After 6 unsteady weeks, beginning in June, when Bitcoin dove by over 15%, the coin is returning. Since this writing, costs remain to publish greater highs, drifting over $62,000.

Bitcoin Getting Rid Of Weak Point

According to one expert, pointing to on-chain metrics provided by CryptoQuant, Bitcoin is improving. There might be extra gains in the coming couple of weeks or months. Technically, Bitcoin is within a favorable outbreak development, with a close over $60,000 essential for driving self-confidence.

In the expert’s sneak peek, the last couple of weeks had Bitcoin bulls dealing with a wave of worry, unpredictability, and question (FUD) information. Of note, the choice by the German authorities to unload 50,000 BTC worth billions nicked belief.

The scenario got worse when Mt. Gox financial institutions claimed they intended to disperse coins in July, not October. Since July 16, Sea serpent supposedly emailed receivers that they prepare to disperse BTC from Mt. Gox in the following couple of days.

Dropping Bitcoin costs in the bulk of June, wrapping up in a critical sell-off in very early July, triggered place Bitcoin ETFs to sign up discharges. Unlike in previous months, when financiers liked acquiring place ETF direct exposure, the decrease made some owners retrieve shares, increasing the sag.

Around the exact same time, the USA Federal Book claimed it would certainly lower prices just when this year, not 3 times as economic experts had actually anticipated. This implied rates of interest would certainly stay more than anticipated, internet bearish for high-risk properties like Bitcoin and cryptocurrencies.

The Significant Turn-around: BTC Trading At A Costs, Miners Relieved

Nonetheless, the turn-around was this weekend break. In the expert’s analysis, the effort on Donald Trump’s life just enhanced the chance of the previous head of state replacing Joe Biden. Trump has actually altered his position on Bitcoin and crypto, also motivating mining task in the nation.

The lift-off over the weekend break comes with the rear of increasing liquidity, particularly for leading stablecoins like USDT and USDC. Currently, with costs higher, the expert likewise kept in mind that temporary owners (STHs) are back in the eco-friendly after costs damaged $62,700.

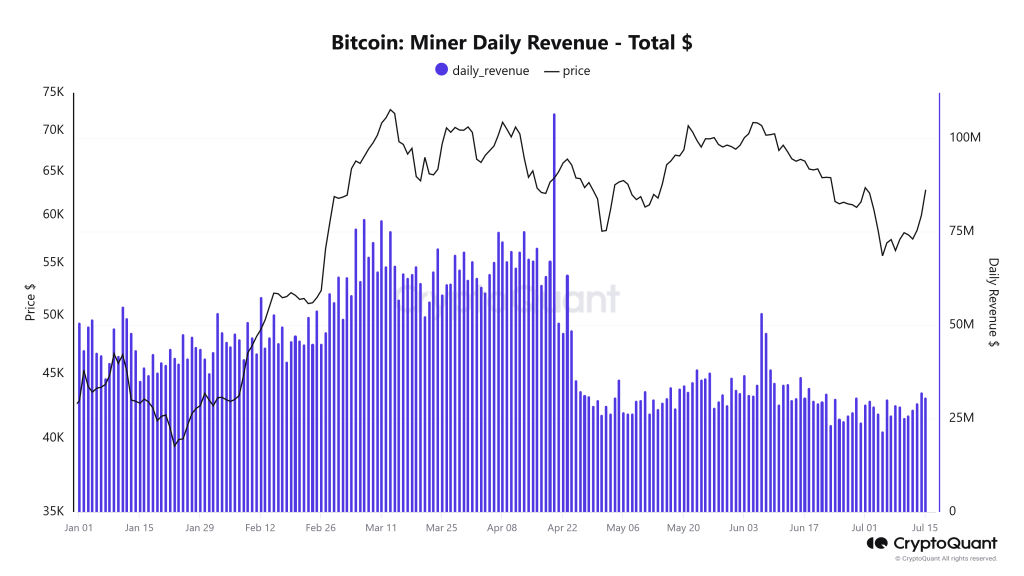

Greater costs likewise converted to even more revenues for miners. As points stand, miners are no more in the “incredibly underpaid” area. Therefore, couple of will certainly be incentivized to market.

The spike in evaluation likewise implies Coinbase customers are paying a costs to obtain BTC. This signals that the energy for much more gains is progressively being developed, a significant growth for purchasers.

Function photo from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.