A separate is emerging in between real need for cross-border air freight solution via the initial fifty percent of 2024 and projections for the complete year, questioning concerning whether the present rise will certainly enhance throughout the typical active period beginning in mid-September or shed power.

Although the shopping eagerness powering the air freight market reveals no indications of cooling off, that does not indicate various other market motorists will not. Numerous carriers are drawing onward drop orders to lessen the opportunity of late-arriving supply related to longer sea transportation times and port blockage because of detours around the harmful Red Sea, and the risk of a dockworker strike at united state East Coastline ports this loss. International customer need is fairly warm, so it’s feasible that pre-buying is cannibalizing future development instead of an indication of raised profession task.

Likewise, outright need is not as solid as the numbers recommend. Development this year is off a reduced base in the initial fifty percent of 2023, when freight quantities were down 10% from the exact same 2022 duration due to the fact that dealers and sellers bewared concerning getting as they attracted down supply. The marketplace’s healing in in 2014’s 4th quarter suggests development gains will certainly be tougher to attain in the last quarter, possibly causing slower year-over-year development prices from today’s raised degrees.

However, limited ability and constant cost boosts on major profession passages are pushing services to secure transportation offers for the approaching top delivery period.

Airfreight quantities in June raised 13% year over year while delivering supply just raised 3%, according to products market tracker Xeneta. It was the 7th successive month of double-digit development in the chargeable weight brought by airline companies, highlighting the obvious healing from an 18-month slump. Capability application raised 4 indicate 59%. Freight quantities are remaining to stand up thus far this month, up 12% year over year.

The International Air Transportation Organization highlighted the pattern with its newest record revealing distance-based air freight website traffic raised 14.7% in Might from a year ago versus worldwide ability up 15.5%. WorldACD claimed worldwide tonnage raised 12% in the initial fifty percent of 2024, with second-quarter freight out of Asia up 18%. The marketplace scientist’s initial price quote was that freight expanded 9% in June.

Air freight remains to be sustained by direct-to-consumer satisfaction out of China for Chinese and united state retail systems in addition to causal sequences from Houthi rebel assaults on industrial delivery in the Red Sea. The assaults are triggering carriers to transform some deliveries to air or integrate sea-air steps through centers in Southwest Asia or the Center East. Logistics suppliers report severe weather today near the Cape of Great Hope have actually created more hold-ups for container lines as vessels alter training course or look for sanctuary from high winds and waves. Capability might be more affected if the scenario lasts greater than a couple of days.

A 5th of worldwide air freight quantities, by some quotes, are credited to shopping. The shopping share is also greater on significant export lanes from Asia to Europe and The United States And Canada. Increased examination by united state Traditions and Boundary Security of shopping deliveries from China has actually not caused lessened air freight website traffic or terminated truck trips, in contrast to some media records. Plans might be postponed an hour or 2 at one of the most, at some incoming handling centers, according to trade specialists.

The stress on sea delivery isn’t originating from the need side– quantities are just up somewhat from in 2014– yet due to the fact that the supply of vessels and containers is extended slim. The typical globally expense of delivering a 40-foot container got to 4,988 late recently, according to Freightos, greater than 5 times the expense in July a year earlier. Sea prices climbed up substantially considering that late June to $8,200 per 40-foot box out of Asia to the west shore of The United States and Canada and $9,300 each to the eastern shore, harkening back to price spikes throughout the COVID-19 dilemma. Peak period need accompanying Red Sea ability restraints have actually pressed Asia-North America area prices 60% greater than their February top, while costs to Northern Europe are 80% greater than optimals seen in January.

With sea costs climbing up much faster than airfreight, the distinction in expense in between the settings is tightening and making air freight an extra appealing transport alternative for services. Evaluation by Rotate, a data-driven air freight working as a consultant based in the Netherlands, reveals that airfreight prices are currently just 6 times greater than sea– the tiniest space considering that the 3rd quarter of 2022– contrasted to 12 to 15 times greater under regular problems.

Mark Webb, primary monetary police officer of J. Jill, claimed on the firm’s first-quarter earnings call that the garments store utilized airfreight to obtain product to storage facilities in time for the summertime buying period. Yet it does not require to accelerate deliveries for the loss due to the fact that it relocated orders onward to make up for vessel diversions around Africa, as flagged by the Wall surface Road Journal.

