Trading crypto is an interesting, yet unforeseeable, adventure, and the most effective method to remain in advance is by locating a crypto exchange with quit loss( SL) and tracking quit attributes. Think of protecting your professions with automated safeguard that secure your gains and reduce your losses, also while you’re resting or hanging out with close friends.

Our crypto specialists have actually assessed and examined over 20 exchanges to discover the most effective systems for making use of quit losses, assessing 15 various information indicate provide you one of the most thorough suggestions feasible.

In this overview, we’ll present you to 5 exchanges that give these wise devices and reveal you exactly how to utilize them to boost your trading technique. So, allow’s dive in and find the exchanges that will certainly encourage you to trade with confidence and maintain those gains rolling in!

The 5 ideal crypto exchanges with quit loss

Out of all the 25 systems and exchange we checked, these are the most effective choices:

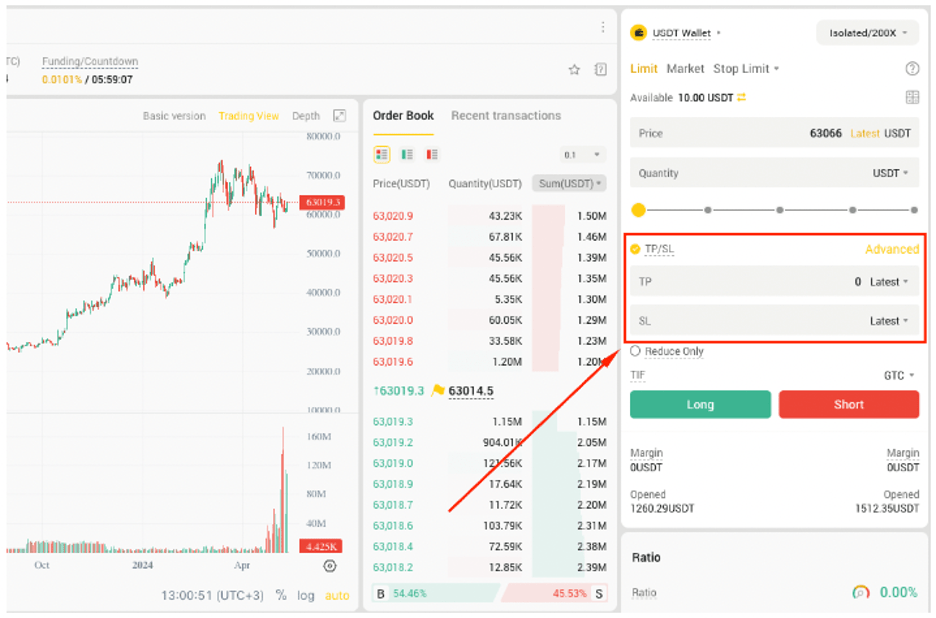

1. BYDFi: Finest Exchange General (Greatest ranked)– Readily available in the United States– No KYC– No VPN– 200x Utilize Continuous Futures– Cheapest Charges 0.02%– Tradingview Charts– Managed in the United States by FinCEN as an MSB (High Safety And Security)– High Withdrawal Limitations– Quick Enrollment– Demonstration Account

- Quit Loss: Easy to make use of and can be included straight in the trading user interface prior to you open your placement. Usage trigger rates or include Pick in between the most recent cost or the last cost. Establish tracking SL conveniently with cost range.

