Bitcoin is optimistically solid at press time, locating its ground over $58,000 and inches far from the vital $60,000 mental degree.

After an unpredictable week, the security is a large increase for bulls. While there are pockets of toughness, vendors are still in control. For the uptrend to materialize and purchasers to construct energy, bulls should turn around July 4 and 5 gains.

Is This The Correct Time To Acquire Bitcoin?

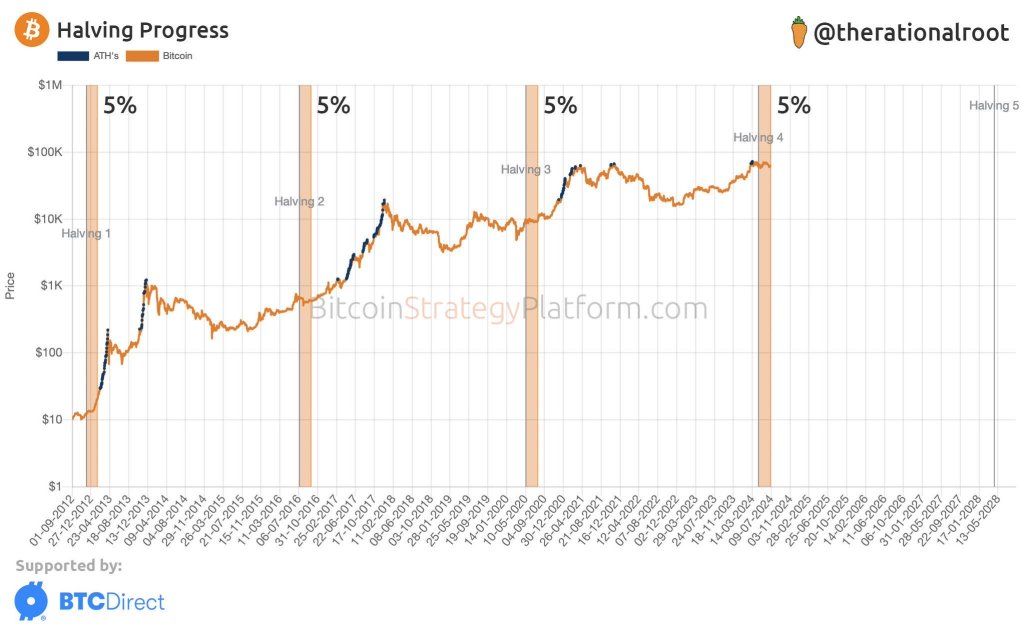

In the middle of this favorable positive outlook, one expert on X said BTC goes to the excellent factor if cost activity post-Halving throughout the years is anything to pass. In the message, the expert claimed Bitcoin generally often tends to publish greater highs, returning to the uptrend 80 days after Cutting in half.

On April 20, the globe’s most useful network Halved its miner incentives, decreasing them from 6.25 to 3.125 BTC. Nonetheless, despite the fact that investors anticipated costs to increase instantly, that had not been the instance.

If anything, the modification from March 2024 highs proceeded, with costs shutting at around $56,500 in May. The drop proceeded in June, with bears also better in the initial fifty percent of July, when BTC collapsed to as reduced as $53,500.

It has actually been exactly 80 days in between the Halving day in late April and July 9. Bulls have a tendency to collect throughout this time around to prepare for an allegorical bull run.

The re-accumulation stage the expert selects is additionally calculated, particularly for smart BTC capitalists. Complying with Cutting in half and in the middle of minimized incentives, weak miners have a tendency to capitulate. As they leave, offering their stockpile, costs drop in tandem.

Is The Bitcoin Miner Capitulation Over?

Information reveals that weak miners have a tendency to close down within 6 to 10 weeks after Cutting in half occasion. Their capitulation, as discussed, accompanies sharp cost gains.

By the end of recently, it noted completion of the 10th week of miner capitulation, the lengthiest given that the 2012 Halving occasion. If cost activity rhymes with historic efficiencies, after that the discarding stage is most likely over, and Bitcoin remains in the very early stages of an allegorical rise.

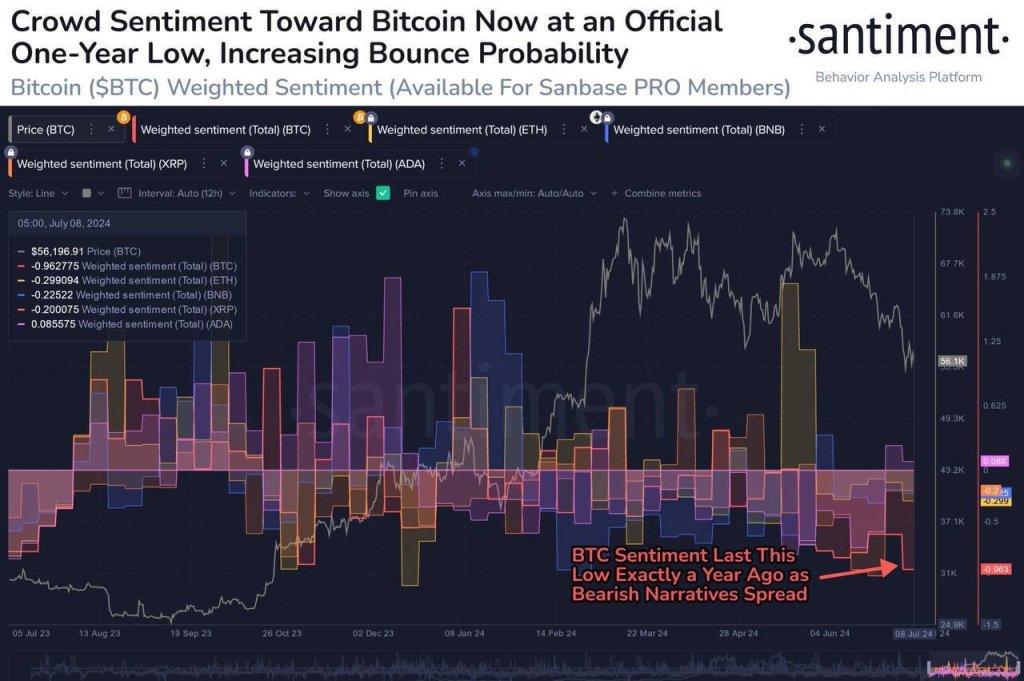

Santiment information shows that bearish belief amongst Bitcoin investors throughout leading social networks systems like X and Telegram is highest possible in over a year. Hostile investors can take a contrarian setting, filling on every dip at these severe concern, unpredictability, and uncertainty (FUD) degrees.

Attribute photo from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.