Allow’s explore the family member efficiency of Zurn Elkay (NYSE: ZWS) and its peers as we untangle the now-completed Q1 cooling and heating and water supply profits period.

Commonly, home building and construction products business have actually developed financial moats with experience in specialized locations, brand name acknowledgment, and solid connections with service providers. Much more lately, advancements to attend to labor schedule and task website efficiency have actually stimulated advancement that is driving step-by-step need. Nonetheless, these business go to the impulse of property building and construction quantities, which often tend to be intermittent and can be affected greatly by financial aspects such as rates of interest. In addition, the expenses of resources can be driven by a myriad of around the world aspects and significantly affect the earnings of home building and construction products business.

The 6 cooling and heating and water supply supplies we track reported a slower Q1; generally, earnings missed out on expert agreement price quotes by 0.8%. Evaluation multiples for numerous development supplies have actually not yet gone back to their very early 2021 highs, yet the marketplace was positive at the end of 2023 as a result of cooling down rising cost of living. The begin of 2024 has actually been a various tale as combined signals have actually brought about market volatility, and cooling and heating and water supply supplies have actually held approximately consistent among all this, with share rates up 4.4% generally because the previous profits outcomes.

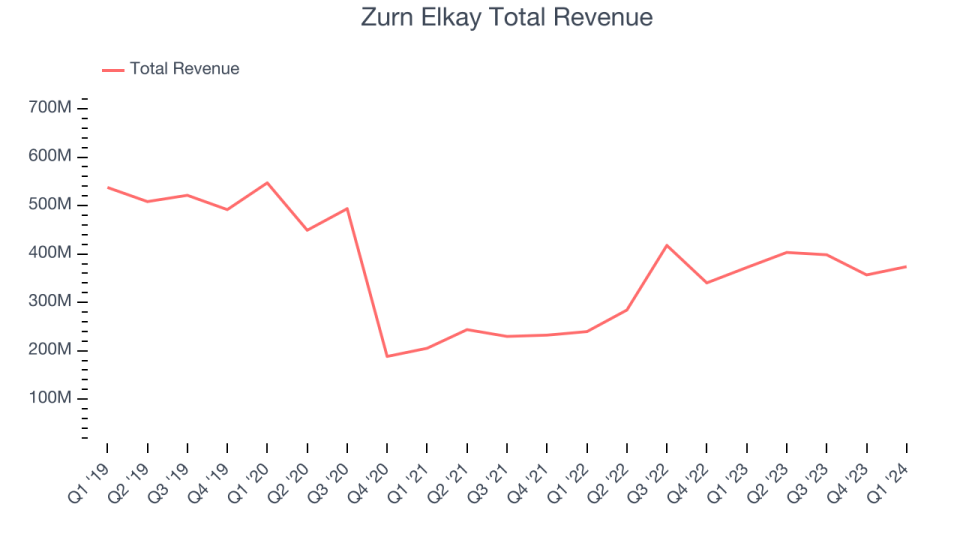

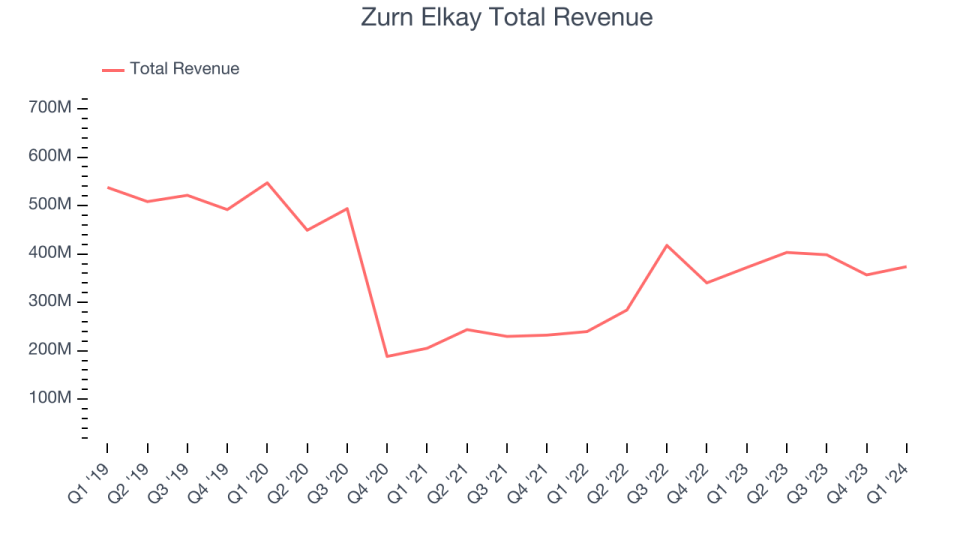

Zurn Elkay (NYSE: ZWS)

Asserting to have actually conserved greater than 34 billion gallons of water as a result of its systems, Zurn Elkay (NYSE: ZWS) offers water monitoring remedies to different sectors.

Zurn Elkay reported earnings of $373.8 million, level year on year, going beyond experts’ assumptions by 1.3%. Regardless of the top-line beat, it was a weak quarter in general for the business with a miss out on of experts’ natural earnings price quotes.

Todd A. Adams, Chairman and President, commented, “We had a strong begin to the year as our initial quarter development, earnings, and totally free capital( 1) each surpassed our assumptions heading right into the quarter.”

The supply is down 7.4% because reporting and presently trades at $30.31.

