Incomes results usually show what instructions a firm will certainly absorb the months in advance. With Q1 currently behind us, allow’s take a look at E.W. Scripps (NASDAQ: SSP) and its peers.

Broadcasting firms have actually been dealing with nonreligious headwinds in the type of customers deserting typical tv and radio for streaming solutions. Therefore, several broadcasting firms have progressed by creating circulation contracts with significant streaming systems so they can participate component of the activity, yet will these registration profits be as premium quality and high margin as their tradition profits? Just time will certainly inform which of these broadcasters will certainly endure the total change of technical innovation and fragmentizing customer interest.

The 9 broadcasting supplies we track reported a good Q1; generally, profits missed out on expert agreement quotes by 0.6%. while following quarter’s income assistance remained in line with agreement. Supplies, particularly development supplies where capital even more in the future are more vital to the tale, had an excellent end of 2023. However the start of 2024 has actually seen much more unstable supply efficiency as a result of blended rising cost of living information, and broadcasting supplies have actually had a harsh stretch, with share costs down 17.7% generally because the previous revenues outcomes.

E.W. Scripps (NASDAQ: SSP)

Started as a chain of day-to-day papers, E.W. Scripps (NASDAQ: SSP) is a varied media venture running a series of regional tv terminals, nationwide networks, and electronic media systems.

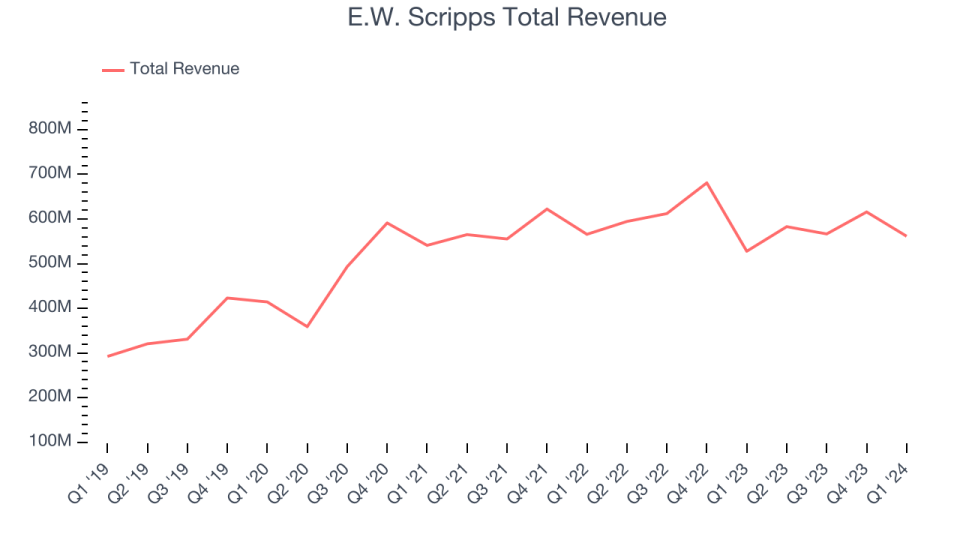

E.W. Scripps reported profits of $561.5 million, up 6.4% year on year, disappointing experts’ assumptions by 1.3%. It was a good quarter for the firm, with an outstanding beat of experts’ revenues quotes yet a miss out on of experts’ Regional Media income quotes.

E.W. Scripps accomplished the fastest income development yet had the weakest efficiency versus expert quotes of the entire team. The supply is down 39.2% because the outcomes and presently trades at $2.81.

Is currently the moment to get E.W. Scripps? Access our full analysis of the earnings results here, it’s free.

Finest Q1: Nexstar Media (NASDAQ: NXST)

Established In 1996, Nexstar (NASDAQ: NXST) is an American media firm running many regional tv terminals and electronic media electrical outlets throughout the nation.

