Dining establishment business Texas Roadhouse (NASDAQ: TXRH) reported lead to line with experts’ assumptions in Q2 CY2024, with earnings up 14.5% year on year to $1.34 billion. It made a GAAP earnings of $1.79 per share, enhancing from its earnings of $1.22 per share in the very same quarter in 2014.

Is currently the moment to purchase Texas Roadhouse? Find out in our full research report.

Texas Roadhouse (TXRH) Q2 CY2024 Emphasizes:

-

Earnings: $1.34 billion vs expert price quotes of $1.34 billion (tiny beat)

-

EPS: $1.79 vs expert price quotes of $1.64 (9.2% beat)

-

Gross Margin (GAAP): 18.7%, up from 16.2% in the very same quarter in 2014

-

Complimentary Capital of $9,300, down 100% from the previous quarter

-

Locations: 762 at quarter end, up from 709 in the very same quarter in 2014

-

Market Capitalization: $11.05 billion

Jerry Morgan, President of Texas Roadhouse, Inc. commented, “We proceeded our energy in the existing quarter as solid web traffic patterns and some alleviation on asset rising cost of living brought about raised success throughout every one of our brand names. With our drivers supplying strong operating outcomes, and a well balanced advancement pipe, we are well placed for the 2nd fifty percent of the year.”

With places typically including Western-inspired style, Texas Roadhouse (NASDAQ: TXRH) is an American dining establishment chain concentrating on Southern-style food and steaks.

Sit-Down Eating

Sit-down dining establishments provide a full eating experience with table solution. These facilities cover numerous foods and are renowned for their cozy friendliness and inviting atmosphere, making them excellent for family members celebrations, unique celebrations, or just taking a break. Their substantial food selections vary from appetisers to indulgent treats and white wines and alcoholic drinks. This room is very fragmented and competitors consists of every little thing from publicly-traded business possessing numerous chains to single-location mom-and-pop dining establishments.

Sales Development

Texas Roadhouse is just one of the bigger dining establishment chains in the sector and take advantage of a solid brand name, offering it client mindshare and impact over acquiring choices.

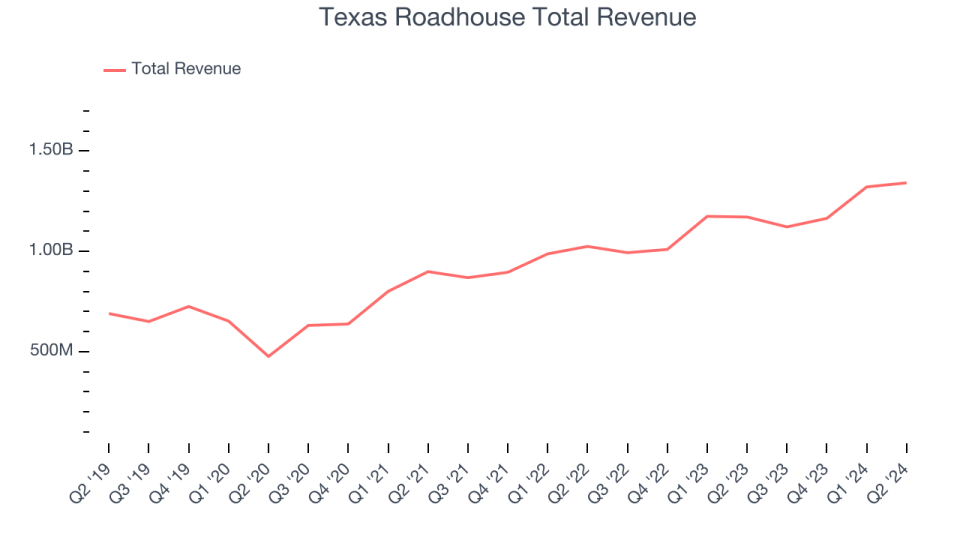

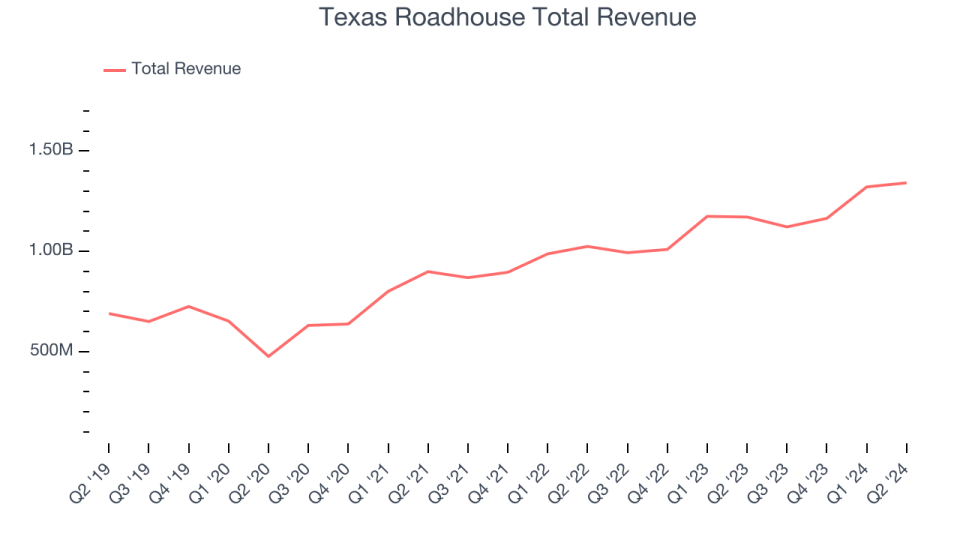

As you can see below, the business’s annualized earnings development price of 13.9% over the last 5 years went over as it included much more eating places and raised sales at existing, developed dining establishments.