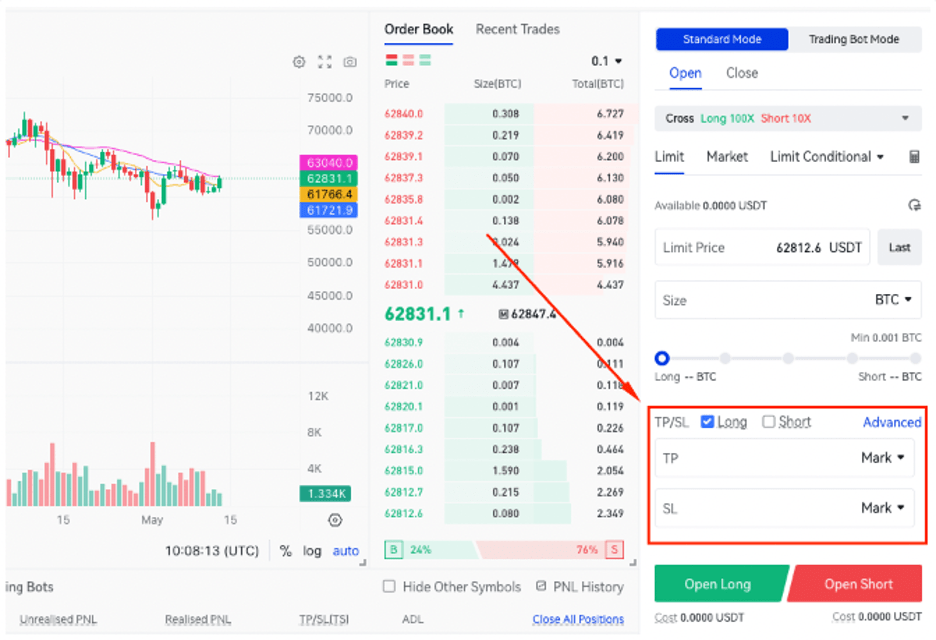

2. Phemex: Leading Mobile Application– Offered in the United States with VPN– No KYC– 100x Utilize– Tradingview Charts– Trading Crawlers– Betting Methods– Great Academy for Beginners– Demonstration Account– Reduced Charges 0.055%– Buy Crypto with Fiat

- Quit Loss: Include it prior to opening up the placement and cause it when the placement is online. Establish the tracking SL with a tracking worth cost.

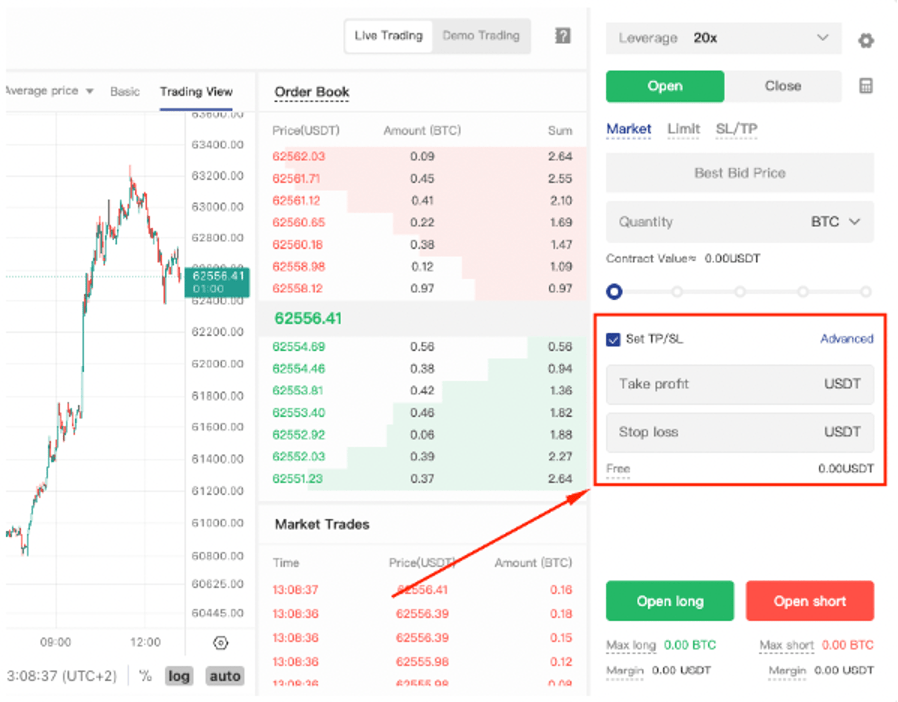

3. MEXC: Cheapest Manufacturer Charges– Offered in the United States with VPN– No KYC– 200x Utilize with Continuous Futures– 0% Manufacturer Charges– 1400 Altcoins– Tradingview Charts– Buy Crypto with Fiat– Replicate Trading System– Demonstration Account Trading

- Quit Loss: Easy to include with alternative to select tracking SL. Include prior to employment opportunity and established trigger rates based upon cost, roe, or pnl.

