Celestia’s (TIA) cost increase in the last couple of days made it among the best-performing possessions today and in the last 24 hr.

However rather than imbuing self-confidence and positive outlook, the rally motivated financiers to take a various, extra bearish course to spin earnings.

Celestia Capitalists Desired a Collision

Celestia’s cost had an excellent run today as the altcoin recouped a lot of its current losses. However as this taken place, TIA owners understood to take a much more harmful concept of shorting the altcoin greatly. Indicators of the very same show up in the Open Passion and Financing Price.

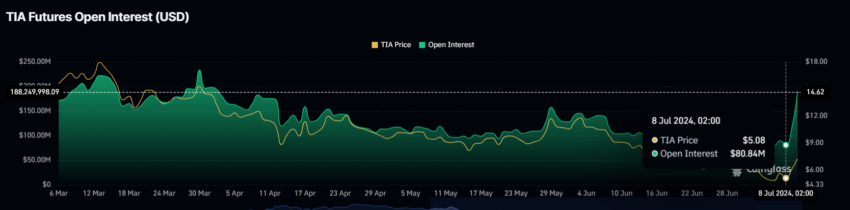

Celestia’s Open Rate of interest has actually increased considerably in the last 2 days, increasing from $80 million to $190 million. This sharp rise suggests a significant rise in trading task and financial investment in the altcoin.

The fast increase in Open Rate of interest usually highlights expanding rate of interest and self-confidence amongst investors and financiers. However this is not the instance with Celestia. TIA investors are craving a cost decrease, which can be kept in mind towards the financing price.

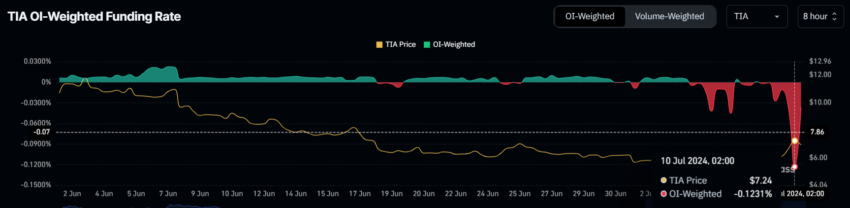

TIA’s Financing price has actually transformed adverse from favorable, getting to the acme considering that its creation. An unfavorable financing price generally suggests that brief placements are paying long placements, showing a bearish view amongst investors.

Learn More: Ideal Forthcoming Airdrops in 2024

Integrating both metrics, it comes to be obvious that the rise in OI is showcasing the increase basically agreements, bringing the financing price to historical lows. This reveals that TIA owners are anticipating and requiring a cost drawdown adhering to the rally.

TIA Cost Forecast: Where Could It Wind up?

Celestia’s cost can take 2 instructions. One is according to the need of the financiers, and the 2nd is the one that the marketplace recommends. IF TIA complies with financiers’ need, it might wind up shedding the current gains and go down to $4.9.

Trading at $6.6, this might cause a 24% decrease, indications of which are currently noticeable in the 8% decrease today.

Learn More: Leading 10 Aspiring Crypto Coins for 2024

On the various other hand, if the cost leaps back up to violation and turns $7.2 right into an assistance degree, an increase past $8.1 is most likely. This would certainly press Celestia’s cost to $10 and revoke the bearish thesis.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation post is for educational objectives just and need to not be thought about economic or financial investment guidance. BeInCrypto is devoted to exact, impartial coverage, however market problems go through transform without notification. Constantly perform your very own study and speak with a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.