This quarter, Texas Roadhouse’s year-on-year earnings development appeared at 14.5%, and its $1.34 billion in earnings remained in line with Wall surface Road’s price quotes. Looking in advance, Wall surface Road anticipates sales to expand 12.7% over the following year, a slowdown from this quarter.

When a business has even more cash money than it understands what to do with, redeeming its very own shares can make a great deal of feeling– as long as the rate is right. Fortunately, we have actually discovered one, a discounted supply that is spurting totally free capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

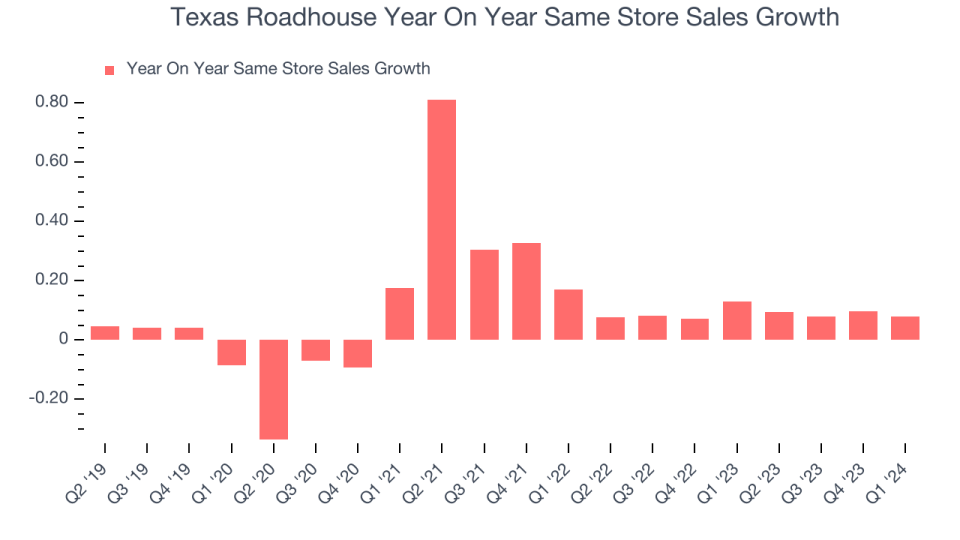

Same-Store Sales

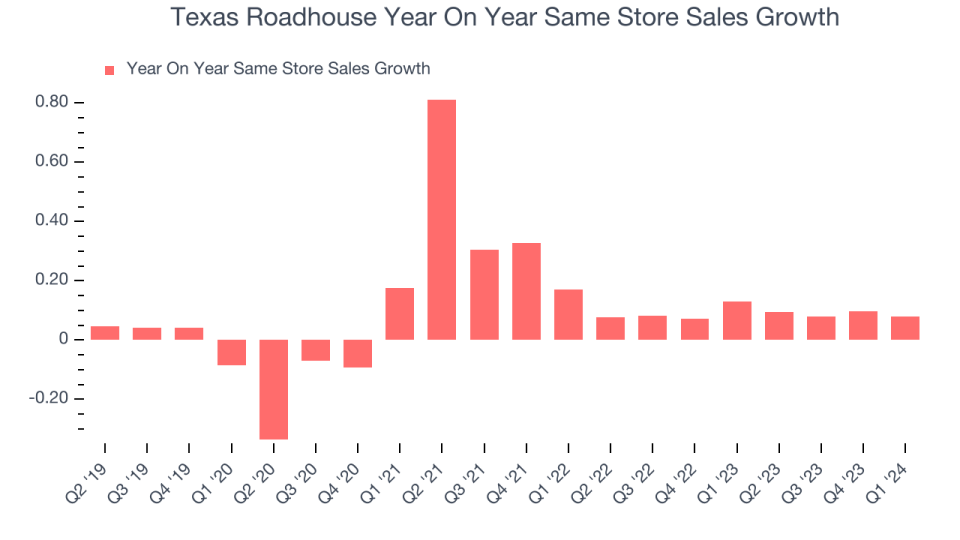

Same-store sales development is a vital efficiency indication utilized to determine natural development and need for dining establishments.

Texas Roadhouse’s need has actually surpassed the more comprehensive dining establishment field over the last 8 quarters. Typically, the business has actually expanded its same-store sales by a durable 9% year on year. With favorable same-store sales development amidst an enhancing variety of dining establishments, Texas Roadhouse is getting to much more restaurants and expanding sales.

Secret Takeaways from Texas Roadhouse’s Q2 Outcomes

We were thrilled by just how considerably Texas Roadhouse blew previous experts’ gross margin assumptions this quarter. We were additionally satisfied its earnings and EPS directly surpassed Wall surface Road’s price quotes. In general, we assume this was a solid quarter that ought to please investors. The supply traded up 1.8% to $169 right away complying with the outcomes.

Texas Roadhouse may have had an excellent quarter, however does that suggest you should spend today? When making that choice, it is very important to consider its appraisal, organization top qualities, along with what has actually occurred in the most up to date quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.