According to a current record by CCData, stablecoin trading quantity on central crypto exchanges (CEX) struck its floor in 7 months in June.

This decrease notes the 3rd successive month of lowered trading quantities.

Stablecoin Market Reveals Mixed Signals: Increasing Cap, Falling Volumes

CCData’s analysis indicate a substantial reduction in stablecoin trading quantities. In June, the number dropped by 18% to $97 billion. Nonetheless, the overall market capitalization of stablecoins climbed for the 9th successive month throughout the coverage duration.

The record discloses that the worldwide stablecoin market capitalization enhanced by 0.53% month-on-month to $161 billion. The number is the greatest stablecoin market capitalization given that April 2022, however the development price has actually slowed down given that May.

Learn More: What is a Stablecoin and Exactly How do They Function?

Moreover, CCData notes that the marketplace share of stablecoins enhanced from 6.22% in May to 6.83% in June. This boost is credited to financiers squandering of even more unstable electronic properties like Bitcoin and Ethereum, choosing the loved one security of stablecoins in the middle of market unpredictabilities.

Tether USD (USDT), the leading stablecoin by market capitalization, preserved its supremacy in June. USDT’s market capitalization enhanced by 0.97% contrasted to May. It held a significant market share of 70% throughout the duration.

Various other stablecoins, like Ethena’s USDe, likewise attracted focus with their substantial regular monthly development prices. USDE’s market capitalization has actually been increasing for 6 successive months, enhancing by 21.2% in June alone.

In spite of a general boost in the stablecoin market capitalization and market share, the downturn in trading quantities mirrors wider market unpredictabilities. This fad has actually been continuous given that April, accompanying the Bitcoin halving, which traditionally influences trading tasks and the marketplace’s total habits.

Nonetheless, a June record from Coinbase supplies a favorable overview for the stablecoin sector in the long-term. The record highlights expanding rate of interest and energy for stablecoins, specifically in cross-border purchases.

Learn More: An Overview to the very best Stablecoins in 2024

As an example, PayPal’s assistance for cross-border stablecoin transfers throughout 160 nations without any purchase charges attracts attention as a substantial growth. Additionally, the yearly negotiation quantity of stablecoins struck $10 trillion in 2023, greater than 10 times the quantity of worldwide compensations. This significant quantity showcases the expanding approval and dependence on stablecoins for different monetary purchases.

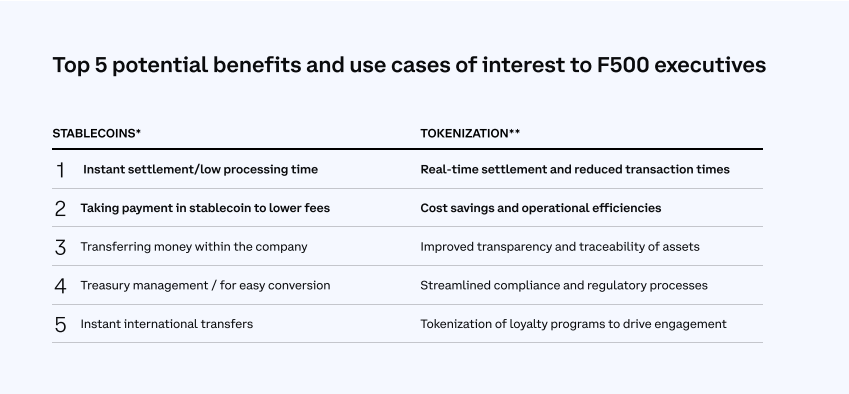

” Many leading firms have passions in the possible advantages of stablecoins and various other sorts of symbols, specifically for faster, less costly purchases. 7 in 10 Ton of money 500 execs want discovering more concerning a stablecoin usage situation, mostly repayments for immediate handling time and reduced charges,” the Coinbase record reviews.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt info. Nonetheless, visitors are suggested to confirm realities separately and seek advice from an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.