Because the Q1 earnings season wraps, let’s dig into this quarter’s finest and worst performers within the sit-down eating business, together with Kura Sushi (NASDAQ:KRUS) and its friends.

Sit-down eating places provide a whole eating expertise with desk service. These institutions span varied cuisines and are famend for his or her heat hospitality and welcoming ambiance, making them good for household gatherings, particular events, or just unwinding. Their in depth menus vary from appetizers to indulgent desserts and wines and cocktails. This house is extraordinarily fragmented and competitors consists of all the things from publicly-traded firms proudly owning a number of chains to single-location mom-and-pop eating places.

The 14 sit-down eating shares we monitor reported an okay Q1; on common, revenues missed analyst consensus estimates by 0.9%. Shares–especially these buying and selling at larger multiples–had a powerful finish of 2023, however 2024 has seen intervals of volatility. Combined indicators about inflation have led to uncertainty round fee cuts, and whereas a few of the sit-down eating shares have fared considerably higher than others, they collectively declined, with share costs falling 2.2% on common because the earlier earnings outcomes.

Kura Sushi (NASDAQ:KRUS)

Identified for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a series of sushi eating places serving conventional Japanese fare with a contact of modernity and know-how.

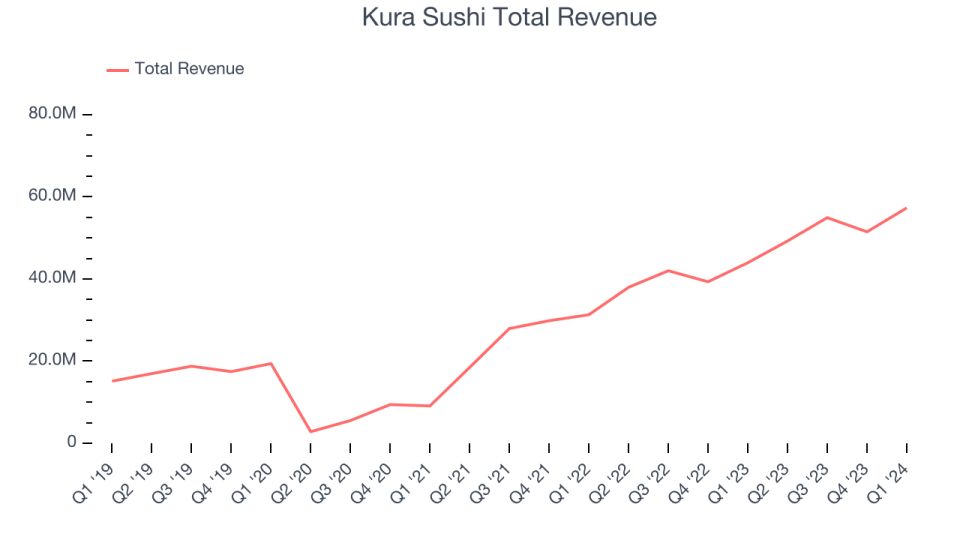

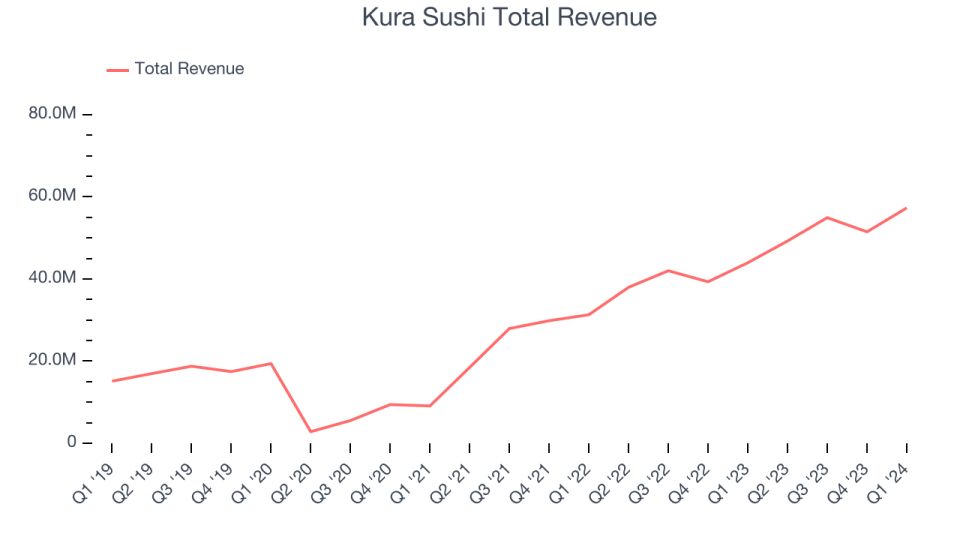

Kura Sushi reported revenues of $57.29 million, up 30.4% 12 months on 12 months, topping analysts’ expectations by 1.1%. It was a weak quarter for the corporate, with a miss of analysts’ earnings estimates.

Hajime Uba, President and Chief Govt Officer of Kura Sushi, said, “I‘m very happy to report the continuing power of our enterprise as we progress by a report fiscal 12 months. It was unprecedented for us once we introduced a steerage increase so early within the 12 months with our first quarter name, and having the ability to comply with the subsequent quarter with one other steerage increase demonstrates our unimaginable confidence within the enterprise…”

Kura Sushi pulled off the most important analyst estimates beat and quickest income progress of the entire group. The inventory is down 15.7% because the outcomes and at the moment trades at $87.78.

Read our full report on Kura Sushi here, it’s free.

Greatest Q1: BJ’s (NASDAQ:BJRI)

Based in 1978 in California, BJ’s Eating places (NASDAQ:BJRI) is a series of eating places whose menu options basic American dishes, usually with a twist.

