Heartland Q2 incomes: No place to go yet up

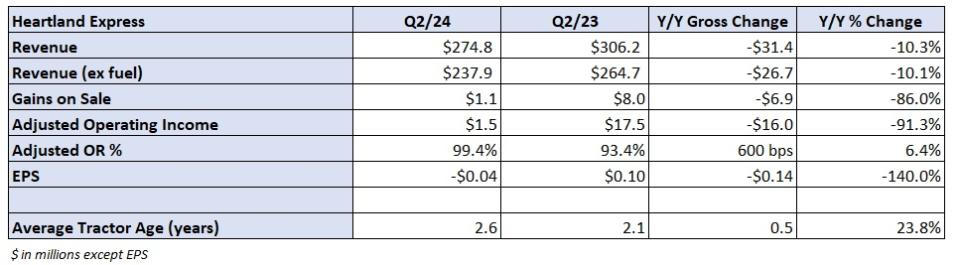

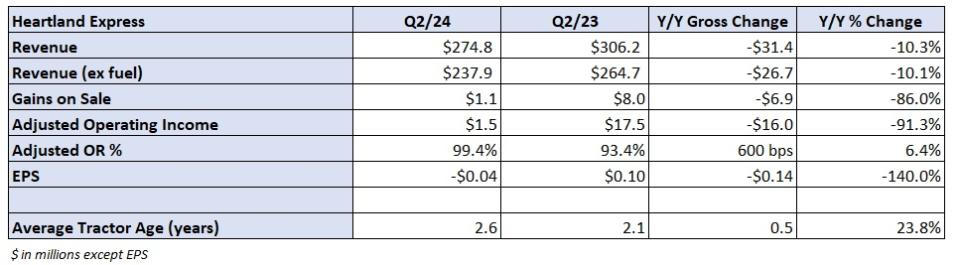

Heartland Express just recently launched its Q2 incomes, which saw a bottom line of $3.5 million. FreightWaves’ Todd Maiden writes, “This was Heartland’s 4th successive quarterly bottom line when leaving out single gains from the sale of realty. It scheduled $25.6 million in gains from the sale of 3 terminals in the 4th quarter, which are considered as nonrecurring advantages.”

Mike Gerdin, Chief Executive Officer of Heartland Express, wrote in the release, “Our combined operating outcomes for the 3 and 6 months finished June 30, 2024, mirror the mix of a prolonged and considerable duration of weak products need, driven by excess capability in the market and continuous operating expense rising cost of living.”

Like negative junk food, Heartland’s acquisition of Smith Transportation and Agreement Freighters Inc. (CFI) might still be triggering acid indigestion. Checking out Heartland’s annual report, it shows up the firm utilized its money to pay for the financial obligation and funding connected with getting Smith and CFI. “Financial obligation and funding lease commitments of $237.2 million stay at June 30, 2024, below the first $447.3 million loanings much less connected costs for the CFI purchase in August 2022 and $46.8 million financial obligation and financing lease commitments thought from the Smith purchase in Might 2022,” stated the launch.

Settling financial obligation additionally leaves much less cash for capex. Heartland isn’t updating its fleet as promptly: Ordinary tractor and trailer age approached from 2.1 years on June 30, 2023, to 2.6 years since June 30, 2024. Ordinary trailer age increased from 6.1 years to 6.9 years throughout that exact same duration.

For Heartland, there’s no place to go yet up for its operating proportion, a common denominator that truckload directors utilize to gauge productivity. Maiden includes, “Heartland’s modified operating proportion (costs as a percent of income) was 99.4% in the quarter, 600 basis factors even worse y/y yet well listed below the virtually 106% degree the provider ran at in the previous 2 quarters.”

