In response to reviews from on-chain detectives, UwU Lend has been hit by a cyber-attack, leading to a lack of $3.72 million.

This marks the second assault on the decentralized finance (DeFi) lending platform, underscoring the persistent vulnerabilities inside the crypto business.

UwU Lend Loses $23.22 Million to the Similar Attacker in a Week

Barely three days after dropping $19.5 million to a cyber-attack, UwU Lend has suffered an extra $3.72 million loss to the identical exploiter. This follows a report by Web3 safety platform Cyvers, which highlighted the transaction in a submit on X.

Specialists attributed the preliminary assault to a flash mortgage, the place the attacker swapped USDe for different tokens, which led to a lower cost of USDe and sUSDe. The attacker then deposited some to UwU Lend, lending extra sUSDe than anticipated.

“The sUSDe token value utilized by UwULend relies on 5 pairs. Although these pairs are deep, they didn’t thwart the attacker from flash-loaning monumental quantities of property to govern value and reap liquidation bonus,” safety agency Certik famous in its forensic report of the assault.

Learn Extra: High 5 Flaws in Crypto Safety and How To Keep away from Them

In a flash mortgage, customers borrow property with out offering collateral, returning the borrowed funds inside the similar transaction. This distinctive characteristic in DeFi lending distinguishes flash loans from conventional loans, which usually require collateral.

UwU Lend didn’t instantly reply to BeInCrypto’s request for remark. Nonetheless, it’s regarding that the identical unhealthy actor focused the DeFi lending protocol inside days. This raises vital questions in regards to the community’s safety defenses. Notably, within the Monday assault, UwU Lend acknowledged the loss and adopted up the following day with a message stating it had recognized and resolved the safety vulnerability.

UwU Founder is Suspected of Shady Actions

Neighborhood members are actively criticizing UwU Lend founder, Michael Patryn, also referred to as “Omar Dhanani” and “0xSifu”. This hypothesis arises as Patryn co-founded the cryptocurrency alternate QuadrigaCX, which finally collapsed amidst fraud-related allegations.

“Appears to be an enormous DeFi rugpull in progress, disguised as a collection of hacks & liquidations Seemingly orchestrated by Michael Patryn aka SIFU (greatest recognized for QuadrigaCX & different crypto ponzis) Mich (Michael Egorov) is both goal or collaborator,” Rho Rider noted.

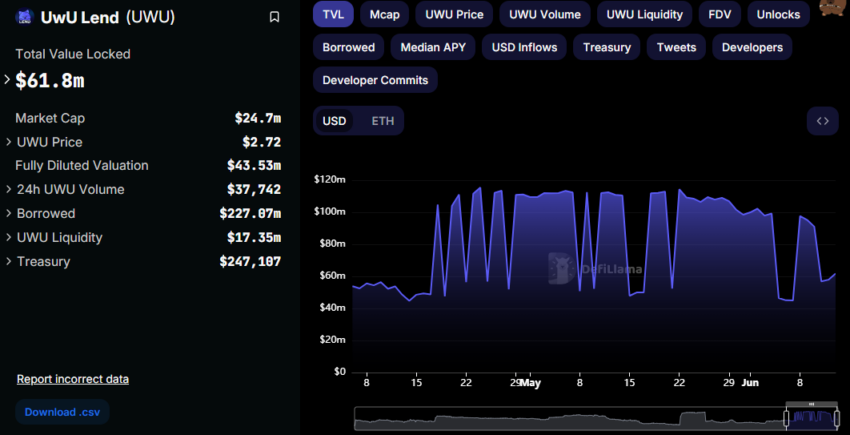

These issues have reached buyers, with DefiLlama knowledge exhibiting a 28% drop in Whole Worth Locked (TVL) this week. UwU Lend’s TVL has decreased from $91.05 million on Monday, June 10, to $65.8 million at press time. A drop in TVL signifies a discount within the whole quantity of property locked or deposited within the DeFi protocol.

Learn extra: 9 Crypto Pockets Safety Suggestions To Safeguard Your Property

This means that customers could also be withdrawing their funds or migrating to different platforms as a consequence of growing safety dangers. Safety breaches and hacks within the crypto area may be alarming and disruptive, and buyers ought to take precautions to guard their property.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.