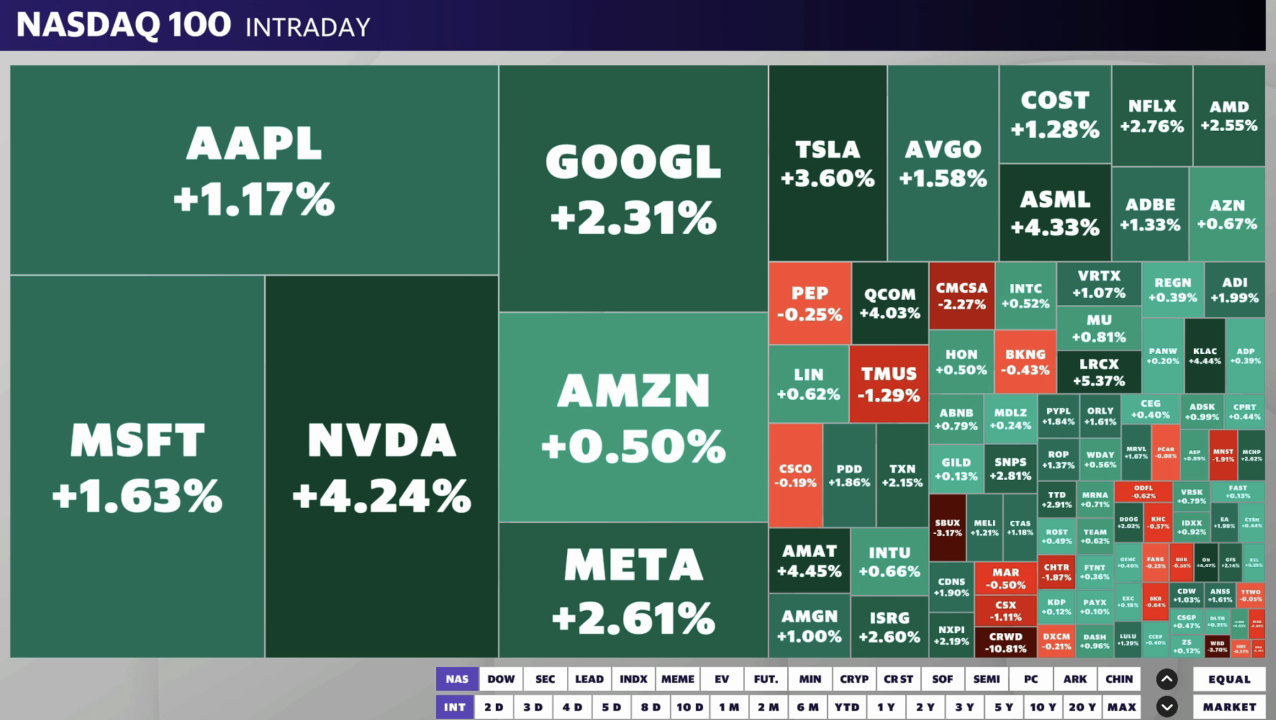

United States supplies increased on Monday with technology leading the gains as capitalists analyzed the possible after effects from Head of state Joe Biden’s departure from the governmental race.

The S&P 500 (^ GSPC) got 07% while the tech-heavy Nasdaq Compound (^ IXIC) increased approximately 0.5%, both coming off their worst once a week losses considering that April. The Dow Jones Industrial Standard (^ DJI) eliminated earlier gains to float near the flatline.