Marten Transportation Q2: Committed obtains much less specialized

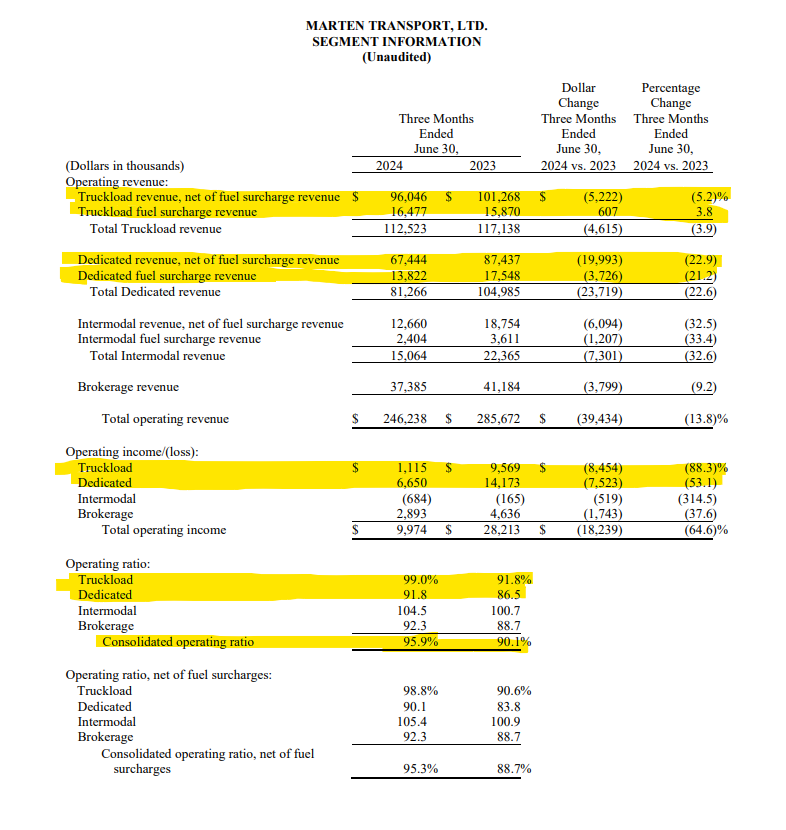

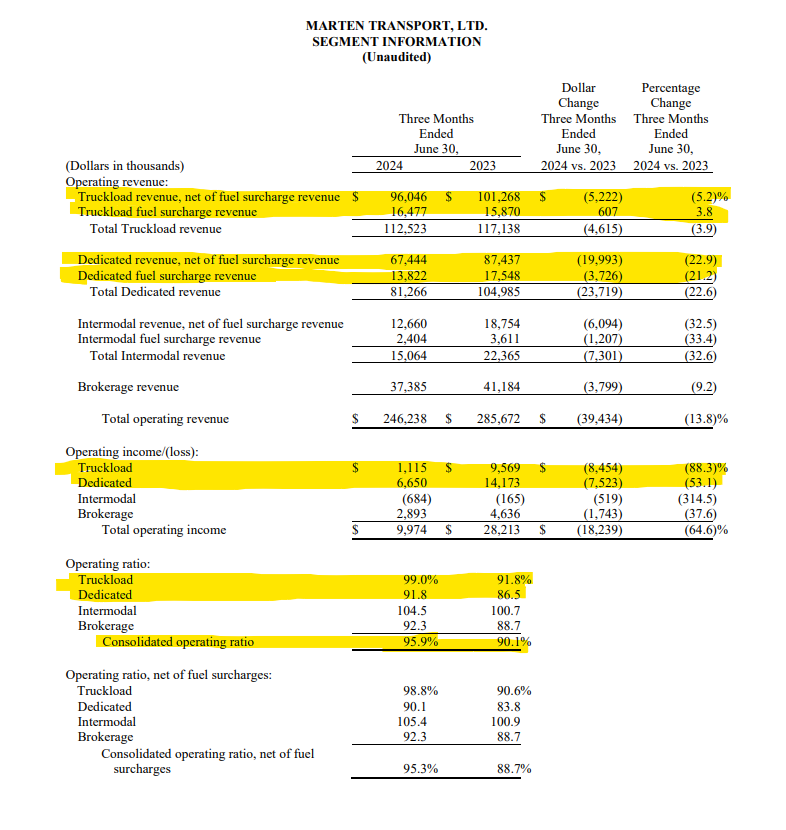

Marten Transportation just recently launched its Q2 earnings, which saw a remarkable damage in both OR and its specialized company. Administration’s pushback on price giving ins and rejection to take price cuts show up to have actually influenced its specialized sector, which saw double-digit decreases, greater than its truckload sector, which saw low-single-digit decreases.