4. BTCC: Best For Greatest Utilize (225x)– Approves United States investors without KYC or VPN– Continuous Futures Trading– VIP Program with Cost Advantages– 0.045% Typical Cost– Crypto or Fiat Deposits– Demonstration Account– 12 Years in Company

- Quit Loss: Establish SL conveniently at your very own cost range straight in the trading user interface.

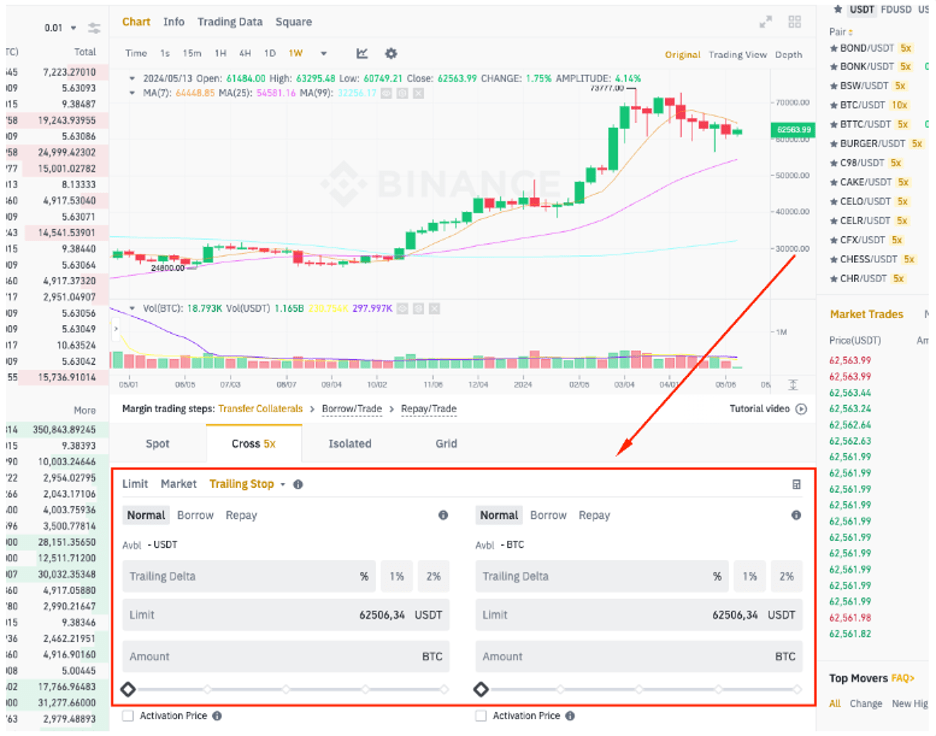

5. Binance: Biggest Crypto Exchange by Quantity– International Accessibility Other Than United States– Call For KYC– 125x Utilize– Tradingview Charts– Trading Crawlers– Betting Alternatives– Futures trading– 0.10% Charges– Margin Trading– Make Down Payments with Crypto or Fiat

- Quit Loss: Establish the cost prior to opening up the placement. Utilize the stop-limit attribute to include your quit. Not as user-friendly as the various other systems.

Financial investment threat and associate disclosure: Crypto trading includes considerable threat and can cause fast losses. Ensure you comprehend the threats included prior to spending. Constantly perform your very own research study and talk to an economic expert if required. This short article has associate web links. If you register or purchase making use of these web links, we might make a payment at no added expense to you. Our referrals are based upon independent research study and evaluation to give you with one of the most precise details feasible.

TL; DR

- BYDFi and Phemex are both leading systems that use simple and vibrant quit loss and tracking SL.

- Choosing a crypto exchange with quit loss and tracking SL attributes is incredibly crucial for taking care of threat and seeing to it you do not shed excessive when trading.

- Our group checked out greater than 20 exchanges, inspecting points like exactly how very easy they are to make use of, exactly how precise they are, and exactly how well they operate in various market problems, to bring you the most effective choices for your trading demands.

