Bitcoin’s (BTC) rate problems have actually decreased trading task on the leading cryptocurrency exchange, Coinbase.

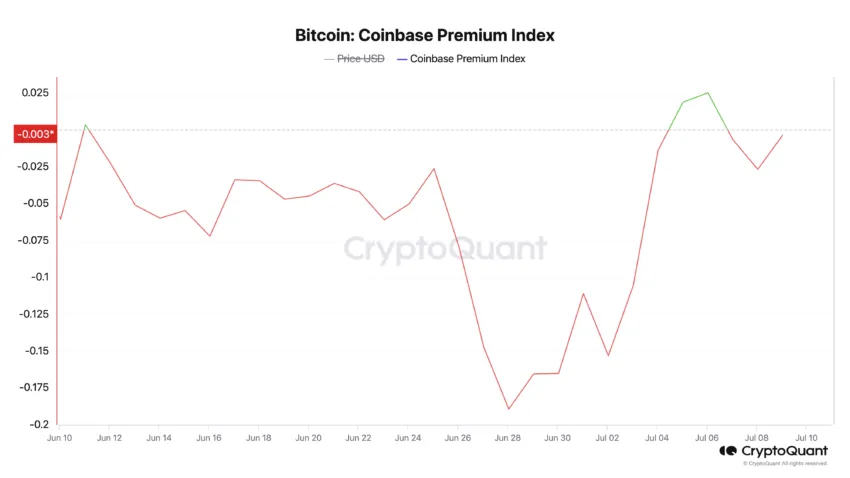

This is gauged by the coin’s Coinbase Costs Index (CPI), which has actually dipped right into adverse region.

American Investors Lower Their Direct Exposure

On-chain information reveal that Bitcoin’s Coinbase Costs Index is -0.003 at press time. This statistics actions the distinction in between BTC’s rates on Coinbase and Binance.

When its worth expands, it recommends considerable acquiring task by US-based capitalists on Coinbase. On the other hand, when it decreases and dips right into the adverse region, it signifies much less trading task on the US-based exchange.

Verifying this, the coin’s Coinbase Costs Void (CPG) patterns likewise. Since this writing, BTC’s CPG is -2.1%. When BTC’s CPG is adverse, it suggests a decrease in purchasing stress from US-based capitalists on the exchange.

In a current meeting with BeinCrypto, Julio Moreno, the Head of Study at CryptoQuant, verified reduced BTC trading task among US-based capitalists. According to Moreno

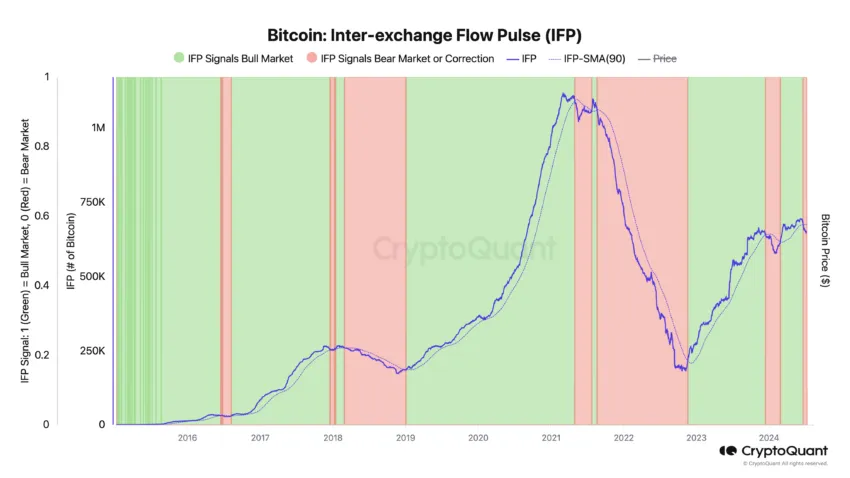

” United States financier need for Bitcoin has actually gotten in adverse region as gauged by our Inter-exchange Circulation Pulse (IFP) indication. United States financier need development is connected with greater Bitcoin rates.”

This statistics actions the activity of BTCs in between place and acquired exchanges to determine financier belief and prospective future rate patterns.

When it climbs, it is a favorable signal. It recommends that even more coins are moving from place exchanges to acquired exchanges. It implies that BTC owners are coming to be extra risk-tolerant and possibly placing themselves for rate boosts via utilize.

On the various other hand, when the coin’s IFP drops, it is a bearish signal that reveals the circulation of coins out of acquired exchanges and back to find exchanges. It implies that capitalists are offering their holdings or taking out from leveraged placements.

Find Out More: That Possesses one of the most Bitcoin in 2024?

Since this writing, BTC’s IFP is decreasing at 649,500, and its rate is presently listed below the 90-day standard. A comparable fad took place in between December 14, 2023, and February 24, 2024, after which the coin’s rate remedied from $46,000 to a reduced of $39,000.

BTC Cost Forecast: Is the Following Cost Degree Under $58,000?

At press time, BTC trades at $58,633. Still tracked by considerable bearish beliefs, the leading coin threats dropping listed below the $58,000 rate degree once again.

According to analyses from the coin’s Allegorical Quit and Opposite (SAR), the indication’s dots exist over BTC’s rate, and they have actually been so located considering that July 4.

This indication determines a property’s rate patterns and prospective turnaround factors. When its dots exist over a property’s rate, the marketplace is stated to be unhealthy. It suggests that the possession’s rate has actually been dropping and might remain to do so.

If the decrease proceeds, BTC’s rate might go down to $57,983.

Nonetheless, if acquiring task rises, the coin’s rate might rally to $59,737.

Please Note

According to the Trust fund Job standards, this rate evaluation write-up is for educational objectives just and ought to not be taken into consideration monetary or financial investment guidance. BeInCrypto is dedicated to exact, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.