Country products seller Tractor Supply (NASDAQ: TSCO) missed out on experts’ assumptions in Q2 CY2024, with earnings up 1.5% year on year to $4.25 billion. It made a GAAP earnings of $3.93 per share, boosting from its earnings of $3.83 per share in the very same quarter in 2014.

Is currently the moment to get Tractor Supply? Find out in our full research report.

Tractor Supply (TSCO) Q2 CY2024 Emphasizes:

-

Earnings: $4.25 billion vs expert quotes of $4.28 billion (tiny miss out on)

-

EPS: $3.93 vs expert assumptions of $3.92 (in line)

-

Business preserved the omphalos of complete year same-store sales and earnings, a little elevated complete year EPS (upgraded earnings and EPS support listed below assumptions)

-

Gross Margin (GAAP): 36.6%, up from 36.2% in the very same quarter in 2014

-

Cost-free Capital of $467.5 million, down 18.1% from the very same quarter in 2014

-

Locations: 2,459 at quarter end, up from 2,373 in the very same quarter in 2014

-

Same-Store Sales were level year on year (2.5% in the very same quarter in 2014)

-

Market Capitalization: $28.3 billion

” We are pleased with our 2nd quarter EPS results that remained in line with our expectation. My genuine recognition heads out to our greater than 50,000 Employee for living our Goal and Worths on a daily basis as we concentrate on looking after our consumers and each various other. The group remained to carry out very well, maintaining the high criteria we established for ourselves on a daily basis. At the middle of the year, we have actually made considerable progression on our Life Out Below technique. We remain to produce even more splitting up in between us and our competitors, many thanks to our Group Members and the purposeful partnerships they have with our consumers,” claimed Hal Lawton, Head Of State and Ceo of Tractor Supply.

Began as a mail-order tractor components company, Tractor Supply (NASDAQ: TSCO) is a store of basic products such as farming materials, equipment, and family pet food for the country customer.

Specialized Retail

Some sellers attempt to offer every little thing imaginable, while others– suitably called Specialized Retailers– concentrate on marketing a slim classification and intending to be phenomenal at it. Whether it’s spectacles, showing off products, or charm and cosmetics, these shops win with deepness of item in their classification along with in-store know-how and support for customers that require it. Shopping competitors exists and subsiding retail foot web traffic influences these sellers, however the size of the headwinds depends upon what they offer and what additional worth they give in their shops.

Sales Development

Tractor Supply is bigger than a lot of customer retail business and take advantage of economic climates of range, offering it a side over its rivals.

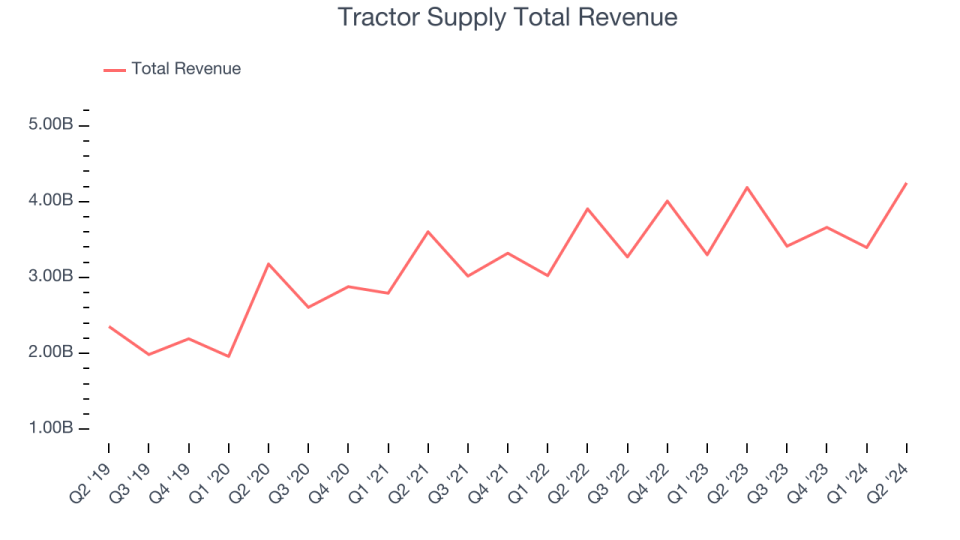

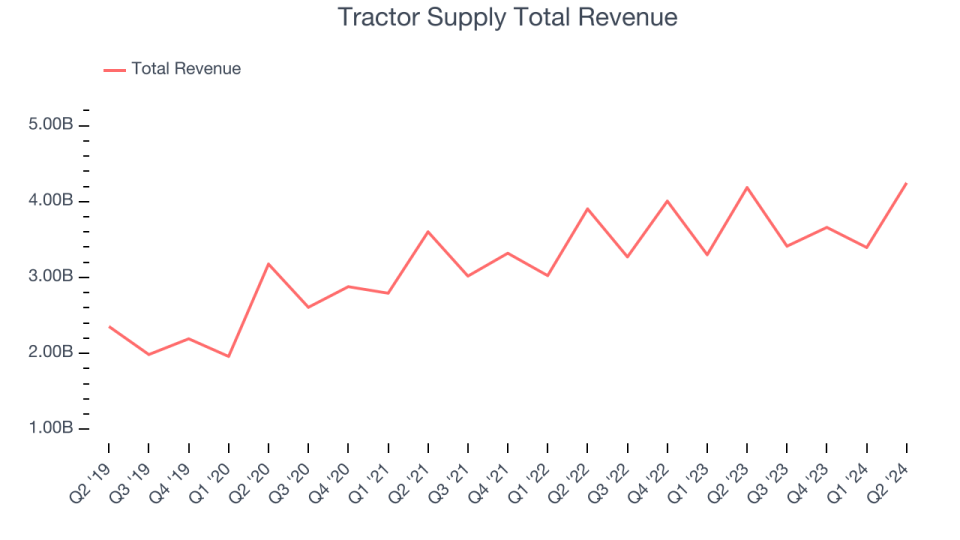

As you can see below, the business’s annualized earnings development price of 12.4% over the last 5 years was suitable as it opened up brand-new shops and expanded sales at existing, developed shops.