Q2 specialized income dropped 22.9% contrasted to Q2 2023, from $87.4 million to $67.4 million, prior to a gas additional charge was included. Contrasted to truckload, its OR continues to be beneficial, dropping just 53 basis factors y/y from 86.5% in Q2 2023 to 91.8% in Q2 2024, not consisting of a gas additional charge. Including a gas additional charge saw a small modification from 83.8% to 90.1% throughout the exact same duration.

Marten’s truckload sector, which administration stated was “greatly pushed by the products market economic crisis’s surplus and weak need,” made out worse. FreightWaves’ John Kingston writes, “And yet the truckload sector web of gas additional charges generated an operating proportion of 98.8% contrasted to 90.6% in the 2nd quarter of 2023. That’s since although that miles driven boosted a little, income web of gas in truckload went down to $96 million from $101.3 million a year back. Ordinary income per tractor each week web of gas decreased to $4,093 from $4,472 a year back.”

There were some positives from the incomes launch. Exec Chairman Randolph L. Marten stated, “We are seeing boosted rate of interest by our consumers to protect specialized capability and have actually just recently included brand-new multi-year specialized programs for an added 133 chauffeurs beginning in the 3rd quarter.” Marten repeated his previous declaration that the firm has actually not accepted price decreases considering that last August.

