Capitalists have actually infused over $500 million right into Bitcoin exchange-traded funds (ETFs) today as Bitcoin (BTC) nears the considerable $60,000 mark. This considerable financial investment shows a rebound in ETF capitalists’ belief.

After a difficult duration, Bitcoin ETFs have actually tape-recorded web inflows in the last 3 trading days.

Capitalists’ Buildup Presses Bitcoin’s Rate In the direction of $60,000

Presently, Bitcoin trades at $59,000, revealing a significant surge from today’s reduced of $54,200. Considering that Monday, the crypto’s worth has actually risen over 9%, showing a market healing and a favorable expectation from capitalists.

Specifically, ETFs have actually experienced a considerable increase, with BlackRock’s iShares Bitcoin Depend on (IBIT) taking the lead. According to information from Farside Investors, today, IBIT tape-recorded remarkable inflows of $308.2 million, placing it at the center of financial investment task.

Learn More: Exactly How To Profession a Bitcoin ETF: A Step-by-Step Method

Stone’s throw behind, Integrity’s Wise Beginning Bitcoin Fund (FBTC) protected the second-highest inflows, amounting to $152.5 million. On Monday and Tuesday alone, the inflows were $61.5 million and $91 million, specifically. Such buildup shows a calculated technique by capitalists to “purchase the dip” complying with current cost variations in Bitcoin.

On the various other hand, the Grayscale Bitcoin Depend On (GBTC) ran into a slump, with web discharges totaling up to $12.4 million over 2 days. This shows an extra mindful position from specific market sections.

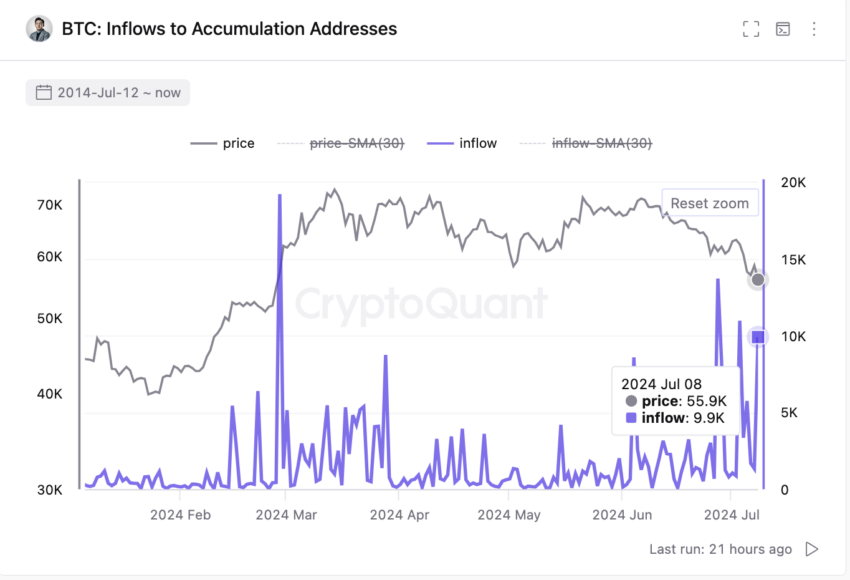

Furthermore, the rise in Bitcoin buildup expands past ETFs. According to CryptoQuant, Bitcoin buildup addresses obtained concerning 9,900 BTC, worth around $553.4 million, on Monday. This considerable task recommends extensive self-confidence in Bitcoin’s possibility for an ongoing cost surge.

In spite of these positive financial investment patterns, the general market belief continues to be blended. The crypto anxiety and greed index stands at 29, showing continuous concerns within the area. This stress and anxiety mostly comes from more comprehensive financial unpredictabilities, specifically with the unavoidable United States CPI news, which might affect financial plans and Bitcoin’s cost trajectory.

Learn More: What Is the Crypto Concern and Greed Index?

” The crypto market recoils as Bitcoin marches in the direction of $60,000. The Fed’s rising cost of living feedback with price walks is a cloud coming up. Nonetheless, if rising cost of living is managed, it might result in cost rises,” Avinash Shekhar, founder of Pi42, a crypto by-products exchange, informed BeInCrypto.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to give precise, prompt info. Nonetheless, visitors are suggested to validate truths separately and seek advice from an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.