Shiba Inu (SHIB) has actually seen a small rate rebound in the previous couple of days. The worth of the leading meme coin has actually risen by 13% given that July 5.

This uptick in SHIB’s worth has actually created a lot of the brief placements in its futures market to be sold off.

Shiba Inu Sees Uptick simply put Liquidations

Liquidations happen in a property’s by-products market when the property’s worth steps versus the setting held by an investor. When this occurs, the investor’s setting is powerfully shut because of inadequate funds to keep it.

Brief liquidations happen when investors that have actually taken brief placements are compelled to redeem the property at a greater rate to cover their losses as the rate surges. This commonly occurs when the property’s rate boosts past a particular factor, compeling investors with employment opportunities versus a cost rally to leave the marketplace.

Given that the rate uptick started on July 5, SHIB has actually tape-recorded even more brief liquidations than lengthy ones. As a matter of fact, on July 6, SHIB’s lengthy liquidations amounted to $3.36 million, going beyond lengthy liquidations by a massive 491%. This stood for SHIB’s highest possible single-day brief liquidations given that March 8.

Find Out More: Just How To Purchase Shiba Inu (SHIB) and Whatever You Required To Know

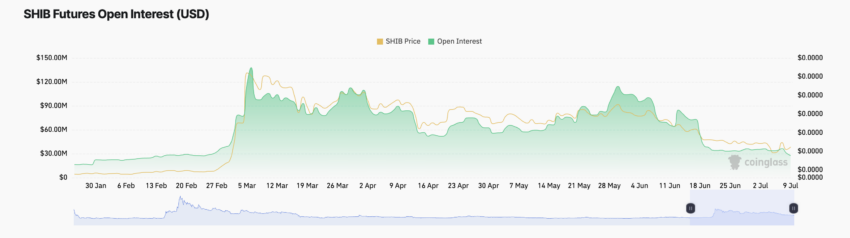

Nevertheless, in spite of the development in SHIB’s worth in the previous couple of days, task throughout its futures market continues to be reduced. This can be obtained from its decreasing futures open rate of interest.

A property’s futures open rate of interest determines the overall variety of exceptional futures contracts/positions that have actually not been shut or cleared up. When it decreases, much more investors leave their placements without opening up brand-new ones.

At $27.61 million at press time, SHIB’s futures Open up Rate of interest has actually visited 23% this month alone. It presently rests at its least expensive degree given that February.

SHIB Rate Forecast: The Current Uptrend Might Not Last

According to SHIB’s Aroon Up Line observed on a one-day graph, the present rate rally might be brief. Since this writing, the indication’s worth is 0%.

A property’s Aroon Sign determines its fad stamina and recognizes possible rate turnaround factors. When the Up Line is close to or at absolutely no, the uptrend is weak, and one of the most current high was gotten to a long period of time back.

If an adjustment takes place, SHIB’s worth might dip to $0.00001570.

Nevertheless, if it preserves the present uptrend, its rate might rally towards the $0.000017 rate degree.

Please Note

According to the Trust fund Task standards, this rate evaluation short article is for educational functions just and must not be thought about economic or financial investment suggestions. BeInCrypto is devoted to exact, objective coverage, however market problems undergo transform without notification. Constantly perform your very own research study and speak with a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.