Testimonial of 5 crypto exchanges with quit loss

1. BYDFi– Leading crypto exchange with quit loss total

BYDFi, a crypto exchange with quit loss and tracking quits developed in 2020, is created to deal with both newbie and seasoned investors. With a clear and uncomplicated interface and attribute collection, it permits crypto newbies to browse trading without really feeling bewildered.

The system sustains place trading throughout 3 rates, satisfying differing degrees of experience: the fundamental “Classic” rate gives a streamlined interface for newbies; the “Advanced” tier attributes boosted charting devices and a much more in-depth control panel for those looking for thorough analytics; and the “Convert” rate promotes smooth stablecoin conversion.

BYDFi attracts attention by offering both stop-loss and tracking stop-loss attributes, which are beneficial devices for crypto investors. They can be conveniently accessed straight via the system’s trading user interface, making them basic to establish and make use of.

Furthermore, the system provides continuous agreements with take advantage of approximately 200x, it’s a great exchange to brief crypto Together with leveraged symbols that use investors basic direct exposure to take advantage of without taking care of intricate margin professions.

One standout attribute is BYDFi’s duplicate trading, which permits much less seasoned individuals to mirror the approaches of effective investors, therefore gaining master investors added earnings and cultivating a joint trading setting.

Charges are affordable throughout the board, with a 0.1% place trading charge and 0.02% charge for continuous agreements and leveraged symbols. Safety procedures consist of two-factor verification, e-mail binding, and IP whitelisting to guarantee accounts stay secured.

Client assistance is durable, with online conversation, e-mail, and a thorough frequently asked question area to settle usual queries.

The exchange additionally preserves conformity with global KYC and AML requirements, strengthening its trustworthiness and governing standing. Nonetheless, it might enhance by including much more instructional sources and progressed economic attributes such as betting. However, BYDFi continues to be an attractive option as a result of its international governing licenses and a thorough trading community that stabilizes simpleness and progressed devices.

2. Phemex– Finest different crypto exchange and application

Phemex is a brand-new Bitcoin by-products exchange which provides quit loss and tracking SL orders and intends to give top-level trading for every person. It was begun by previous Morgan Stanley execs and released in Singapore in November 2019.

Phemex concentrates on being easy to use and just recently included the LINK/USD trading set since the area asked for it. The system has actually swiftly drawn in countless individuals around the world and intends to have actually 2 million signed up individuals by the end of 2025.

New individuals can obtain huge incentives for doing points like opening up an account and uploading on social media sites. Phemex does not bill for down payments, and the trading costs are -0.025% for manufacturers and 0.075% for takers. There is a level withdrawal charge of 0.0005 BTC for bitcoin withdrawals. Subscribing is basic, and the system provides trading on both desktop computer and mobile with different devices for technological evaluation. Nonetheless, it does not sustain fiat trading, choices trading, or crypto-to-crypto sets.

Phemex sustains a number of trading sets like BTC/USD and ETH/USD, with take advantage of approximately 100x. It gives threat administration devices like sub-account seclusion and stop-loss orders. Safety attributes consist of an ordered Deterministic Cold Budget System and AWS Cloud for web server safety and security, with withdrawal demands refined 3 times a day.

Phemex takes on exchanges like Bybit and BitMEX, using client assistance via a straight line to the chief executive officer on Telegram. Its associate program provides a 50% payment on costs created by recommendations. With its easy to use system and growth-focused strategy, Phemex is an encouraging alternative for crypto by-products trading.

3. MEXC– Least expensive costs crypto exchange for market manufacturers

MEXC, which began in 2018, is swiftly coming to be a preferred exchange with quit loss and tracking quit loss orders amongst crypto investors. Why? Due to the fact that it has a few of the most affordable costs about, making it a leading choice for market manufacturers that wish to conserve cash. MEXC does not bill any type of costs for place trading on all trading sets. This is a large offer contrasted to various other exchanges like Binance and Coinbase, which still have costs despite price cuts.