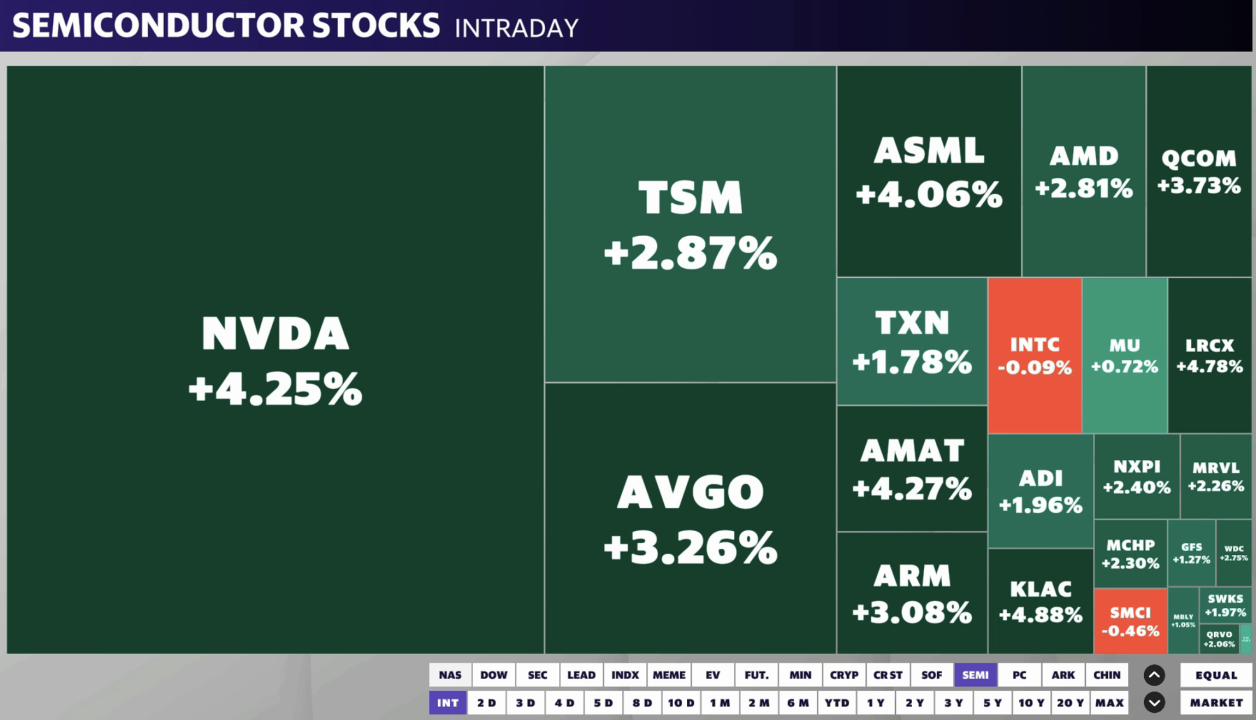

Chip heavyweight Nvidia (NVDA) led a broad-based technology rebound complying with hefty losses recently as capitalists turned out of huge cap names.

Capitalists are checking a transformed political landscape after Biden aborted his reelection proposal on Sunday and backed his vice head of state, Kamala Harris, to change him as the Autonomous candidate. The political shock can infuse even more volatility right into a currently damaged securities market, sidetracking emphasis from today’s flooding of incomes and essential rising cost of living launch.

Biden’s step, while not unanticipated after weeks of stress, is seen on Wall surface Road as wearing down the probabilities of Republican competitor Donald Trump protecting a go back to the White Residence. That can trigger a light loosening up of current “Trump profession” bank on possessions viewed as gaining from a 2nd Trump presidency, such as bitcoin, financial institution supplies, and greater United States bond returns. The return on the standard 10-year Treasury (^ TNX) insinuated Monday’s very early hours.

At the same time, incomes period will kick right into greater equipment, with a stream of S&P 500 firms anticipated to report in a week headlined by Alphabet (GOOGL, GOOG), Tesla (TSLA), and Chipotle (CMG).

Those outcomes will certainly offer understanding right into the economic situation and the customer in advance of Thursday’s record on 2nd quarter GDP and Friday’s upgrade on the Federal Get’s favored rising cost of living statistics, the Personal Usage Expenses (PCE) index.

Live 9 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.