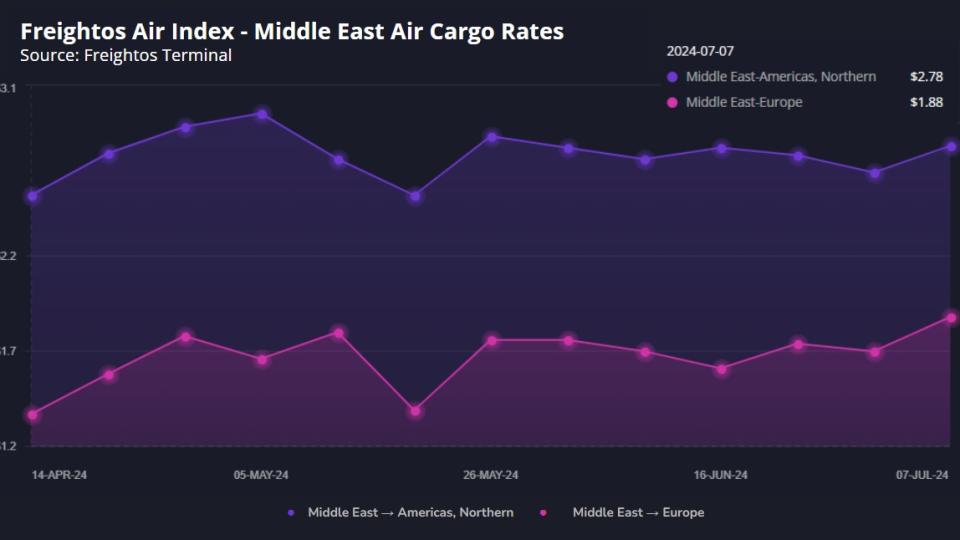

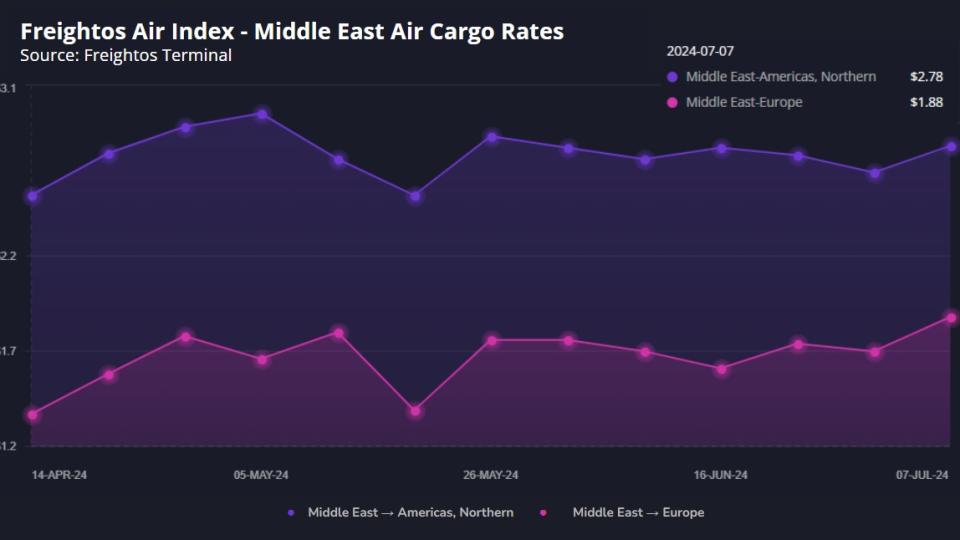

Typical worldwide airfreight prices for instant delivery have actually substantially raised throughout the previous 2 months. The expense of airfreight is 13% greater than it was a year earlier, according to the TAC Index. Fees out of China are well over regular off-season degrees at concerning $5.60/ kg to The United States and Canada and $3.38/ kg to Europe, per Freightos. The delivery expense from Center East airport terminals to Europe has actually raised 10% in the previous week, maybe an indicator that getting worse sea interruptions might be pressing extra quantities to air.

In a turnaround from a year earlier, WorldACD kept in mind that development as a whole freight surpassed that of unique freight items, such as drugs, by 3 factors due to shopping, which drops under the umbrella of basic freight, and Red Sea interruptions. Midway via 2023, need for specialized air freight was expanding, while the marketplace all at once was down 7% year over year.

