Coinbase, the leading crypto exchange in the United States, lately introduced that it will certainly consist of Stader (SD) in its property listings roadmap.

This news stimulated a significant rise in SD’s rate.

SD Token Rate Rises In The Middle Of New Listings

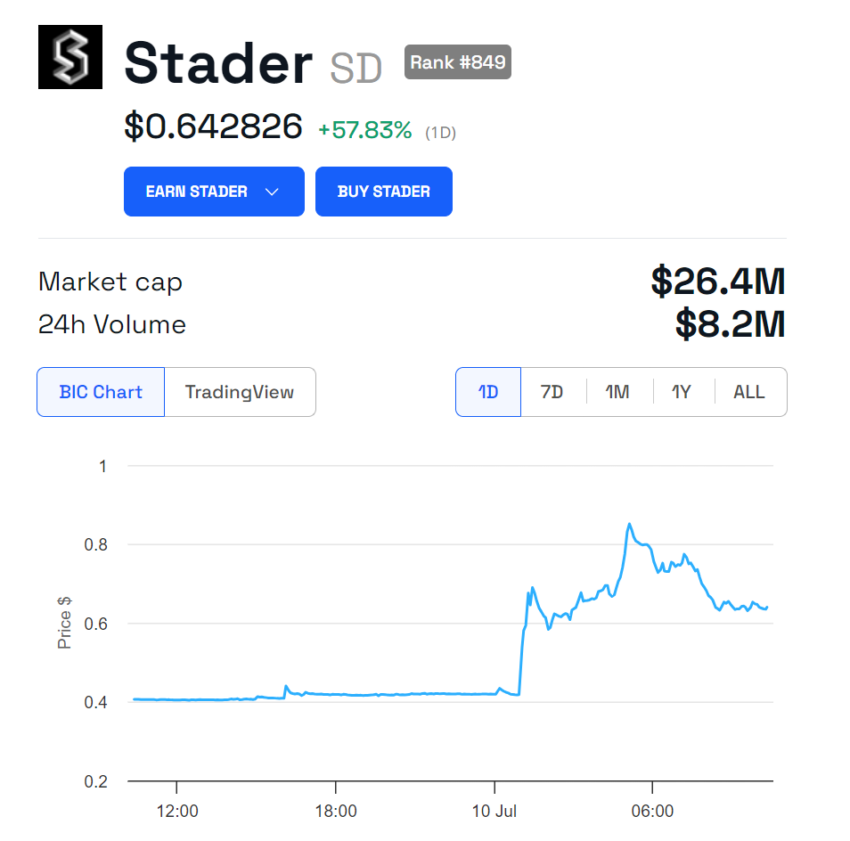

According to BeInCrypto’s information, SD has actually climbed almost 104% from $0.417695 to $0.850730 within simply 4 hours. In spite of the preliminary rise, SD’s rate has actually supported. It is trading at $0.642826 at the time of composing.

Learn More: Leading 7 High-Yield Fluid Laying Systems To View in 2024

Stader is a non-custodial, multi-chain fluid betting system. It uses customers accessibility to several of one of the most fulfilling decentralized financing (DeFi) chances throughout Proof-of-Stake (PoS) networks. These consist of Ethereum, Polygon, BNB, and Hedera.

SD, Stader’s indigenous token, is an ERC-20 token with an optimum supply of 120 million. This token flaunts several energies, consisting of an one-of-a-kind SD Energy Swimming pool, liquidity mining rewards, and an administration function within the Stader method.

Stader differentiates itself from indigenous Ethereum betting by reducing the funding dedication for node drivers. As opposed to the 32 ETH needed for indigenous staking, Stader permits node drivers to keep the connect with simply 4 ETH.

This minimized bond is supplemented by fluid stakers, making it possible for the issuance of the ETHx token and standing for the whole risk. Moreover, Stader uses customers a 50% incentive increase, leading to a benefit price going beyond 6%, while node drivers can make as much as 35% even more returns with 8x utilize on their laid ETH.

ETHx Restaking Release and Chainlink Assimilation Raise Stader’s DeFi Video game

In December 2023, Stader’s ETHx ended up being an approved fluid betting token (LST) for restaking on EigenLayer. Beginning December 18, 2023, customers can restake their ETHx.

They can get involved either straight on EigenLayer or via the Very Early Line on Kelp DAO. These alternatives goal to make best use of the benefits for ETHx owners and improve the betting experience.

Stader additionally incorporated Chainlink CCIP throughout the Ethereum and Arbitrum mainnets in June. By leveraging CCIP’s Simplified Symbol Transfer abilities, Stader assists in safe cross-chain transfers of ETHx. Stader is funding the ETHx/ETH Chainlink Rate Preyed On Ethereum to improve ETHx fostering throughout DeFi.

” We’re thrilled to incorporate the industry-standard Chainlink CCIP to assist protect cross-chain transfers of ETHx. By leveraging CCIP’s level-5 protection and progressed danger monitoring facilities, we can assist enhance the fostering of ETHx throughout DeFi,” Amitej Gajjala, Founder of Stader Labs, said.

Learn More: What Is Crypto Staking? An Overview to Earning Passive Earnings

According to Symbol Terminal data, Stader’s present overall worth secured (TVL) is $474.74 million. Although this stands for a decline from its year-high of $706.84 million on March 13, the current inclusion of Stader on Coinbase’s roadmap indicates a ballot of self-confidence in its possibility, guaranteeing more development and fostering within the crypto area.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt details. Nevertheless, viewers are suggested to validate realities separately and talk to a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.