The tip of the earnings season is at all times a great time to take a step again and see who shined (and who not a lot). Let’s check out how training providers shares fared in Q1, beginning with Lincoln Academic (NASDAQ:LINC).

A complete business has emerged to deal with the issue of rising training prices, providing customers alternate options to conventional training paths reminiscent of four-year faculties. These different paths, which can embody on-line programs or versatile schedules, make training extra accessible to these with work or child-rearing obligations. Nevertheless, some have run into points across the worth of the levels and certifications they supply and whether or not clients are getting a great deal. Those that don’t show their worth might wrestle to retain college students, and even worse, invite the heavy hand of regulation.

The 8 training providers shares we monitor reported a powerful Q1; on common, revenues beat analyst consensus estimates by 3.6%. whereas subsequent quarter’s income steerage was in step with consensus. Shares, particularly development shares the place money flows additional sooner or later are extra necessary to the story, had a great finish of 2023. However the starting of 2024 has seen extra unstable inventory efficiency resulting from combined inflation knowledge, and training providers shares have held roughly regular amidst all this, with share costs up 3.2% on common for the reason that earlier earnings outcomes.

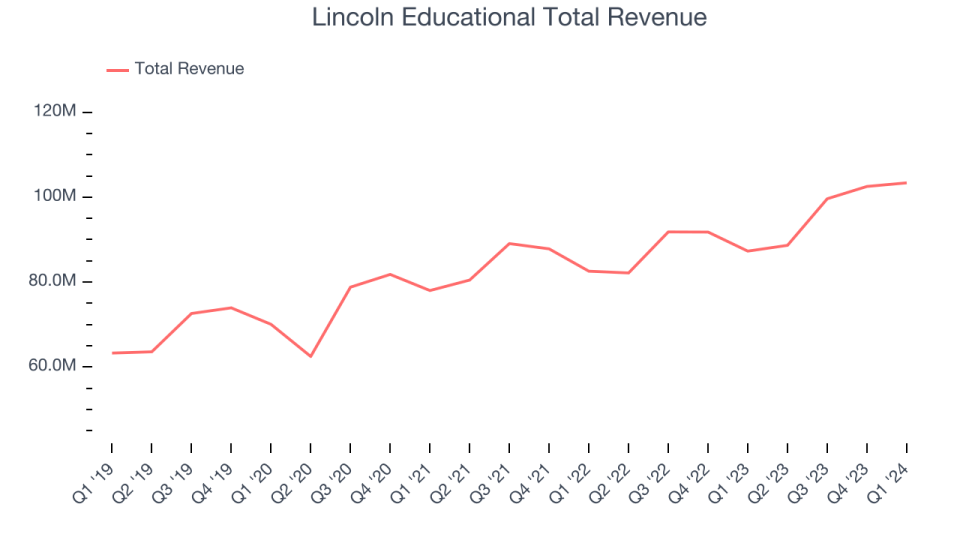

Lincoln Academic (NASDAQ:LINC)

Established in 1946, Lincoln Academic (NASDAQ:LINC) is a supplier of specialised technical coaching in the USA, providing career-oriented packages to supply sensible expertise required within the workforce.

Lincoln Academic reported revenues of $103.4 million, up 18.4% 12 months on 12 months, topping analysts’ expectations by 6.6%. It was a powerful quarter for the corporate, with a formidable beat of analysts’ working margin estimates and full-year income steerage exceeding analysts’ expectations.

“We had an exceptionally robust begin to 2024 and the momentum generated throughout the first quarter has continued,” commented Scott Shaw, President & CEO.

Lincoln Academic scored the most important analyst estimates beat and quickest income development of the entire group. The inventory is down 6.9% for the reason that outcomes and at present trades at $10.31.

Is now the time to purchase Lincoln Academic? Access our full analysis of the earnings results here, it’s free.

