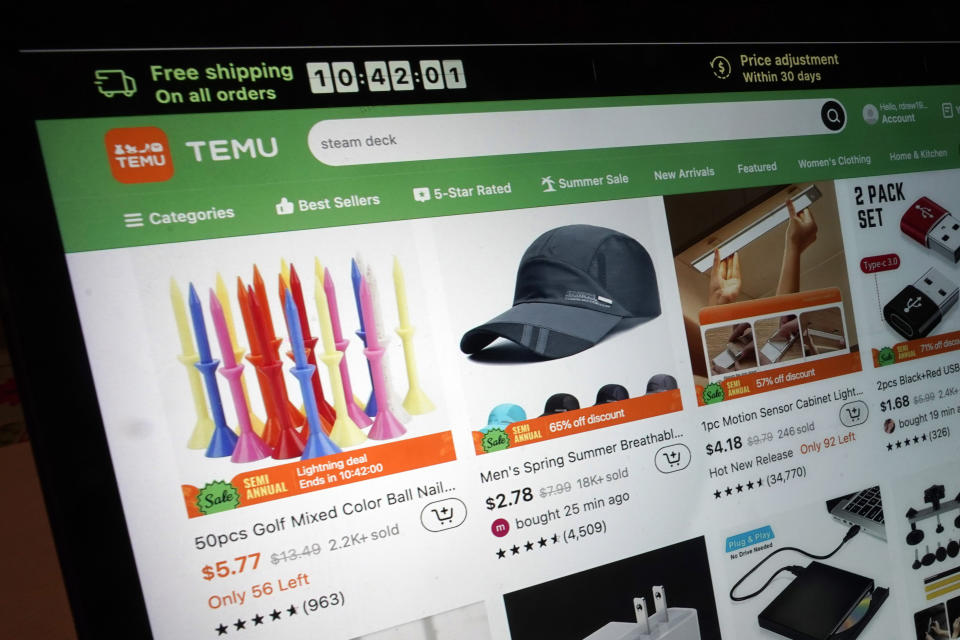

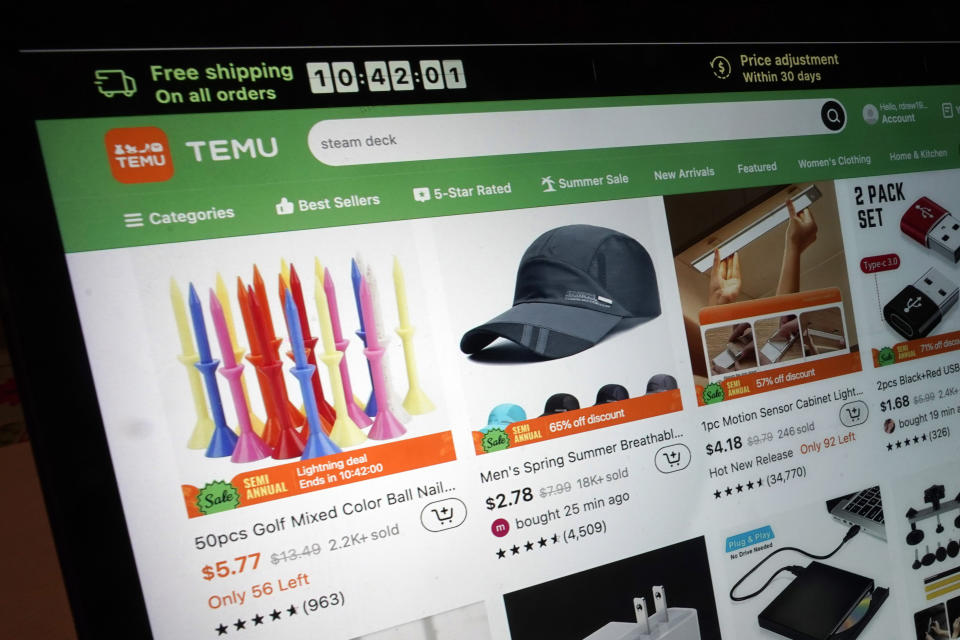

Amazon’s (AMZN) prominence in shopping makes any kind of prospective danger upsetting seriously. Externally anyhow. Yet the shocking development of straight carriers like Temu and Shein, though undersized in contrast, has actually gotten the interest of individuals that run the whatever shop.