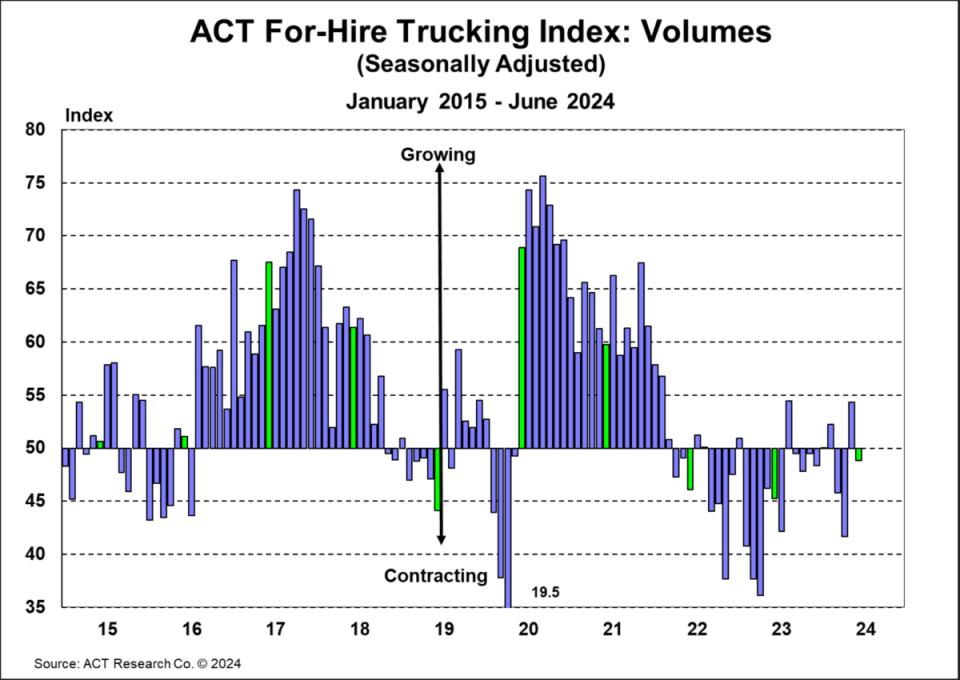

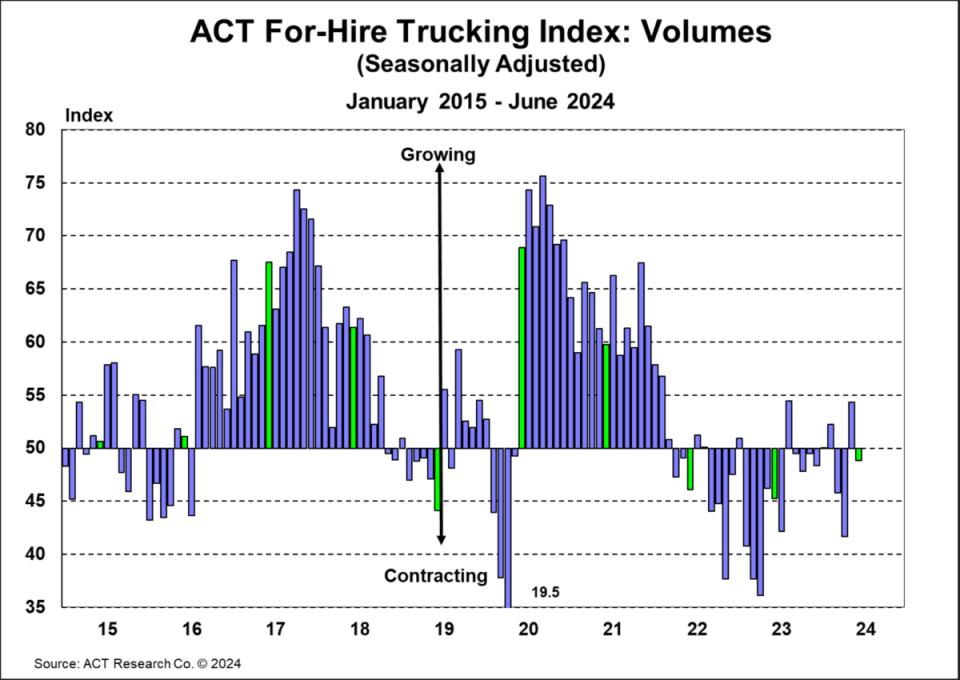

Market upgrade: For-Hire Trucking Index relocates closer to stabilize

On Thursday, ACT Study launched its July For-Hire Trucking Index information, which saw the equilibrium in between truckload supply and need constricting for June. Considering the index, a worth over 50 shows development, while a worth listed below 50 is a tightening. The quantity index dropped 5.5 factors from Might’s 54.4 indicate 48.9 factors in June. While quantities are not terrific, the record keeps in mind that it’s not as negative as June 2023’s analysis of 42.8. Carter Vieth, research study expert at ACT Study, stated in the launch, “Despite customers under stress, genuine United States retail sales are up 1.8% ytd, and even more disinflation assists sustain our overview on genuine revenue development. Furthermore, intermodal and import quantities are trending favorable, which minimally includes in total surface area products quantities.”

Truckload capability is nearing stability, up 3.6 factors from 45.6 in Might to 49.3 in June. Vieth included, “Though the index boosted m/m, this month’s For-Hire Supply Need Equilibrium June 2024 analysis notes the 12th month straight capability has actually been listed below 50, the lengthiest touch of decrease considering that the creation of the study in late 2009. Fleet capability tightenings happening at a slower price recommend the supply-demand equilibrium in between the fleet and products is tightening.”

Reduced profits and prices remain to influence fleet buying choices, with 32.5% of participants in June stating they intend to acquire tools in the following 3 months, listed below the historic standard of 55.3%. The record keeps in mind that as soon as prices enhance, ACT anticipates a renovation in buying view.

