Bitcoin is recovering however nonetheless beneath immense liquidation stress when writing. As BTC faces headwinds, the zone between $70,000 and $72,000 is proving to be a powerful resistance stage that have to be damaged for the wave of upper highs registered in Q1 2024 to proceed.

The world’s most respected coin is buying and selling beneath $70,000 at press time, bouncing increased from round $67,000. The first essential help stage to look at at press time is $66,000.

Nonetheless, if bears are relentless, reversing positive aspects of earlier at this time, extra losses might be on the horizon.

Will Bitcoin Drop To The STH Realized Worth And Assist At $62,300?

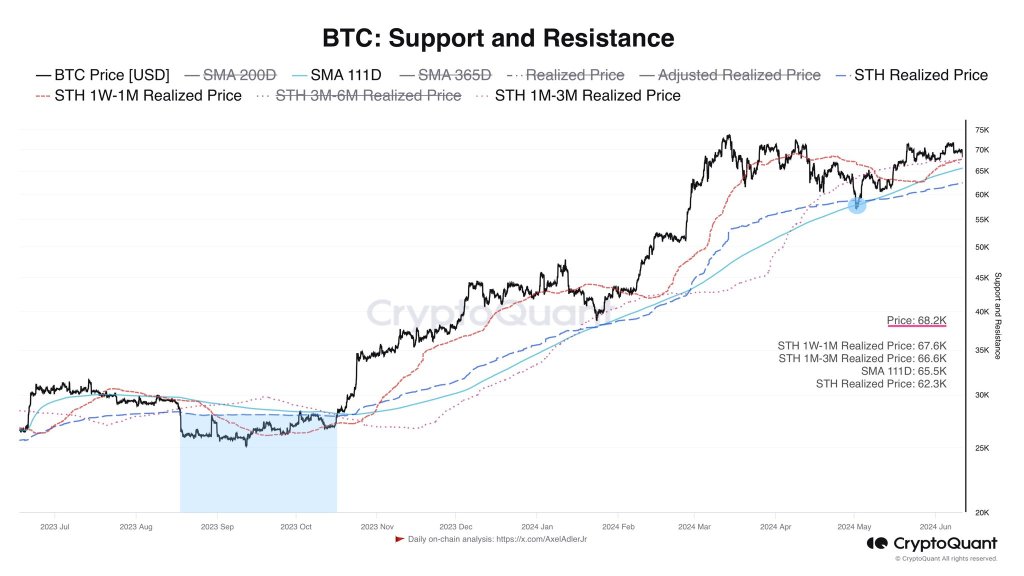

Taking to X, one analyst notes that if the continuing liquidation of lengthy positions continues, BTC may plummet to the “Brief-Time period Holder Realized Worth” (STH Realized Worth) of $62,300.

The dealer sees this stage as a zone of low lengthy liquidity. Accordingly, it might be a restricted help the place BTC bulls would possibly discover entry to plug losses.

The STH Realized Worth is normally used to gauge sentiment. Basically, it represents all BTC’s common buy value inside 155 days. Those that select to carry BTC throughout this time are also known as short-term holders or primarily speculators aiming to scalp value volatility.

Whereas the STH Realized Worth serves as a sentiment indicator, the road plotted can act as help. If BTC costs proceed plunging, trending beneath the STH Realized Worth, it may pressure coin holders to liquidate since they’re within the purple.

Alternatively, if costs strategy the STH Realized Worth, merchants would possibly select to purchase, convincing holders that they’re at near-breakeven.

The STH Realized Worth is at present $62,300, however the one-to-three-month Realized Worth is $66,600.

Subsequently, if Bitcoin loses $66,000, the liquidation would possibly speed up the dump towards the 155-day STH Realized Worth.

Eyes On The FOMC Amid Excessive Inflation And Stable Employment Knowledge In America

Because the crypto market stays on edge, traders are carefully watching the upcoming Federal Open Market Committee (FOMC) assembly. Given the robust labor market circumstances, the central financial institution is predicted to go away rates of interest unchanged at 5.50%.

Final week, employment information exceeded expectations. In line with america Bureau of Labor Statistics (BLS), 272,000 new jobs had been created in June, way over the 185,000 economists projected.

Nonetheless, stable non-farm payrolls (NFP) information poured chilly water on hopes of an imminent price minimize.

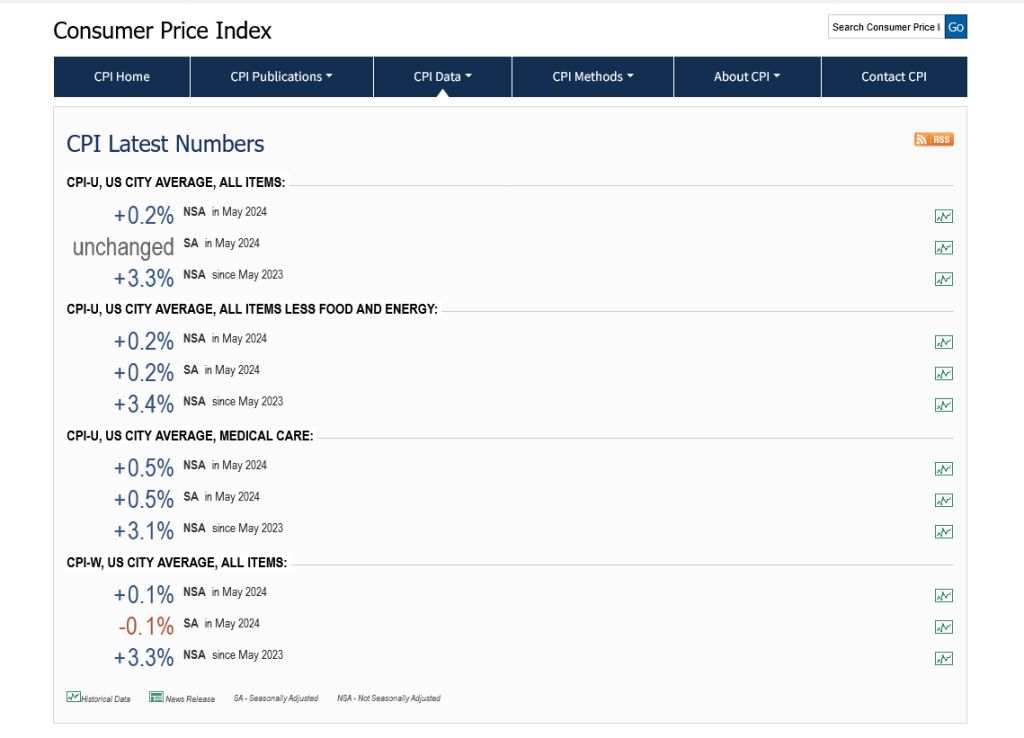

Even so, with inflation dropping to three.3% year-to-date, in response to the BLS, the chances of a price minimize is increased, an enormous increase for Bitcoin bulls.

Function picture from Canva, chart from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.