Logistics suppliers remain to report that scheduling ensured area quantities with airline companies for the rest of the year is exceptionally hard due to the fact that Chinese shopping systems have pre-bought long-lasting ability, with various other carriers paying a costs for any type of continuing to be blocks or scheduling tons instantly market. Some providers are anticipated to keep back a part of their ability for spot-market purchases to benefit from increasing returns.

” We anticipate reduced need development year-on-year in the 2nd fifty percent of 2024 due to such a solid Q4 2023 contrast, yet if you have not prepared your ability now you might be in for fairly a trip. Carriers will pay even more throughout Q4, the inquiry is just how much extra?” claimed Niall van de Wouw, Xeneta’s primary airfreight police officer, in the firm’s newest record.

Carriers and forwarders with ability arrangements in markets that are currently tight will certainly have minimized direct exposure to price walkings and peak period additional charges. Companies that exceed their assigned limit, or do not have a block area arrangement, might encounter a 50% boost in prices from present degrees, he kept in mind.

Throughout the 2nd quarter, carriers progressively selected agreements lasting greater than 6 months over three-month agreements to stay clear of products price changes throughout the top period thrill later on this year, according to Xeneta. The information revealed the percentage of freight quantities acquired in the area market made up 42% of the overall market, down 3 factors versus a year earlier.

Some providers are still including ability out of China, specifically to sustain Chinese shopping gamers. Air China Freight, as an example, lately released solution 4 times each week in between Chengdu and Paris with its initial Airplane A330 truck, according to a regular monthly market upgrade from AIT Worldwide Logistics. The chilly chain logistics arm of China Eastern Airlines last month opened up an Ezhou-Seoul, South Korea-Miami path ran as soon as each week by Kalitta Air using a Boeing 747 truck. Main assets being delivered are shopping items, blossoms, electronic devices and subject to spoiling foods, such as lobsters, salmon and cherries.

But Also For one of the most component widebody truck ability is limited on significant profession paths. An indication that increasing guest tummy ability is affecting the marketplace originates from the Financial institution of America, which claimed in a current record that devoted truck trip task is not expanding after sinking 5% in 2023. Charter airplane will certainly end up being progressively hard to obtain when the active top period begins in September, logistics professionals claim.

Second-half slowdown?

In spite of the shocking first-half renewal of air freight need, IATA projections that full-year freight profits for airline companies will certainly reduce due to the fact that an increase of lower-deck ability related to development in guest traveling is surpassing quantities and placing descending stress on returns.

The airline company team last month anticipated airfreight website traffic will certainly enhance 5% in 2024 (up from its previous price quote of 4.5%) while ability will certainly expand 8.6%. The supply-demand discrepancy, which shows a return to pre-pandemic patterns, is anticipated to minimize typical delivery costs by 17.5%.

Freight profits will certainly reduce 13% year over year to $120 billion due to the reduced returns, claimed IATA. High returns and income were allowed by serious ability lacks and supply chain restraints throughout the pandemic, which turned around with the solid return of guest tummy ability. The price of income decrease is far better than the 33% decrease experienced in 2023.

IATA’s projections for income and return decrease were changed upwards from $111 billion and adverse 21% in December. Comparative, sector freight income was $101 billion in 2019.

International returns year-to-date via April were still 28% over pre-pandemic degrees, although IATA financial experts hint they get on track to technique pre-COVID-19 degrees, working out somewhat over the long-lasting standard.

Whether air freight need will certainly stand up stays an open inquiry. Consider air freight’s support consist of development in worldwide production, yet development isn’t consistent worldwide and really expanded at a slower rate in June, while brand-new export orders revealed their initial decrease in 3 months. Rising cost of living additionally saw a combined image in Might, with decreases in the European Union and Japan and consistent cost development in the united state still over federal government targets. On the other hand, united state retail sales hardly raised in Might and previous months were changed downward, recommending wonderful monetary difficulty amongst customers, according to Bloomberg.

It needs to be kept in mind that the united state federal government’s retail sales numbers aren’t changed for rising cost of living, which suggests adjustments in costs might raise total amounts also without a boost in quantities marketed. Significant sellers in current weeks have actually executed significant discounting programs to aid restore customers that have actually tightened their pursestrings.

SUGGESTED ANALYSIS:

What does air cargo’s early peak season mean for peak season?

Airfreight rides e-commerce to surprise growth in May

The blog post Air cargo surge could be at expense of peak season growth showed up initially on FreightWaves.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.