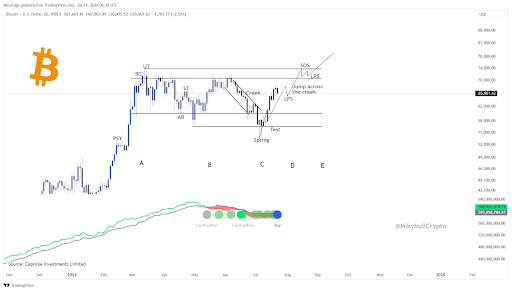

Crypto expert Mikybull Crypto has actually disclosed the return of a technological indication that stands for a buy signal for Bitcoin. Based upon his forecasts, the front runner crypto can appreciate a large rally that can ultimately send its cost as high as $130,000

Bitcoin Witnesses “Uncommon” Get Signal

Mikybull Crypto disclosed in an X (previously Twitter) post that Bitcoin had actually simply seen an uncommonhash ribbon buy signal The expert included that “an eruptive rally” adheres to whenever this occurs. Without a doubt, this is favorable for BTC as the hash bow blinking a buy signal recommends that miners’ capitulation may be done or at the very least has actually cooled down.

The hash bow indication tracks the BTC hash price’s 30-day and 60-day relocating standards. The buy signal typically happens when the 30-day MA goes across over the 60-day MA, as this recommends that the most awful of the miners’ capitulation mores than which a recuperation in the hash price has actually started.

As A Result Of the Bitcoin supply they manage, miners’ capitulation is recognized to considerably influence the marketplace and Bitcoin’s cost particularly. Bitcoinist reported that these miners marketed over 30,000 BTC in June, which resulted in substantial cost collisions for the front runner crypto. The Bitcoin halving is thought to have actually triggered these miners to capitulate as their mining incentives were halved while managing increasing procedure expenses and a drop in Bitcoin’s cost.

Nevertheless, as the hash bow indication recommends, this marketing stress from BTC miners has actually considerably decreased, and Bitcoin can appreciate a large surge from right here on. According to this, Mikybull Crypto told his fans to prepare yourself for a “huge rally” that can send out BTC over $100,000 and to a cost target of $130,000, as he had formerly anticipated

It deserves pointing out that crypto expert James Van Straten additionally lately kept in mind that miners’ earnings was once more near its 365-day relocating standard. The expert described that this was an additional means to evaluate if miner capitulation was practically over. The expert included that Bitcoin would certainly remain to trend greater once miners’ earnings can redeem the $40 million annual standard.

No Factor For BTC’s Capitalists To Panic

An additional element that has actually triggered Bitcoin’s financiers to panic is the prospective marketing stress that can arise from Mt. Gox’s Bitcoin payments. These problems might have added to the current cost modification that the front runner crypto experienced after recuperating as high as $68,000. Nevertheless, on-chain metrics recommend these financiers have no factor to panic.

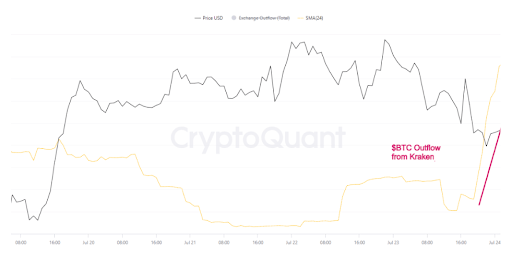

Crypto expert OnChainSchool kept in mind in a recent analysis that there has actually been a substantial rise in BTC withdrawals from Sea Serpent after Mt. Gox individuals started getting their BTC. The expert kept in mind that this can be a favorable signal as it shows that these individuals are selecting to hold instead of market their crypto symbols.

Cryptoquant’s chief executive officer Ki Youthful Ju resembled a comparable belief, stating that the instantaneous dump market individuals gotten out of Mt. Gox’s financial institutions really did not take place. He additionally recommended that any kind of cost decrease that Bitcoin may be experiencing is likely as a result of market belief and not Mt. Gox marketing

Included photo developed with Dall.E, graph from Tradingview.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.