Specifically 5 months earlier, the indigenous token of modular blockchain Celestia (TAI) got to an all-time high (ATH) of $20.09. Nevertheless, afterwards, the cost dropped by 65.37% prior to it kept in mind a substantial healing beginning Tuesday, July 9.

In the last 24-hour, TIA’s cost has actually boosted by 17.36%. Presently trading at $7.16, evaluation discloses that the cryptocurrency is refrained with the walking. Right here is just how.

Celestia Bulls Lastly Locate a Means

Prior to it became the greatest gainer today, Celestia reached its most affordable cost given that November 2023 on July 5. The cost since after that was $4.78, indicating it was 80% below its ATH.

According to the day-to-day TIA/USD graph, the extensive decrease brought about a coming down network development. A coming down network is a technological graph pattern that suggests a drop in the cost of a cryptocurrency.

This pattern is bearish as it reveals reduced highs and reduced lows throughout the duration altered by a recession and debt consolidation in between.

Learn More: Finest Approaching Airdrops in 2024

From the graph above, bulls appear to have actually made use of the decrease by producing an excellent degree of need in between $5.06 and $6.09.

If continual, Celestia might remain to experience an outbreak to the benefit. At The Same Time, Satoshi Fin, an investor, discussed TIA’s possible cost activity.

According to Satoshi Fin, the lengthy debt consolidation the token skilled can cause exceptionally greater costs.

” Burst out of this 8-month lengthy debt consolidation network @ $8.50 for the actual enjoyable to start … the longer the debt consolidation, the more challenging the pump.” He wrote.

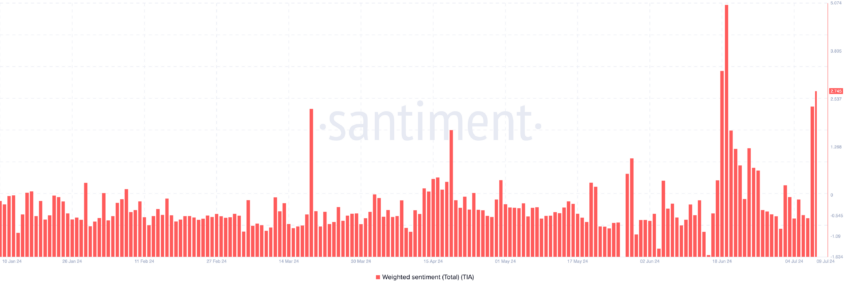

From an on-chain point of view, Santiment information discloses that belief around Celestia has actually altered right. Making Use Of the Weighted View statistics, we observe that the ranking of -0.633 on July 7 is 2.745 at press time.

Analyses of this statistics program if remarks on-line regarding a task declare or unfavorable. If the analysis is unfavorable, it suggests the wider market shares a bearish belief.

Considering that it declares, it indicates that confident states have to do with 2 times greater than bleak ones. If this stays the situation, need for the token might be greater.

TIA Rate Forecast: Press Above Trick Resistance Next

Review at the day-to-day graph reveals that TIA has actually increased over the 20-day EMA (blue). EMA represents Exponential Relocating Ordinary, and it gauges pattern instructions over an amount of time.

If the cost is listed below the EMA, the pattern is bearish. However when it is over it, the pattern is favorable. For that reason, as long as TIA remains over the limit, the cost can remain to boost.

Moreover, the token gets on the edge of damaging over the 50-day EMA (yellow) at $7.51. If bulls effectively breach this area, the following target for the token will certainly be $8.07.

Additionally, the Family member Toughness Index (RSI) goes to 53.07. The RSI gauges energy by determining the rate and dimension of cost modifications. Analyses listed below 50.00 suggest that energy is bearish.

Learn More: Leading 10 Aspiring Crypto Coins for 2024

Therefore, given that TIA’s RSI has actually exceeded the middle, energy is favorable. If the RSI remains to increase, the worth of the token might likewise adhere to parallel, with temporary targets in between $8.07 and $9.16.

Beyond the technological and on-chain components, the Modular Top, scheduled to be held on July 11, might likewise aid TIA’s cost suffer the uptrend.

Nevertheless, this projection will certainly be taken into consideration null if belief around Celestia transforms bearish. The cost can likewise go down if profit-taking shows up or stops working to turn the 50 EMA. If this occurs, TIA’s cost will certainly go down towards $6.00.

Please Note

According to the Trust fund Job standards, this cost evaluation short article is for educational functions just and ought to not be taken into consideration monetary or financial investment recommendations. BeInCrypto is dedicated to exact, objective coverage, yet market problems go through transform without notification. Constantly perform your very own study and speak with a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.