Famous financier Warren Buffett is popular for making practical choices, and among his preferred oil firms, Occidental Oil ( NYSE: OXY), stands positioned for a possibly substantial increase from Republican opposition and previous Head of state Donald Trump. Complying with a disastrous debate performance by present Head of state Joe Biden, the Democrats remain in huge difficulty.

It’s not nearly major problems regarding Biden’s capacity to manage an additional year– not to mention a 2nd term– in the White Residence. Instead, in the discussion, he allowed Trump escape dissentious language. As an example, when the previous head of state mentioned undocumented employees taking work far from areas of shade, the wording Trump utilized was not in one of the most expert or decent way.

Consequently, Biden endured a dual fine: initially, for bad efficiency, and 2nd, for not testing Trump’s declarations. The last factor might have resulted in a normalization of questionable chatting factors. Which normalization might supply a simpler course to the White Residence for Trump and down-ballot Republican politicians.

From an opportunistic perspective, that misbehaves information for Democrats and great information for Occidental Oil. By sensible reduction, I am favorable on OXY supply.

OXY Supply Might Possibly Increase on a 2nd Trump Management

While there’s even more to OXY supply than just as a recipient of political tailwinds, it’s tough to neglect the capacity. Formerly in the race, both prospects from opposing significant celebrations seemed head-to-head, with Trump perhaps having the minor benefit. Complying with the discussion, energy is plainly on the side of the Republicans.

That benefits the wider hydrocarbon sector and especially OXY supply. Initially, Buffett understands just how to choose wonderful concepts in both favorable and bearish cycles. Real, as The Wall Surface Road Journal mentioned, there’s even more to his video game than simply selecting supplies. Nevertheless, allow’s not youngster ourselves: the factor individuals respect Buffett’s profile is since he’s so efficient spending.

2nd, OXY supply mostly drops under the expedition and manufacturing part of the hydrocarbon worth chain. Additionally referred to as upstream, this sector is mosting likely to be specifically essential due to the present geopolitical environment. Stress in Europe and the Center East recommend that international oil supply chains can be interrupted. If so, the globe would certainly require a lot more trustworthy resources of oil, which’s where Occidental can get in the phase.

Even More, Trump himself specified that he would certainly ditch Head of state Biden’s tidy power plans, especially focusing on EVs and wind power. That’s primarily songs to the ears of oil and gas upstream ventures. Real, that’s not an unique advantage to OXY supply. Nevertheless, it’s rather feasible that with the Buffett link and the Republicans’ increasing prominence in the political race, Occidental needs to be just one of the leading recipients.

Just recently, Buffett’s commercial empire Berkshire Hathaway ( NYSE: BRK.A) ( NYSE: BRK.B) has actually beenramping up its stake in OXY stock While the Oracle of Omaha’s choices on the market do not stand for the be-all, end-all, it’s still a significant self-confidence increase to retail capitalists that he’s especially selecting Occidental over various other upstream gamers.

Trust Fund the Obvious Story

Certainly, there’s absolutely nothing especially interesting regarding OXY supply in the narrative feeling. It’s not contrarian in the least. In my point of view, it’s an instead noticeable financial investment. Still, noticeable does not indicate poor. Often, the congested concept is the practical one.

Given That we get on the subject of national politics, allow’s consider the lobbying of oil and gas firms throughout political election cycles. According to details put together by Statista, hydrocarbon firms have actually invested regarding $27.88 million until now this year lobbying Republican politicians. The quantity invested towards lobbying Democrats? A parsimonious $4.04 million.

To be reasonable, the quantity of lobbying bucks from the hydrocarbon sector jointly has actually decreased because 2020. Nevertheless, the ideological pattern continues to be the very same: the fossil-fuel field invests even more cash targeting Republican politicians than Democrats. So, make indisputable: the oil sector, at huge, desires Trump to win.

Surprisingly, experts might be factoring this truth right into their forward forecasts. For Financial 2024, they just see Occidental’s income touchdown at $29.25 billion. That’s up a plain 1.1% from in 2015’s tally of $28.92 billion. Nevertheless, they expect that Financial 2025 sales can strike $32.4 billion, up 10.8%.

Currently, OXY supply professions at 2.18 x trailing-year sales. In between the initial quarter of 2023 to Q1 2024, this statistics balanced 1.91 x. Nevertheless, with the current political rumblings, a Republican politician management can make the Financial 2025 sales target extremely possible.

In truth, after that, OXY supply is trading at 1.69 x predicted 2025 sales. And due to the political scenario, that’s a reasonable several, making OXY reasonably underestimated. Not surprising that Buffett is acquiring it hand over hand.

Is Occidental Oil a Buy, According to Experts?

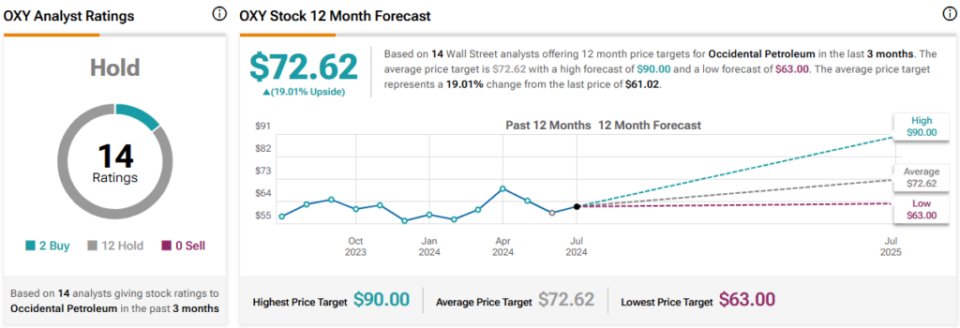

Transforming to Wall Surface Road, OXY supply has a Hold agreement ranking based upon 2 Buys, 12 Holds, and no Offer scores. The average OXY stock price target is $72.62, indicating 19% upside prospective.

The Takeaway: Political Winds Unexpectedly Make OXY Supply Extremely Appealing

With the political winds plainly profiting Donald Trump and the Republicans, hydrocarbon expedition company Occidental Oil must appreciate an effective stimulant. Historically and presently, traditionalists have actually lengthy straightened themselves with oil and gas firms. Even More, Warren Buffett’s risk in OXY supply offers it an air of self-confidence. Also, the concept can be underestimated as a result of the political landscape.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.