The Crypto Anxiety & & Greed Index gauges exactly how financiers really feel towards the marketplace at any kind of provided time, placing their determination to place cash right into the marketplace. Over the in 2014, this index has actually remained fairly high, entirely staying clear of Extreme Anxiety area. Nonetheless, this remarkable touch involved an end after the Crypto Anxiety & & Greed Index came under Extreme Anxiety in the very early hours of Friday.

Crypto Anxiety & & Greed Index Sees Lowest Degree Considering That November 2022

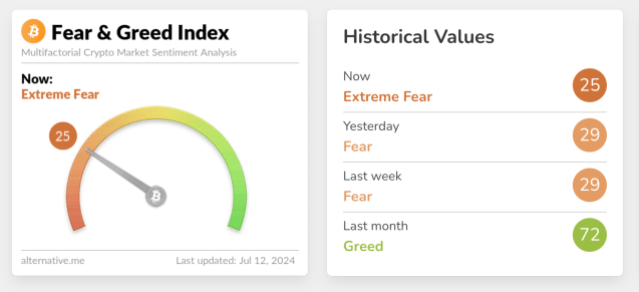

Since Friday early morning, the Crypto Anxiety & & Greed Index has actually formally gone back to the Extreme Anxiety degree. The index shows a rating of 25 after delaying in the Anxiety area right component of the recently. This decrease remains in raw comparison to last month when the index was still securely in the greed area.

While the Crypto Anxiety & & Greed Index blinking Extreme Anxiety is not brand-new, what makes this set attract attention is how much time it has actually been considering that view has actually been this reduced. Checking out the graph, it reveals that the last time that the Crypto Anxiety & & Greed Index remained in Extreme Anxiety was throughout the FTX exchange collapse of 2022.

Because that time, the marketplace had actually recoiled and remained in an advancing market for around a year, at some point getting to Extreme Greed in 2024. Nonetheless, the kip down capitalist view recommends an exhaustion in the rally as vendors have actually currently taken control of the marketplace.

Currently, the Crypto Anxiety & & Greed Index’s rating of 25 methods that it goes to the extremely leading end of the Extreme Anxiety area. This suggests that it can quickly be tipped back right into the Anxiety degree. Yet it likewise provides births the chance to press view additionally towards Extreme Anxiety.

Why This Might Be Helpful For Rate

The Crypto Anxiety & & Greed Index falling under the Extreme Anxiety is traditionally a great advancement for bulls considered that it provides enough time to enter cryptocurrencies at affordable price prior to the marketplace recoups. The very same point was seen in the FTX collision of November 2022 when the Bitcoin cost recoiled from $16,000 to go across $40,000 in the room of one year.

By the year 2024, which was much less than 2 years later on, the Bitcoin cost would certainly take place to get to $73,000, a brand-new all-time high. This recommends that purchasing when the marketplace is afraid is the most effective time to place of what can be an eruptive rally.

An old-time stating amongst skilled financiers is “Acquire when there is blood on the roads.” This just suggests that purchasing when every person is afraid, like currently, is normally the most effective time to enter the marketplace. If there is a repeat of the 2022 fad, after that the marketplace can trade sidewards for some time prior to a rebound that can send out costs to brand-new all-time highs.

Included photo developed with Dall.E, graph from Tradingview.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.