This quarter, Tractor Supply’s earnings expanded 1.5% year on year to $4.25 billion, disappointing Wall surface Road’s quotes. Looking in advance, Wall surface Road anticipates sales to expand 5% over the following twelve month, a velocity from this quarter.

Below at StockStory, we absolutely comprehend the capacity of thematic investing. Varied victors from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Beast Drink (MNST) might all have actually been determined as appealing development tales with a megatrend driving the development. So, because spirit, we have actually determined a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

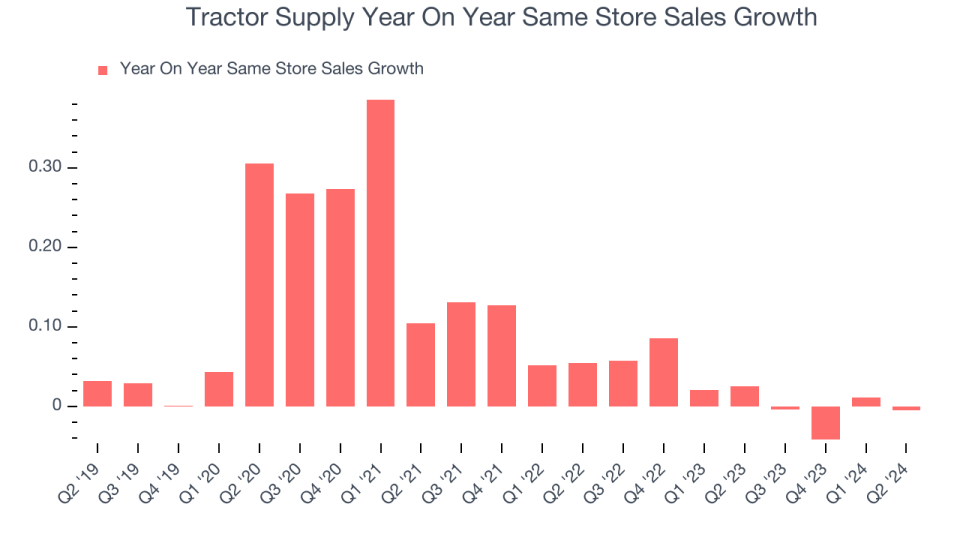

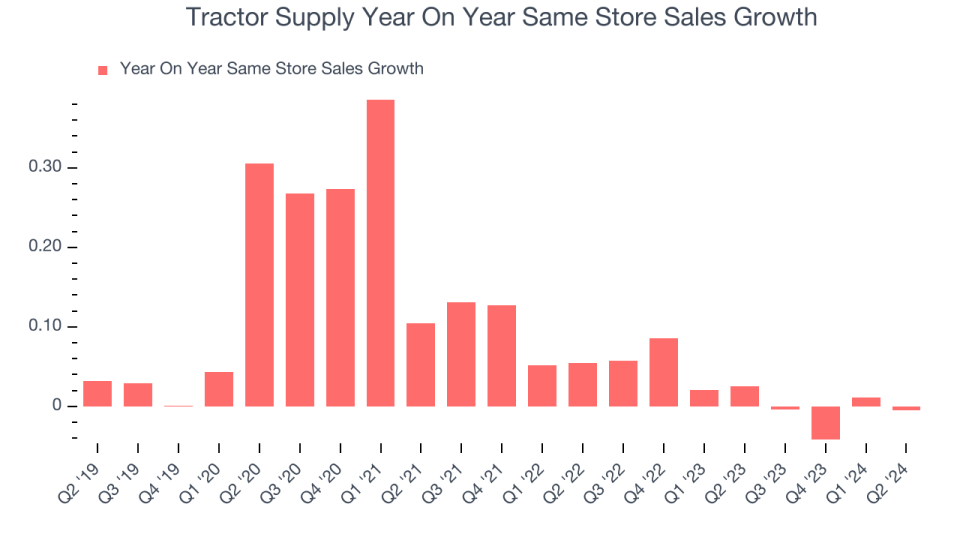

Tractor Supply’s need within its existing shops has actually been reasonably secure over the last 8 quarters however fallen back the wider customer retail field. Usually, the business’s same-store sales have actually expanded by 1.9% year on year. With favorable same-store sales development in the middle of a raising physical impact of shops, Tractor Supply is getting to a lot more consumers and expanding sales.

In the most recent quarter, Tractor Supply’s year on year same-store sales were level. By the business’s criteria, this development was a significant slowdown from the 2.5% year-on-year rise it published twelve month back. We’ll be viewing Tractor Supply very closely to see if it can reaccelerate development.

Trick Takeaways from Tractor Supply’s Q2 Outcomes

Earnings missed out on by a percentage, although EPS remained in line. While there were some tiny alterations completely year support, earnings and EPS expectation inevitably wound up listed below assumptions. The supply traded down 2.9% to $254.88 instantly complying with the outcomes.

So should you buy Tractor Supply today? When making that choice, it is very important to consider its appraisal, company high qualities, along with what has actually occurred in the most recent quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.