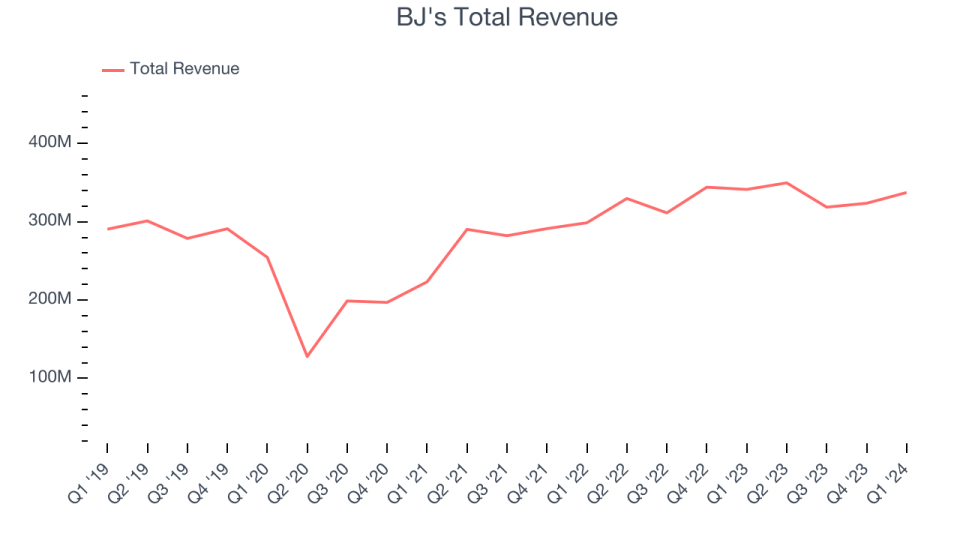

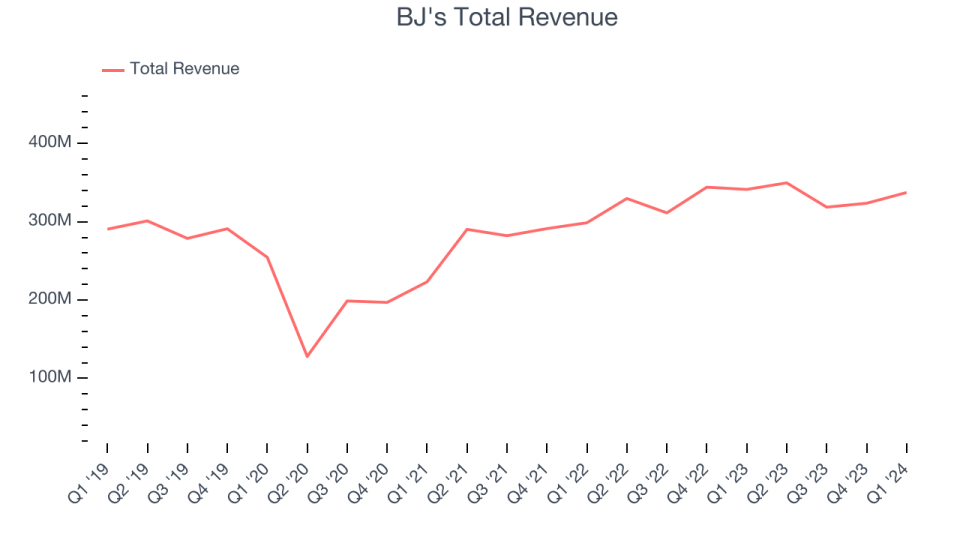

BJ’s reported revenues of $337.3 million, down 1.2% 12 months on 12 months, consistent with analysts’ expectations. It was an distinctive quarter for the corporate, with a powerful beat of analysts’ similar retailer gross sales, gross margin, and EPS expectations.

The inventory is up 9.4% because the outcomes and at the moment trades at $35.83.

Is now the time to purchase BJ’s? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Dine Manufacturers (NYSE:DIN)

Working a franchise mannequin, Dine Manufacturers (NYSE:DIN) is an off-the-cuff restaurant chain that owns the Applebee’s and IHOP banners.

Dine Manufacturers reported revenues of $206.2 million, down 3.5% 12 months on 12 months, falling in need of analysts’ expectations by 2%. It was a weak quarter for the corporate, with a miss of analysts’ earnings estimates.

The inventory is down 9.3% because the outcomes and at the moment trades at $39.59.

Read our full analysis of Dine Brands’s results here.

Cracker Barrel (NASDAQ:CBRL)

Identified for its country-themed meals and merchandise, Cracker Barrel (NASDAQ:CBRL) is a beloved American restaurant and retail chain that celebrates the heat and appeal of Southern hospitality.

