Stablecoin issuer Paxos just lately laid off roughly 20% of its workforce, affecting 65 workers. The layoffs lowered Paxos’ headcount to between 200 and 300 workers.

This choice got here as the corporate held over $500 million on its stability sheet.

Paxos’ Strategic Shift for Future Development

A latest report revealed that Paxos CEO Charles Cascarilla introduced the layoff in an e mail on Tuesday. Whereas acknowledging the problem of the choice, Cascarilla said that the corporate stays “in a really robust monetary place to succeed.”

“This [layoff] permits us to finest execute on the huge alternative forward in tokenization and stablecoins,” he defined.

Learn extra: What’s Tokenization on Blockchain?

Paxos has supplied substantial assist to affected workers. This consists of 13 weeks of severance pay, three months of sponsored medical health insurance, outplacement assist, and an extension for vested choices.

Moreover, workers on quarterly incentive applications acquired second-quarter bonuses. These on authorised parental or medical go away acquired funds and advantages past the separation package deal.

Paxos has been reorienting its enterprise technique to deal with the rising market of tokenizing real-world property. This restructuring consists of phasing out its settlement companies in commodities and securities to pay attention extra on tokenized property and stablecoins. This shift follows the discontinuation of their Binance-branded stablecoin, BUSD, because of regulatory pressures.

Cascarilla highlighted that whereas the adoption of stablecoins will proceed to develop, launching and scaling new regulated tokens takes time. Nonetheless, he stays optimistic about Paxos’ future in tokenization, supported by its robust monetary place.

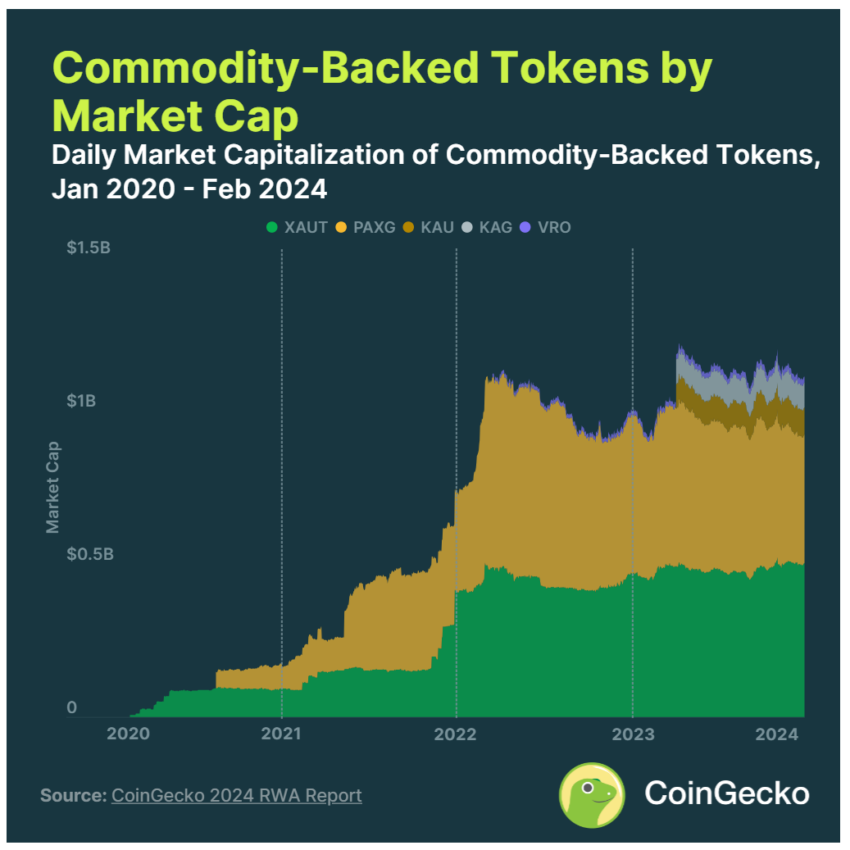

Paxos’ deal with tokenization aligns with market developments. CoinGecko’s RWA Report 2024 highlights that tokenized valuable metals like Paxos’ PAX Gold (PAXG) make up 83% of the market capitalization of commodity-backed tokens. These tokens, backed by one troy ounce of bodily gold, quantity to a market capitalization of $1.1 billion.

Learn extra: What’s The Affect of Actual-World Belongings (RWAs) Tokenization?

A collaborative report by the Boston Consulting Group and ADDX additional affirms the potential of real-world property tokenization. The report predicts that the tokenization of illiquid property may create a enterprise price $16 trillion. By 2030, this tokenized market is predicted to contribute 10% of the worldwide GDP.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.