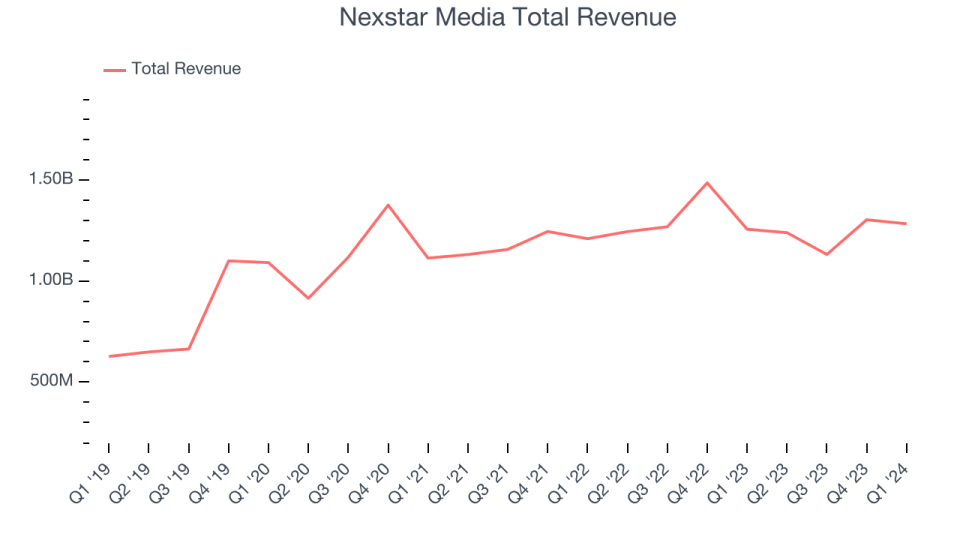

Nexstar Media reported profits of $1.28 billion, up 2.1% year on year, disappointing experts’ assumptions by 0.4%. It was an extremely solid quarter for the firm, with an outstanding beat of experts’ revenues quotes and a good beat of experts’ Core Marketing income quotes.

The supply is down 1.7% because the outcomes and presently trades at $165.02.

Is currently the moment to get Nexstar Media? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: AMC Networks (NASDAQ: AMCX)

Initially the joint-venture of 4 cable firms, AMC Networks (NASDAQ: AMCX) is a broadcaster creating a varied variety of tv programs and films.

AMC Networks reported profits of $596.5 million, down 16.9% year on year, disappointing experts’ assumptions by 0.8%. It was a weak quarter for the firm, with a miss out on of experts’ income and revenues quotes.

AMC Networks had the slowest income development in the team. The supply is down 31.7% because the outcomes and presently trades at $9.39.

Read our full analysis of AMC Networks’s results here.

FOX (NASDAQ: FOXA)

Established In 1915, Fox (NASDAQ: FOXA) is a varied media firm, running popular cable television information, tv broadcasting, and electronic media systems.

FOX reported profits of $3.45 billion, down 15.6% year on year, according to experts’ assumptions. It was a combined quarter for the firm, with a good beat of experts’ revenues quotes yet a miss out on of experts’ Associate income quotes.

FOX accomplished the most significant expert approximates defeat amongst its peers. The supply is up 6.9% because the outcomes and presently trades at $34.54.

Read our full, actionable report on FOX here, it’s free.

TEGNA (NYSE: TGNA)

Drawn Out of Gannett in 2015, TEGNA (NYSE: TGNA) is a media firm running a network of tv terminals and electronic systems, concentrating on regional information and neighborhood web content.

TEGNA reported profits of $714.3 million, down 3.5% year on year, disappointing experts’ assumptions by 0.6%. It was a strong quarter for the firm, with an outstanding beat of experts’ revenues quotes.

The supply is down 6.3% because the outcomes and presently trades at $13.75.

Read our full, actionable report on TEGNA here, it’s free.

Sign Up With Paid Supply Capitalist Study

Assist us make StockStory much more useful to financiers like on your own. Join our paid customer research study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.