And Amazon intends to face them straight prior to they obtain far more grip.

Amazon’s reported transfer to begin a brand-new solution concentrated on delivery affordable style and way of living items straight from China highlights exactly how deal systems have actually made invasions with American consumers and Chinese producers. And exactly how also market leaders are compelled to get used to keep prominence.

” The Chinese industries aren’t presently a big danger to Amazon, however they are expanding, and they are munching away at its market share,” stated Neil Saunders, a retail expert at GlobalData.

New information emphasizes exactly how extensively Amazon regulates the shopping market however additionally recommends why propping up a deal imitator solution looks like a calculated requirement, comparable to a mainstream airline company releasing a discount rate service provider to repel the “little individuals.”

By the numbers, naturally, the rising stars look even more like specific niche companies compared to the Seattle mega-retailer.

Amazon is anticipated to produce greater than $360 billion in 2025 from sales linked to independent vendors that utilize the online system, according to a record released by eMarketer recently. That stands for a 10% dive from 2024. And it’s 10 times more than its closest online rival, ebay.com (EBAY.COM).

Yet also as Amazon towers over its competitors, consisting of the similarity Walmart (see over graph), and is anticipated to upload healthy and balanced development, Temu’s expected numbers, for instance, outperform every person else.

Temu– where consumers can purchase footwear for much less than $10, drones for $15, or a cushion topper for a bit greater than $30– is anticipated to expand its third-party sales by almost 60% following year to greater than $30 billion, eMarketer approximates program. That’s well over the development projections of various other industry rivals, consisting of Walmart (WMT) and Etsy (ETSY).

Currently, Temu and various other inexpensive systems have actually a directory constrained to even more budget friendly items and fundamental durable goods. “Yet there is a risk the overlap might expand as the industries complete their deal and press right into greater cost factors,” stated Saunders.

Like various other kinds of on the internet purchasing or strolling the aisles up for sale, viewed financial savings have a means of loosening up bags, playing off impulses, and persuading consumers to grab products they really did not recognize they required.

Possessed by the Chinese shopping team PDD Holdings (PDD), Temu started running in the United States in 2022. The firm has actually counted on an advertising and marketing strike and aids to interfere with well-known gamers in China and abroad, possessing ultra-low costs to claw away market share, a design that has actually flourished as customers mind their investing. PDD does not burst out Temu sales numbers. Yet the moms and dad firm reported revenue of $12 billion for the quarter finishing in Might.

Shein additionally has Chinese origins however is presently headquartered in Singapore. The fast-fashion juggernaut, which includes $5 pajama collections and $7 yoga exercise tights, does not report its financials. Yet in a run-up to a prospective IPO, estimates pin the company’s annual revenue at greater than $30 billion.

Together with their monetary success, both systems have actually attracted political examination over the method they manage sending out products to the United States. Shein and Temu take advantage of a tax obligation technicality that excuses bundles from tolls if they deserve much less than $800. Some legislators have actually required an end to this profession stipulation, targeting Chinese firms. Nearly fifty percent of the deliveries that are sent out over making use of the duty-free exception originated from China, according to a current Legislative board record.

A less expensive however slower supply chain

Systems like Shein and Temu have actually found that for some consumers seeking a particular collection of items, rate is lesser than phenomenal worth.

For many years, Amazon has actually conditioned United States customers to acquire unbranded products from Chinese vendors at small cost. The firm enhanced for fast shipment, creating a gratification network that can provide products in days or perhaps hours. That holds true for products currently delivered to the United States from abroad and from residential sellers. In March, as an example, almost 60% of Prime participant orders showed up the exact same or the following day throughout the leading 60 biggest United States city locations, the firm has actually promoted.

Consumers going shopping on discount rate systems, nonetheless, can purchase from vendors that deliver items straight from China. Considering that the products aren’t currently being in stateside storehouses, the logistical trip suggests shipment times are determined in days and weeks. Yet what these deals shed in time, they offset in cost. That’s exactly how consumers can locate a variety of products on Temu that are more affordable than those marketed by chain store or perhaps Amazon. (To defeat the warmth, an ice manufacturer expenses around $50 on Temu, contrasted to approximately $80 on Amazon. And a neck follower– that does not require among those?– chooses about $5 on Temu. Comparable products vary from $20 to $45 on Amazon.)

