Solana (SOL) has actually eliminated its current losses in a solid resurgence rally that started 3 days back. It started the uptrend on July 12, and its worth has actually given that increased by 13%.

Trading hands at $152, the 5th biggest cryptocurrency by market capitalization presently trades at a cost last observed on June 27 when possession supervisor VanEck made filings to market shares in a Solana exchange-traded fund (ETF).

Solana Sees Spike in Purchasing Task

Solana’s three-day rally has actually pressed its worth over a crucial relocating standard. The altcoin shut over its 50-day little relocating standard (SMA) the other day. It had actually originally damaged over the 20-day rapid relocating standard (EMA) on July 6.

A possession’s 50-day SMA tracks its ordinary closing rate over the previous 50 trading days. When a property’s rate surges over this crucial relocating standard, it typically signifies a change in market belief from bearish to favorable. It suggests that rate energy is reinforcing and verifies the opportunity of an additional rate rally.

On the various other hand, a property’s 20-day EMA determines its ordinary rate over the previous 20 days.

When a property professions over its 50-day SMA and its 20-day EMA, its rate has not just get rid of the ordinary rate over the previous 50 days yet additionally went beyond the temporary standard. This verifies that the customers remain in control and are pressing the possession’s rate greater.

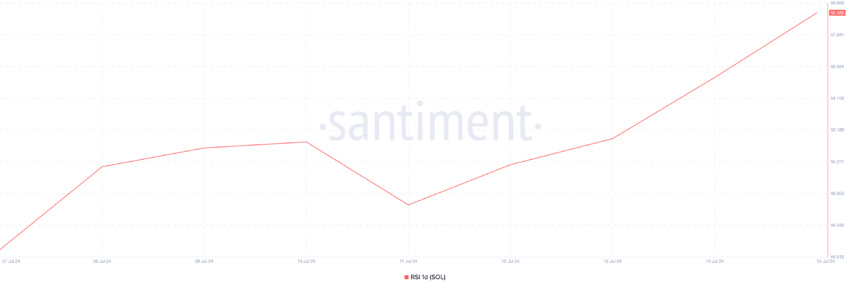

Better, since this writing, the coin’s Family member Stamina Index (RSI) remains in an uptrend at 59.26. This verifies that acquiring task is more than marketing stress in the SOL market.

Find Out More: 6 Finest Systems To Get Solana (SOL) in 2024

A possession’s RSI determines its overbought and oversold market problems. At 59.26, SOL’s RSI recommends that market individuals prefer acquiring even more SOL coins over marketing their existing holdings.

SOL Cost Forecast: The Bulls Have Control

In the recently, SOL’s rate has actually climbed up by 8%. This rate walk might be attributable to the marketplace positive outlook regarding a possible ETF launch for the altcoin.

Simply 7 days back, the Chicago Board Options Exchange (CBOE) submitted a demand with the united state Stocks and Exchange Payment (SEC) to enable it to provide VanEck’s and 21Shares’ possible place Solana ETFs.

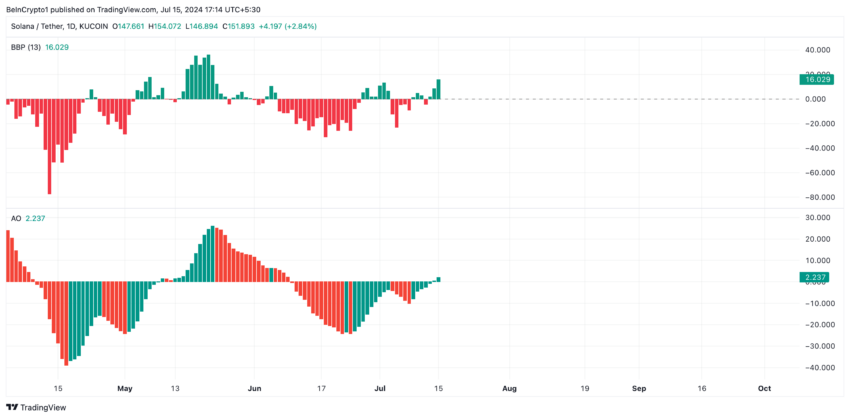

SOL’s Elder-Ray Index, analyzed on a one-day graph, reveals that the bulls have control of its market. Since this writing, the sign’s worth is over absolutely no at 16.05.

This sign determines the connection in between the stamina of customers and vendors in the marketplace. When its worth declares, it indicates that bull power controls the marketplace.

Furthermore, SOL’s Awesome Oscillator returns an upward-facing eco-friendly bar since this writing. This sign determines a property’s rate energy.

When it presents eco-friendly bars, it signifies raising favorable energy. This indicates the temporary SMA is climbing quicker than the long-lasting SMA, recommending that acquiring stress is raising.

If SOL’s acquiring stress lingers, it might rally previous $153.

Find Out More: Solana vs. Ethereum: An Ultimate Contrast

Nevertheless, if SOL turns around the existing pattern and starts to drop, it will certainly trade at $146.

Please Note

In accordance with the Depend on Task standards, this rate evaluation write-up is for informative objectives just and must not be thought about economic or financial investment suggestions. BeInCrypto is dedicated to exact, objective coverage, yet market problems go through alter without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.