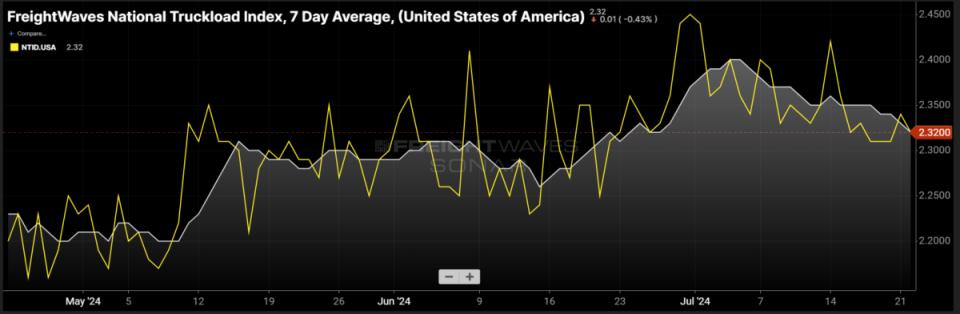

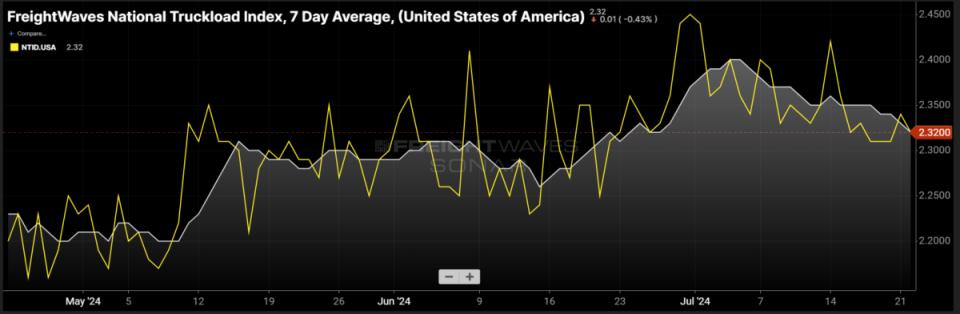

FreightWaves finder limelight: Summertime products blue funks mute July 4th rally

Recap: The rally in completely dry van area market prices that led up to the 4th of July vacation shows up to have actually mellowed out, according to current information from the FreightWaves National Truckload Index, 7-Day Standard. NTI proceeded its stairstep decreases complying with the very first week of July, dropping 3 cents per mile all-in week over week from $2.35 on July 15 to $2.32. Month over month, area prices are just 1 cent per mile more than the $2.31 reported on June 23. The decreases in area market rates power additionally expanded right into the agreement room, which saw completely dry van outgoing tender denial prices drop 48 basis factors w/w from 5.21% on July 15 to 4.73%.

The completely dry van sector was not the only tools kind to see decreases complying with July 4th. The flatbed and reefer sectors dropped too. Reefer area prices are down 3 cents per mile all-in w/w from $2.64 on July 15 to $2.61. Reefer outgoing tender denial prices dipped listed below 8%, dropping 54 bps w/w from 8.5% to 7.96%.

The return of seasonality has actually been particularly unkind to flatbed agreement rates power, with flatbed outgoing tender denial prices being up to reduced solitary numbers, 4.91%, which is extra comparable to 2020’s analysis of 5.47% than in 2015’s analysis of 13.73%. An intense area regardless of the agreement price decreases was the mild uptick in flatbed area market prices. FTI boosted 3 cents per mile w/w from $2.72 to $2.75.

The Routing Overview: Hyperlinks from around the internet

Werner student driver wage lawsuit struck down for a third time (Land Line)

FMCSA says it has too little data to assess double-brokering fraud (FreightWaves)

Safety request for tougher rear guards not reasonable or practicable, NHTSA says (Trucking Dive)

Why do truck drivers leave a fleet? (Commercial Service Provider Journal)

Legal challenges ahead for truck speed, hours-of-service rules? (FreightWaves)

Owner-operator concerns grow over labor classifications and hours of service (Fleet Proprietor)

Like the web content? Register for the e-newsletter here.

The article Heartland Q2 earnings: Nowhere to go but up showed up initially on FreightWaves.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.