Uniswap Labs is testing the United States Stocks and Exchange Payment’s (SEC) recommended rulemaking initiatives that would certainly increase the meaning of a crypto ‘exchange’ under United States safeties regulations to consist of decentralized financing (DeFi) systems. The obstacle is mounted within a letter to the SEC, boosted by current High court choices that might affect the analysis and enforceability of such regulative growths.

Uniswap Handles SEC

Katherine Minarik, Principal Legal Police Officer of Uniswap Labs, disclosed the business’s action in a blog post on X, mentioning the United States High court’s current judgment which turns down the application of Chevron submission in government firm rulemaking. “For much better or even worse, the High court has actually turned down Chevron submission. The SEC’s proposition was flawed despite that submission– and it’s all the much more so under today’s requirement,” Minarik specified.

Today @Uniswap Labs advised the SEC not to wage its recommended rulemaking that would substantially and poorly increase the meaning of an ‘exchange’ to consist of DeFi and much more. 1/x

— Katherine Minarik (@MinarikLaw) July 9, 2024

The Chevron submission traditionally enabled courts to accept a government firm’s analysis of an unclear law within its territory. The spots choice when it comes to Loper Bright Enterprises, et al. v. Raimondo ruled that government companies need to stick much more purely to the legal message, which has ramifications for the SEC’s present enforcement activities versus the whole crypto market.

In the letter, Uniswap Labs information its setting versus the SEC’s proposition to change the meaning of a crypto “exchange” as described in the Stocks Exchange Act of 1934. This Act presently specifies an exchange as “an industry or centers for uniting buyers and vendors of safeties.” The SEC’s recommended modifications look for to expand this meaning to consist of not simply standard safeties trading systems yet additionally decentralized methods like Uniswap.

The business’s entry reveals a solid lawful position that the SEC’s more comprehensive meaning is in need of support by the legal language of the Exchange Act. The letter says that increasing the meaning to consist of decentralized networks and modern technologies exceeds the range of the Serve as it stands and would likely encounter lawful difficulties based upon the current High court choice. According to Minarik, this might cause “an illegal policy” that would certainly throw away both the Payment’s and the market’s sources.

The letter additionally stresses the possible lawful consequences by mentioning 2 current lawsuit: SEC vs. Binance Holdings and SEC vs. Coinbase. In both instances, government courts shared hesitation concerning the SEC’s method to managing the whole crypto market via enforcement activities instead of clear, well-known policies.

These instances, according to Uniswap Labs, highlight the judicial pushback versus using standard safeties regulations to the decentralized facets of the crypto market, which might show the most likely function of the SEC’s recommended policy modifications in the courts.

Uniswap’s document additionally recommends that the SEC must take into consideration the effect of the Loper Bright choice and resume the remark duration for its proposition. This would certainly permit added market input thinking about the altered lawful landscape post-decision.

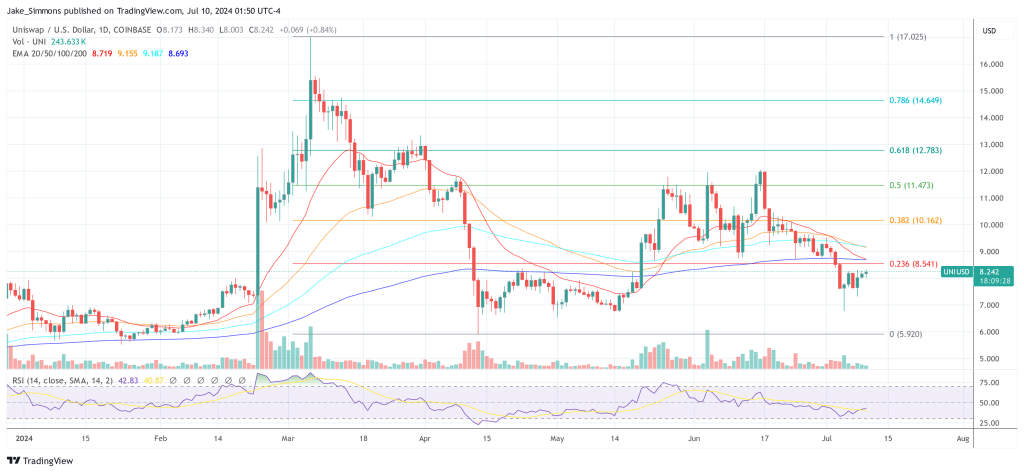

At press time, UNI traded at $8.24.

Included picture from Uniswap, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.