Bitcoin’s (BTC) value is thought to drive the crypto market, however the king of cryptocurrencies tends to react to macro-financial circumstances.

Since these circumstances have been somewhat optimistic recently, it looks like BTC may have a shot at escaping consolidation and marking a brand new ATH.

Impression of the US Monetary Markets

Bitcoin’s value has been reacting positively to the Federal Reserve’s latest shift in tone. Earlier this week, the inflation charge, measured by the Client Worth Index (CPI), softened to three.3% yr over yr.

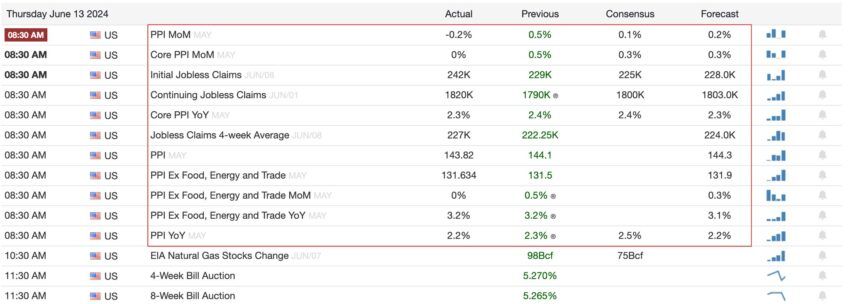

Quickly after, the Federal Open Market Committee (FOMC) additionally introduced that it could hold the rates of interest unchanged at 5.25% to five.50%. On Thursday, the Producer Worth Index (PPI) additionally got here in at 2.2% on a yearly foundation, as per the forecasts and decrease than April’s 2.3%.

The mixed optimistic outlook has created favorable bullish circumstances for Bitcoin’s value. The analysis workforce at Bitfinex additionally believes that BTC is progress in the long run. Bitfinex analysts instructed BeInCrypto,

“Because the Fed determined to take care of present charges, Bitcoin may expertise short-term volatility because the market adjusts to the information. Nonetheless, the general development may stay optimistic, particularly if the broader financial outlook continues to enhance.”

Discussing concerning the potential affect on the ETF flows, the analysts acknowledged,

“ETF flows might stabilize with a maintain choice, as buyers await clearer alerts from the Fed’s future coverage strikes. Spot Bitcoin ETFs may see regular inflows, however the momentum might be much less pronounced in comparison with a charge minimize situation. The launch of Ether ETFs may nonetheless entice important curiosity, probably resulting in diversified investments throughout each Bitcoin and Ethereum ETFs.”

Thus, Bitfinex analysts consider that Bitcoin may consolidate round present ranges or expertise reasonable positive factors as buyers stay optimistic about future charge cuts later within the yr.

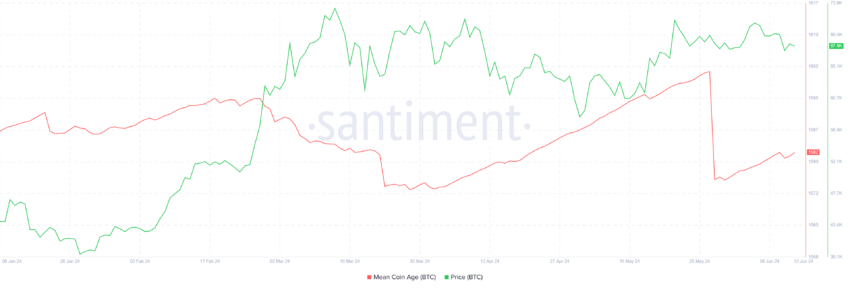

BTC holders are additionally of this opinion, as their conviction appears to be making a comeback. The Imply Coin Age is observing an uptick once more after noting a downtick in March and once more in Might.

Imply coin age is a metric that measures the typical age of all cash within the community, indicating the typical holding interval of the cryptocurrency. It helps assess investor conduct and potential market tendencies by exhibiting how lengthy cash have remained of their present addresses.

Upticks on this metric recommend buyers are HODLing, whereas downticks trace on the elevated motion of tokens throughout the community.

Learn Extra: Bitcoin Halving Historical past: Every part You Want To Know

Thus, Bitcoin’s value may see some sideways motion earlier than it initiates its restoration once more.

BTC Worth Prediction: Validating the Sample

Bitcoin’s value, which was buying and selling at $67,800 on the time of writing, has been consolidated underneath $71,000. Latest makes an attempt at closing above it failed, and BTC dropped again down beneath $68,500, one other essential assist flooring.

Nonetheless, wanting on the macro timeframe, it may be famous that BTC is awaiting a breakout following a Wyckoff sample. The Wyckoff sample is a technical evaluation methodology that describes the cyclical value conduct of economic markets. It consists of phases of accumulation, markup, distribution, and markdown, serving to merchants establish potential market tendencies and reversals.

Per this sample, an increase past the all-time excessive of $73,736 is on the playing cards. Nonetheless, as talked about above, this could doubtless come after a interval of consolidation.

Learn Extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

But when Bitcoin’s value breaks beneath the consolidation earlier than this restoration, the bullish thesis shall be invalidated. BTC may additionally lose the assist of $67,000, sending the crypto asset to lows of $63,000 or decrease.

Disclaimer

Consistent with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.