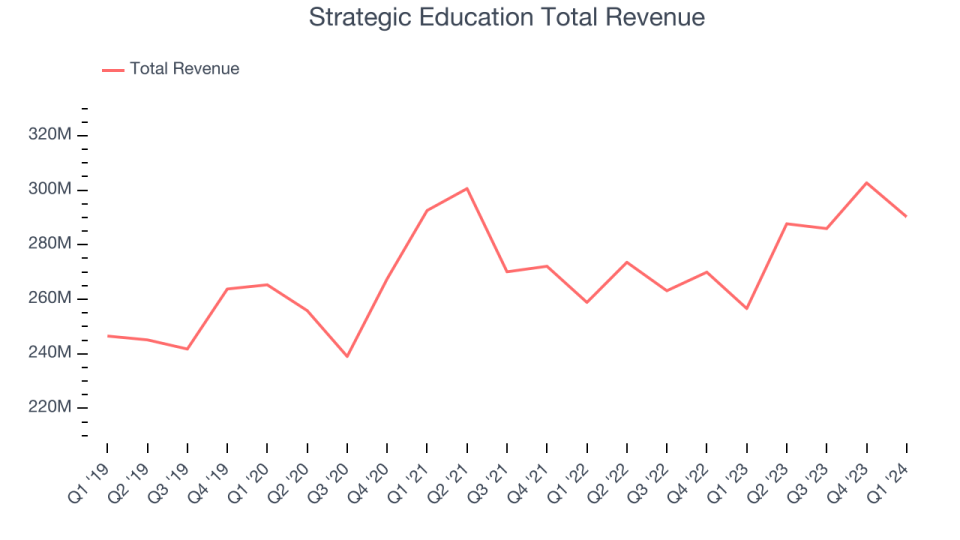

Greatest Q1: Strategic Training (NASDAQ:STRA)

Shaped by way of the merger of Strayer Training and Capella Training in 2018, Strategic Training (NASDAQ:STRA) is a career-focused larger training supplier.

Strategic Training reported revenues of $290.3 million, up 13.1% 12 months on 12 months, outperforming analysts’ expectations by 5.8%. It was a surprising quarter for the corporate, with a formidable beat of analysts’ earnings estimates.

The inventory is up 9.6% for the reason that outcomes and at present trades at $110.27.

Is now the time to purchase Strategic Training? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Brilliant Horizons (NYSE:BFAM)

Based in 1986, Brilliant Horizons (NYSE:BFAM) is a world supplier of kid care, early training, and workforce assist options.

Brilliant Horizons reported revenues of $622.7 million, up 12.5% 12 months on 12 months, exceeding analysts’ expectations by 1.2%. It was an okay quarter for the corporate, with a good beat of analysts’ natural income estimates however full-year income steerage lacking analysts’ expectations.

Brilliant Horizons had the weakest full-year steerage replace within the group. The inventory is up 1.2% for the reason that outcomes and at present trades at $105.56.

Read our full analysis of Bright Horizons’s results here.

Laureate Training (NASDAQ:LAUR)

Based in 1998 by Douglas L. Becker and primarily based in Miami, Laureate Training (NASDAQ:LAUR) is a world community of upper training establishments.

Laureate Training reported revenues of $275.4 million, up 9.6% 12 months on 12 months, surpassing analysts’ expectations by 2.3%. It was an okay quarter for the corporate, with a formidable beat of analysts’ working margin estimates however a miss of analysts’ earnings estimates.

The inventory is up 0.1% for the reason that outcomes and at present trades at $14.61.

Read our full, actionable report on Laureate Education here, it’s free.

Common Technical Institute (NYSE:UTI)

Based in 1965, Common Technical Institute (NYSE: UTI) is a number one supplier of technical coaching packages, specializing in automotive, diesel, collision restore, motorbike, and marine technicians.

Common Technical Institute reported revenues of $184.2 million, up 12.4% 12 months on 12 months, surpassing analysts’ expectations by 4%. It was a good quarter for the corporate, with full-year income steerage beating analysts’ expectations however a miss of analysts’ earnings estimates.

The inventory is down 13.5% for the reason that outcomes and at present trades at $14.42.

Read our full, actionable report on Universal Technical Institute here, it’s free.

Be a part of Paid Inventory Investor Analysis

Assist us make StockStory extra useful to buyers like your self. Be a part of our paid consumer analysis session and obtain a $50 Amazon present card in your opinions. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.