Capitalists count on Warren Buffett for a factor. Although he’s the initial to claim he’s made blunders, he has a tried and tested performance history of choosing champions and defeating the marketplace.

Among his even more interested choices is Nu Holdings ( NYSE: NU) That’s not due to the fact that Nu isn’t a wonderful supply; it’s up 54% this year, and it’s reporting extraordinary outcomes. It’s uncommon due to the fact that it’s a development supply in a dangerous area, which isn’t generally Buffett’s design.

If Buffett’s favorable on this supply, however, it might not be as high-risk as it appears. And at under $15 per share, maybe a deal. Allow’s dive in and see.

What Nu has actually currently done

Nu runs under the NuBank banner as an all-digital financial institution in Brazil, Mexico, and Colombia. It has actually swiftly become an actual challenger to the traditional banks in these areas, catching market share and showing remarkable outcomes.

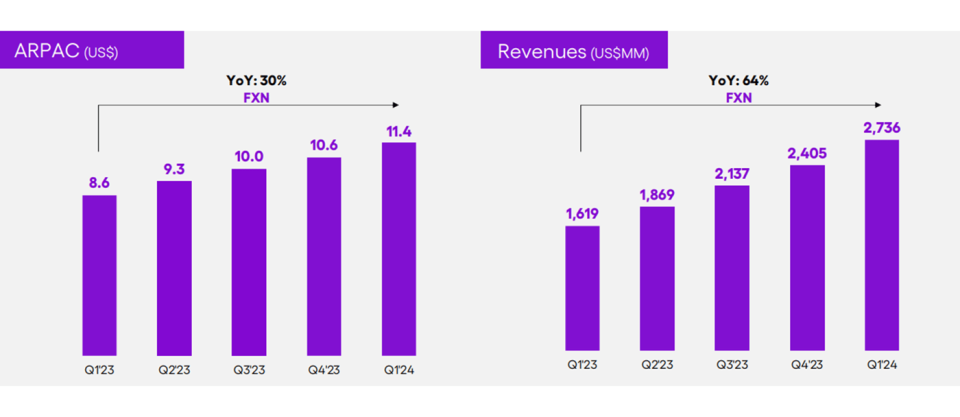

Nu is a fast-growing company and is reporting solid operating metrics throughout the board, however it’s concentrated on 3 vital objectives: Including clients, increasing income per consumer, and scaling effectively. Its quarterly updates regularly reveal progression in these locations, and it proceeded in the 2024, including 5.5 million clients in the initial quarter and finishing it with 99.3 million.

The firm is still primarily focused in its core area and head office of Brazil, where there were 1.3 million brand-new clients monthly. It has 54% of the grown-up populace of Brazil on its system and has actually gone up to the come to be the fourth-largest financial institution in the nation by variety of participants.

Still, Nu likewise included 1.5 million participants in Mexico, finishing the quarter with 6.6 million, or 106% greater than in 2015. It just has 900,000 participants in Colombia, its latest area, and it’s still turning out items there.

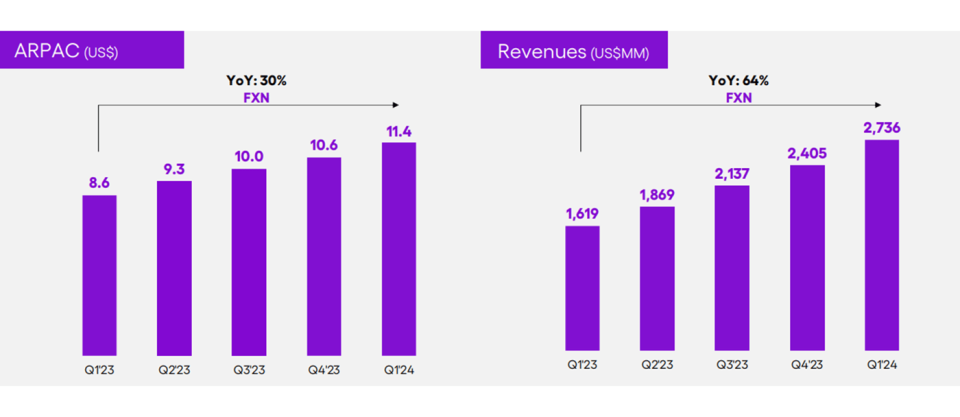

Typical income per energetic consumer (ARPAC) is among Nu’s essential metrics, and it remains to increase quarterly. This determines involvement and natural development, both of which, incorporated with brand-new clients, result in overall income development.

When it comes to effective scaling, Nu transformed successful a couple of years back and has actually preserved andgrown its net income As an all-digital financial institution (which indicates no property), with enhancing income per consumer (which indicates much less advertising expenditure), it’s maintaining its expenditures reduced. Expense to offer (a book-keeping step) has actually stayed fairly secure over the previous couple of quarters, being available in at $0.80 or $0.90 per energetic consumer.

Where Nu is going

Nu has a number of purposes to maintain making its development a fact. It has 4 vital concerns for 2024: obtaining much deeper right into Mexico, increasing its credit score service in Brazil, targeting a high end market in Brazil, and updating innovation to use much better items.

Not just is Nu including numerous participants in Mexico, however at 19 quarters right into its Mexico launch, numerous vital efficiency signs are surpassing just how it carried out in Brazil at 19 quarters in. It has even more clients in outright numbers and portion of market, even more bank card clients, and a lot more bank card acquisition quantity, and a lot more metrics reveal comparable outcomes.

Its credit score section in Brazil is outshining general market standards, and the overall profile boosted 52% year over year. Car loan sources were up 95%, and development in the interest-earning profile is driving internet passion earnings development and internet passion margin development.

Nu is catching better market share in the high-income section, with 2023 acquisition quantity up 104% year over year, and the greatest web marketer ratings in the market. It lately released a brief movie in collaboration with Walt Disney to draw in passion from this populace.

Is it a deal at under $15?

As the majority of financiers understand, determining a deal supply has even more to do with the supply’s assessment than its price. There are a selection of devices to evaluate assessment, and some job much better than others for various supplies.

Nu Holdings is a financial institution, however it’s a high-growth-fintech type of financial institution. It’s method a lot more pricey than the typical, well-known financial institution when making use of a price-to-book worth, and it’s likewise a lot more pricey making use of a price-to-earnings proportion. However it’s really more affordable when making use of a forward 1 year price-to-earnings development (PEG) proportion, due to the fact that it’s expanding so quickly.

A firm reporting development as high as Nu with secure and rising revenues obtains a costs on its supply. Its price-to-earnings proportion of 49 could be pricey for a financial institution supply, however affordable for a high-growth supply. So while it might not look like a deal in the typical feeling, its assessment does not appear unreasonable.

Nu supply professions at $12.80 since this writing, and it appears like a solid purchase for development financiers with some hunger for danger.

Should you spend $1,000 in Nu Holdings now?

Prior to you acquire supply in Nu Holdings, consider this:

The Supply Consultant expert group simply determined what they think are the 10 best stocks for financiers to acquire currently … and Nu Holdings had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Think About when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $805,042! *

Supply Consultant gives financiers with an easy-to-follow plan for success, consisting of advice on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Supply Consultant solution has greater than quadrupled the return of S&P 500 because 2002 *.

* Supply Consultant returns since July 8, 2024

Jennifer Saibil has settings in Nu Holdings and Walt Disney. The has settings in and advises Walt Disney. The advises Nu Holdings. The has a disclosure policy.

Should You Buy Nu Holdings Stock While It’s Below $15? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.