VanEck and 21Shares have actually applied for a Solana-based exchange-traded fund (ETF). Nonetheless, the expectation for authorization doubts, with much relying on the upcoming United States governmental political election outcomes.

If Donald Trump, a Republican politician, wins the presidency, the characteristics could move positively.

Solana Institutional Need Continues To Be High

Specialists such as Bloomberg ETF expert James Seyffart consider VanEck and 21Shares’ filings to be a slim chance under the present management. Market experts anticipate fat chances of the ETF’s authorization if Democrats keep control.

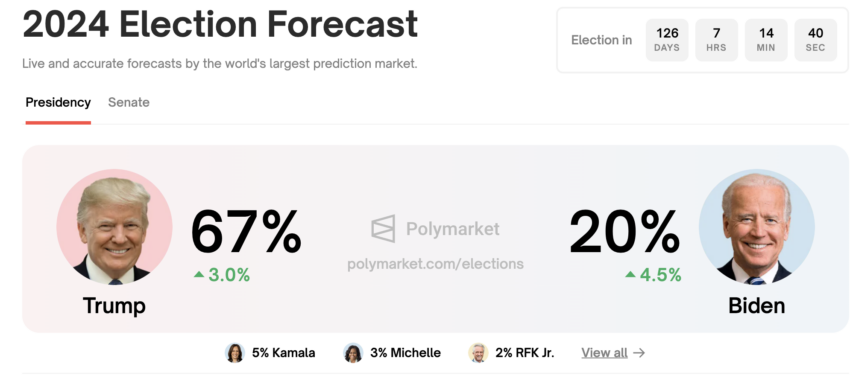

On The Other Hand, a Stocks and Exchange Payment (SEC) head, most likely assigned under Trump, can boost these probabilities. Presently, forecast markets like Polymarket reveal a 67% opportunity of Trump winning the 2024 political election.

Learn More: That Is Gary Gensler? Whatever To Find Out About the SEC Chairman

Conjecture is swarming concerning possible substitutes for Gary Gensler, the present SEC chair, ought to Trump recover the presidency. Dan Gallagher, Principal Legal Police Officer at Robinhood and previous SEC Commissioner, is reported to be a prospect for Gensler’s setting.

On the other hand, some market leaders see the Solana ETF declaring skeptically. Nic, Chief Executive Officer of CoinBureau, considers it an advertising and marketing method.

” It’s wonderful to see Van Eck declare a SOL ETF. Nonetheless, I assume it’s actually not likely it will certainly obtain authorized this year. There isn’t a CME futures market for market information to have actually been collected (something the SEC clearly needs). In Addition, ETH ETFs have yet to launch, and we do not understand what need will certainly resemble. Likewise, the influence of FIT21 can quicken its running. Yet not this year,” Nick said.

Matthew Sigel from VanEck’s electronic possession research study group says that a CME futures market isn’t obligatory for crypto-ETF authorization. Nonetheless, market agreement recommends that considerable governing approval could just feature brand-new SEC management.

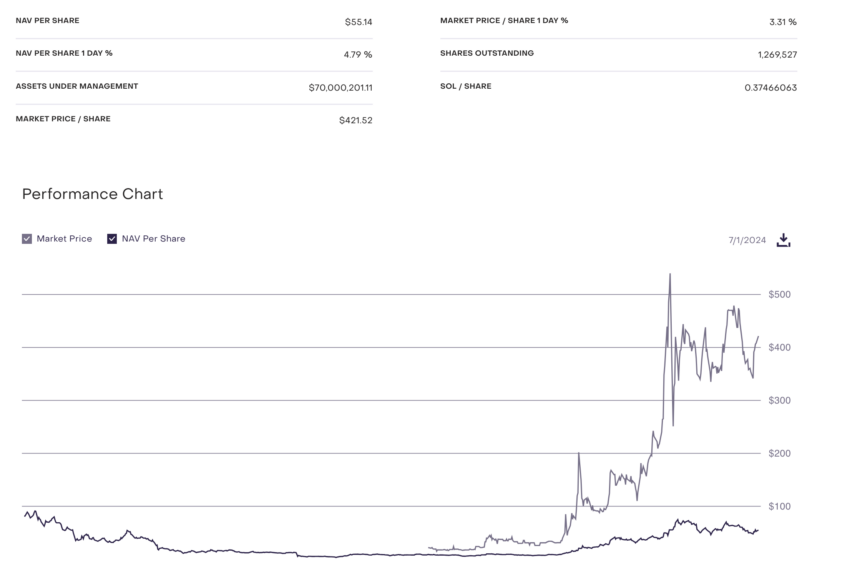

Regardless of apprehension, institutional passion in Solana continues to be solid. Grayscale’s Solana Depend on (GSOL), as an example, has a market value per share that is 7.6 times its NAV, presently at $421. Nic believes that this institutional bullishness could have stimulated the speculative VanEck ETF authorization effort.

On the other hand, market manufacturer GSR has actually anticipated a considerable rate dive for Solana if the ETFs are authorized under desirable problems.

” We can change our family member circulation quotes under the numerous circumstances for Solana’s family member dimension to Bitcoin’s 2.3 x rise as a result of the area ETFs. Doing so recommends Solana might enhance 1.4 x under the bear moves circumstance, 3.4 x under the standard circumstance, and 8.9 x under heaven skies circumstance,” GSR experts anticipated.

Learn More: Just How to Purchase Solana Meme Coins: A Step-By-Step Overview

The complicated interaction in between market characteristics, governing difficulties, and political results provides the Solana ETF filings a diverse wager. These filings are contingent on considerable adjustments in the United States governmental management.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, viewers are suggested to confirm realities individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.