Read our full report on Zurn Elkay here, it’s free

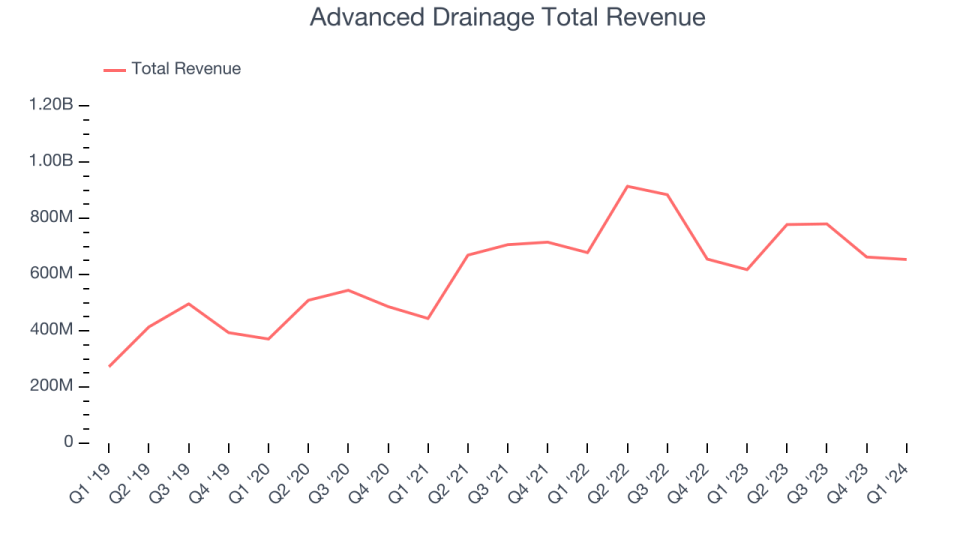

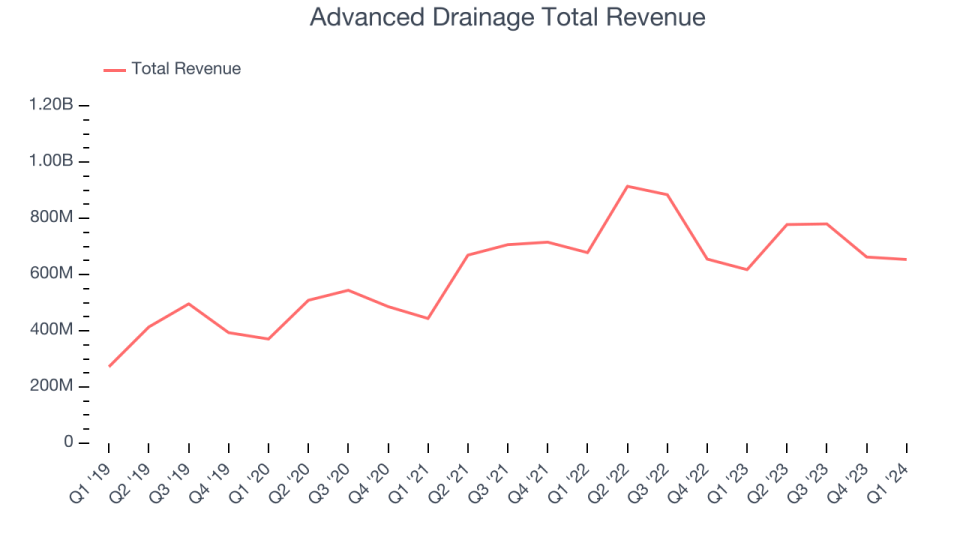

Finest Q1: Advanced Drain (NYSE: WMS)

Initially began as a ranch water drain business, Advanced Drain Equipment (NYSE: WMS) offers tidy water monitoring remedies to areas throughout America.

Advanced Drain reported earnings of $653.8 million, up 5.9% year on year, surpassing experts’ assumptions by 6.9%. It was a sensational quarter for the business with a strong beat of experts’ profits price quotes.

Advanced Drain provided the greatest expert approximates defeat amongst its peers. Although it had a wonderful quarter contrasted its peers, the marketplace appears miserable with the outcomes as the supply is down 7.2% because coverage. It presently trades at $163.51.

Is currently the moment to acquire Advanced Drain? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: AAON (NASDAQ: AAON)

Backed by 2 million square feet of laboratory screening room, AAON (NASDAQ: AAON) makes home heating, air flow, and cooling devices for various kinds of structures.

AAON reported earnings of $262.1 million, down 1.4% year on year, disappointing experts’ assumptions by 8%. It was a weak quarter for the business with a miss out on of experts’ profits price quotes.

AAON published the weakest efficiency versus expert price quotes and slowest earnings development in the team. The supply is level because the outcomes and presently trades at $90.48.

Read our full analysis of AAON’s results here.

A. O. Smith (NYSE: AOS)

Attributed with the creation of the glass-lined hot water heater, A.O. Smith (NYSE: AOS) produces water home heating and therapy items for different sectors.

A. O. Smith reported earnings of $978.8 million, up 1.3% year on year, disappointing experts’ assumptions by 1.7%. Zooming out, it was a weak quarter for the business with a miss out on of experts’ natural earnings price quotes.

The supply is level because reporting and presently trades at $87.83.

Read our full, actionable report on A. O. Smith here, it’s free.

Service Provider Worldwide (NYSE: CARR)

Established by the innovator of cooling, Provider Worldwide (NYSE: CARR) produces home heating, air flow, cooling, and refrigeration items.

Provider Global reported earnings of $6.18 billion, up 17.2% year on year, disappointing experts’ assumptions by 2.4%. Generally, it was a slower quarter for the business with a miss out on of experts’ natural earnings price quotes.

Provider Worldwide racked up the fastest earnings development amongst its peers. The supply is up 23.4% because reporting and presently trades at $67.60.

Read our full, actionable report on Carrier Global here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Assist us make StockStory extra useful to financiers like on your own. Join our paid customer study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.