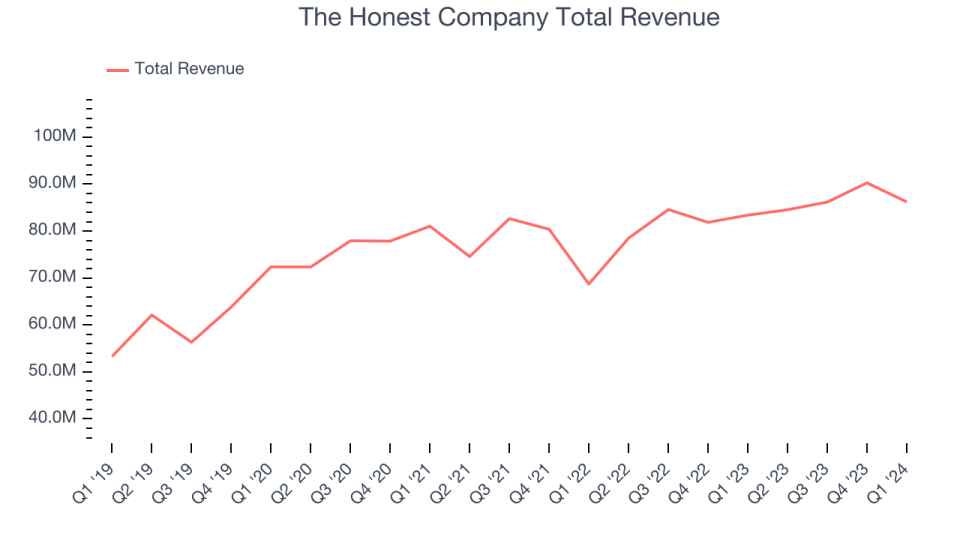

Finest Q1: The Honest Firm (NASDAQ: HNST)

Co-founded by starlet Jessica Alba, The Honest Firm (NASDAQ: HNST) offers baby diapers and wipes, skin treatment items, and house cleansing items.

The Honest Firm reported profits of $86.22 million, up 3.4% year on year, exceeding experts’ assumptions by 3.5%. It was a magnificent quarter for the business with an outstanding beat of experts’ revenues price quotes.

The marketplace appears pleased with the outcomes as the supply is up 37.1% because coverage. It presently trades at $4.03.

Is currently the moment to purchase The Honest Firm? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: USANA (NYSE: USNA)

Mosting likely to market with a straight marketing design as opposed to via typical merchants, USANA Health and wellness Sciences (NYSE: USNA) makes and offers dietary, individual treatment, and skin care items.

USANA reported profits of $212.9 million, down 10.6% year on year, disappointing experts’ assumptions by 3.7%. It was a weak quarter for the business with underwhelming revenues support for the complete year and a miss out on of experts’ revenues price quotes.

USANA had the weakest efficiency versus expert price quotes in the team. As anticipated, the supply is down 8.7% because the outcomes and presently trades at $41.85.

Read our full analysis of USANA’s results here.

e.l.f. (NYSE: FAIRY)

e.l.f. Charm (NYSE: FAIRY), which represents ‘eyes, lips, deal with’, provides top notch appeal items at easily accessible rate factors.

e.l.f. reported profits of $321.1 million, up 71.4% year on year, going beyond experts’ assumptions by 9.8%. Generally, it was a combined quarter for the business with an outstanding beat of experts’ revenues price quotes however underwhelming revenues support for the complete year.

e.l.f. supplied the largest expert approximates beat and fastest earnings development, however had the weakest full-year support upgrade amongst its peers. The supply is up 9.6% because reporting and presently trades at $170.55.

Read our full, actionable report on e.l.f. here, it’s free.

BeautyHealth (NASDAQ: SKIN)

Operating in the arising appeal wellness classification, the suitably called BeautyHealth (NASDAQ: SKIN) is a skin care business best recognized for its Hydrafacial item that cleans and moistens skin.

BeautyHealth reported profits of $81.4 million, down 5.7% year on year, according to experts’ assumptions. A lot more generally, it was a combined quarter for the business with an outstanding beat of experts’ revenues price quotes however earnings support for following quarter missing out on experts’ assumptions.

The supply is down 47.9% because reporting and presently trades at $1.87.

Read our full, actionable report on BeautyHealth here, it’s free.

Sign Up With Paid Supply Capitalist Study

Assist us make StockStory extra valuable to capitalists like on your own. Join our paid individual research study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.