The straight delivery design functions specifically well for more affordable products given that even more of their cost is credited to set you back and costs. Getting rid of a gratification layer can make them substantially more affordable. That’s why conventional stores and Amazon– which provide solution, comfort, and rate– commonly can not match the costs of deal applications.

Copycat versions

As the discount rate systems have actually expanded their consumer base, Amazon has actually taken notification.

The shopping leader has actually shared strategies with Chinese vendors to introduce a brand-new purchasing network that would certainly satisfy individuals seeking budget friendly clothes and way of living items, as initially reported by the Information‘s Jing Yang and Theo Wayt. The products, most of which will certainly set you back much less than $20, would certainly be delivered straight from China, with shipment as quick as 9 days.

” There is additionally something of a future danger because the Chinese industries are really interesting more youthful generations, which Amazon additionally intends to hire and keep as future consumers,” stated Saunders.

And it’s not simply consumers Amazon seeks.

In a declaration to Yahoo Financing, Amazon stated “We are constantly discovering brand-new methods to collaborate with our offering companions to thrill our consumers with even more choice, reduced costs, and better comfort.”

Temu informed Yahoo Financing in a declaration that their direct-from-factory design structured the conventional retail supply chain. “By getting rid of middlemans, we pass financial savings straight to customers, using reduced costs without endangering high quality,” the firm stated. “Customers have actually accepted this technique by making Temu among one of the most preferred purchasing applications on the planet.”

Shein did not react to ask for remark.

Amazon’s organized discount rate shop is additionally an effort to court Chinese vendors, their circulation of company, and their advertisement bucks, stated Skies Canaves, a primary expert at eMarketer.

” They might separately offer percentages, however in the accumulation, they are high. If the vendors make a decision to go offer in other places, on TikTok and Shein and Temu, if they begin discovering various other systems, they are mosting likely to be investing in various other systems,” she stated. “That’s what Amazon is attempting to prepare for.”

Yet the supply chain mimicry and attack right into competing lawn go both methods. Equally as Amazon is attempting to be a lot more like Temu and Shein, the discount rate systems are attempting to be a lot more like Amazon, stated Juozas Kaziukėnas, owner of the marketplace research study company Industry Pulse.

Deal systems are establishing collaborations and neighborhood stockroom programs in the United States and are hiring residential sellers.

Temu’s initiatives to hire even more Chinese vendors with United States supply, in addition to neighborhood sellers, are taking a web page out of the Amazon publication. It’s additionally a means to secure the firm if the United States federal government gets rid of the profession stipulation that excuses affordable deliveries from custom-mades tasks, as the Information reported on Wednesday. While it remains to deliver items straight from China, Temu is developing a more powerful base of independent United States vendors

Temu informed Yahoo Financing that certified vendors can currently manage their very own logistics from neighborhood United States and European storehouses. “This improves our item choice, minimizes delivery ranges, and reduces shipment times,” the firm stated.

The wide success of Amazon’s shopping company has actually additionally welcomed various other significant gamers like Walmart and Target (TGT) to develop their very own industries with third-party vendors. And the build-out of supply chain logistics has actually made it much easier for bands outside the United States to acquire a footing, stated Cayce Roy, the owner and president at Standvast, an ecommerce gratification firm, and a previous vice head of state at Amazon.

The difficulties for Amazon

In an atmosphere where Amazon still has clearance for development however is more detailed to saturation, specialists state developing brand-new profits streams and asserting share from competitors are methods to enhance development.

Yet difficulties exist in advance for tackling the discount rate systems that have actually strengthened a particular niche on their own.

If Amazon developed an identification based around quick shipment and comfort, exactly how will the firm interact to consumers the benefit of slower shipment?

” This is not an all-natural suitable for them. And they do not always have a benefit,” stated Kaziukėnas.

Kaziukėnas additionally indicated Prime Day, simply around the bend, to highlight the several various other purchasing actions Amazon is attempting to satisfy.

” Shein and Temu are not unintentional. This is the one point these applications are concentrated on, but also for Amazon, this is mosting likely to be priority number 17,” he stated. “For every one of Amazon’s expertise and toughness, this is where they are beginning with a factor of weak point.”

Hamza Shaban is a press reporter for Yahoo Financing covering markets and the economic situation. Comply With Hamza on Twitter @hshaban.

Visit This Site for the current stock exchange information and extensive evaluation, consisting of occasions that relocate supplies

Check out the current monetary and company information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.