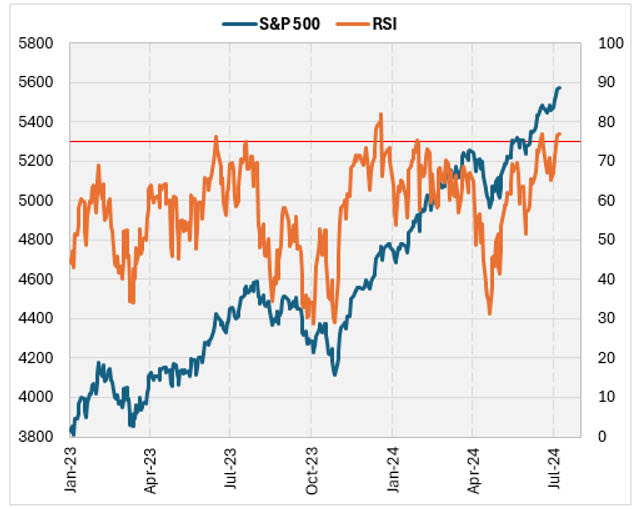

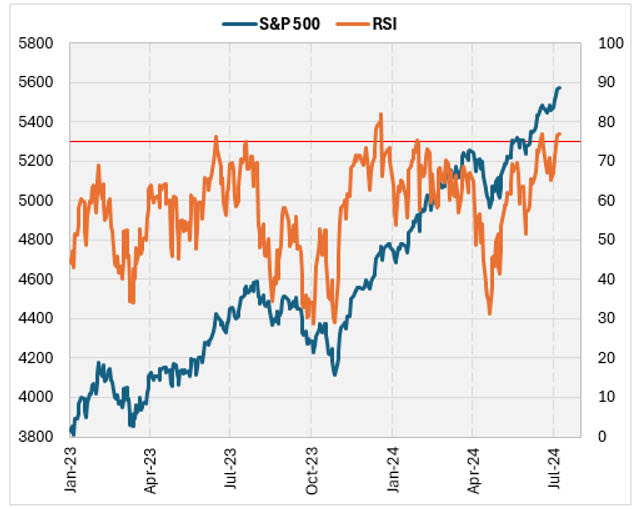

The S&P 500 Index (SPX) has actually been solid over the previous numerous months, besides a quick pullback in April. Therefore, the Family Member Stamina Indication (RSI) has actually increased over 75, which is well right into overbought region.

The RSI is a commonly utilized sign that gauges overbought and oversold degrees, varying from no to 100. An analysis over 70 is usually thought about overbought, while an analysis listed below 30 is thought about oversold. Today, I will certainly examine historic information to check out exactly how the marketplace acts when this sign gets to such degrees.

Historic Information to View

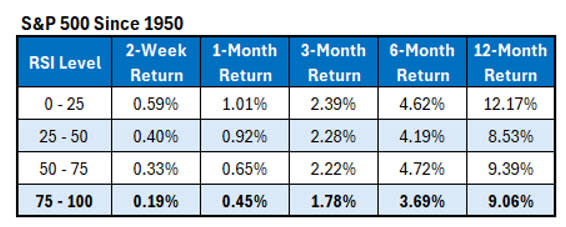

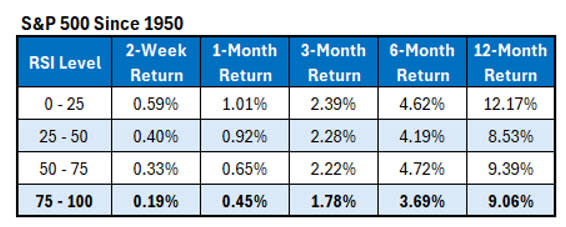

The table listed below programs SPX returns because 1950, arranged by the degree of the RSI. Keep in mind that the RSI has actually been over 75 just around 4% of the moment because 1950. Sadly, the information does sustain the RSI as a trustworthy overbought signal at these degrees, at the very least in the short-term.

Over the following 2 weeks, with the RSI over 75, the index balanced a return of 0.19% contrasted to a 0.35% return total (disappointed). As you expand the duration, the returns obtain much less bearish up until they match total market returns at twelve month. It’s likewise worth keeping in mind that the RSI, at incredibly reduced degrees, has actually been a great oversold sign.

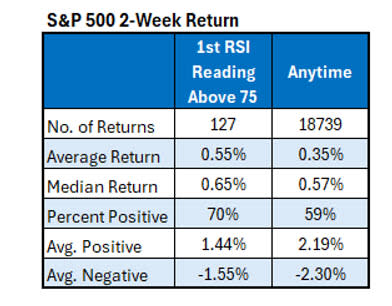

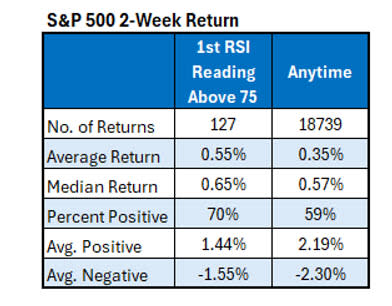

I discovered the information in the following table unusual and motivating. I developed a signal utilizing this information, together with the standards of RSI crosses over the 75 degree for the initial in at the very least 10 trading days. From this, I obtained 127 signals returning to 1950. In spite of the information over, these particular signals reveal favorable returns moving forward. The SPX standards a two-week return of 0.55% with 70% of the returns favorable after the signals, contrasted to 0.35% typical return and 59% favorable anytime.

Likewise, there’s a great deal much less volatility after these signals based upon the size of typical favorable and unfavorable complying with the signals contrasted to anytime. Simply put, when we initially obtain a signal (practically, this signified at the close last Friday), the SPX has a tendency to remain greater over the following number of weeks. However the longer the index remains over the overbought RSI degree of 75, the a lot more you can anticipate some underperformance.

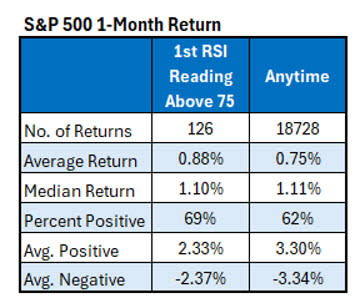

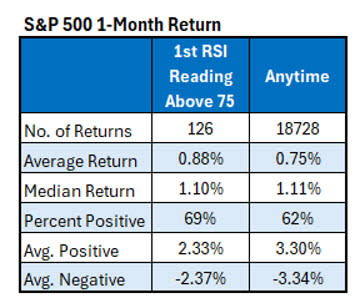

Ultimately, below’s a comparable table as above, yet taking a look at one-month returns rather than two-week returns. There’s still some outperformance, yet not virtually as much. Based upon the RSI degrees and historic information, it would not be unusual to see some even more gains in the short-term, yet a downturn can be ideal nearby.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.