Cracker Barrel reported revenues of $817.1 million, down 1.9% 12 months on 12 months, falling in need of analysts’ expectations by 0.4%. It was a really robust quarter for the corporate, with a powerful beat of analysts’ gross margin estimates and a strong beat of analysts’ earnings estimates.

The inventory is up 12.1% because the outcomes and at the moment trades at $50.82.

Read our full, actionable report on Cracker Barrel here, it’s free.

The Cheesecake Manufacturing facility (NASDAQ:CAKE)

Celebrated for its scrumptious (and free) brown bread, gigantic parts, and delectable desserts, Cheesecake Manufacturing facility (NASDAQ:CAKE) is an iconic American restaurant chain that additionally owns and operates a portfolio of separate restaurant manufacturers.

The Cheesecake Manufacturing facility reported revenues of $891.2 million, up 2.9% 12 months on 12 months, consistent with analysts’ expectations. It was a really robust quarter for the corporate, with a powerful beat of analysts’ gross margin estimates and a good beat of analysts’ earnings estimates.

The inventory is up 16.9% because the outcomes and at the moment trades at $39.71.

Read our full, actionable report on The Cheesecake Factory here, it’s free.

Be part of Paid Inventory Investor Analysis

Assist us make StockStory extra useful to buyers like your self. Be part of our paid person analysis session and obtain a $50 Amazon reward card on your opinions. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.