What makes MEXC truly trendy is the number of various cryptocurrencies you can trade. They have practically 2,000 kinds of crypto and over 2,350 trading sets. That implies you can discover and trade practically any type of coin you want. And also, the exchange has incredibly high liquidity, which implies it’s very easy to deal swiftly without influencing the cost excessive.

MEXC is additionally incredibly quick. Its trading engine can manage approximately 1.4 million orders per secondly. This rate is excellent for market manufacturers that require to implement professions swiftly and successfully. And if you wish to trade crypto futures, MEXC costs just a little taker charge of 0.010%, which is way less than a lot of various other systems.

Security is an additional huge and also.

MEXC makes use of solid safety and security procedures like two-factor verification (2FA) and a mix of chilly and warm pocketbooks to maintain your funds secure. Despite the fact that there have actually been some problems with customer care and governing cautions, MEXC still attracts attention as a result of its incredibly reduced costs and significant option of trading choices.

For those that like incentives and competitors, MEXC usually runs occasions where you can make added crypto. When you register, you can obtain a 1,000 USDT perk by finishing jobs like making transfers and trading. They additionally have routine competitors with huge reward swimming pools.

On The Whole, MEXC is a terrific option if you’re wanting to trade a wide range of cryptocurrencies at really reduced costs. It’s specifically helpful for market manufacturers that require the fastest crypto trading system for effective trading with high liquidity. So, if you’re wanting to conserve cash and profession great deals of various cryptos, MEXC may be the ideal exchange for you.

4. BTCC — Greatest take advantage of crypto exchange readily available in the United States

BTCC is among the most significant cryptocurrency trading systems with quit loss orders available. Initially based in Hong Kong, this exchange has actually had a great deal of ups and downs as a result of transforming Chinese laws. Regardless of these difficulties, BTCC has actually taken care of to remain reputable and is currently readily available in the USA, providing American investors an opportunity to make use of a system recognized for its high take advantage of choices.

BTCC was started in 2011 by Bobby Lee, that is the sibling of Charlie Lee (the man behind Litecoin). For many years, BTCC came to be China’s biggest cryptocurrency exchange. Despite the fact that it needed to quit approving Yuan down payments a couple of times, BTCC has actually transferred to the united state market, where it just handles USD. This adjustment aids BTCC stay clear of the governing problems it encountered previously and establishes it approximately end up being preferred in its brand-new home.

On BTCC, individuals can make use of various kinds of trading orders like market orders, limitation orders, quit orders, and One Terminates Various Other (OCO) orders, throughout an easy user interface. The system additionally sustains stop-loss and tracking stop-loss orders, which are important for taking care of threat and shielding your financial investments.

BTCC generally sustains significant cryptocurrencies like Bitcoin and Ethereum, concentrating on making trading very easy instead of using a substantial selection of electronic properties. This makes it uncomplicated for individuals that want the primary cryptocurrencies.

BTCC’s costs are rather reduced, which is excellent, specifically taking into consideration the high take advantage of it provides. The exchange additionally has its very own multi-currency budget, which includes in its ease and safety and security. Although it sustains just a few money and has high withdrawal costs, its solid customer care and great safety and security make it a strong option for investors.

As BTCC begins its brand-new phase in the USA, it provides excellent advantages, specifically for those trying to find high take advantage of trading. While the future of BTCC in China is still unsure, its lengthy background of great solution and capacity to adjust implies it has an encouraging future worldwide of cryptocurrency.

5. Binance– Most significant crypto exchange with greatest quantity

Binance, a crypto exchange with quit loss and take revenue orders, began in 2017 by Changpeng Zhao, a Chinese-Canadian business owner, has actually swiftly turned into one of one of the most preferred systems for cryptocurrency trading. Its head offices remain in Malta, yet it additionally has workplaces in Japan, Singapore, and the USA. Binance deals with a substantial day-to-day trading quantity of over $2 billion, making it among the most significant exchanges worldwide.

Among the factors Binance is so preferred is its reduced trading costs. They just bill 0.1% for both trading, which is way less than numerous various other exchanges. And also, if you utilize their very own cryptocurrency, Binance Coin (BNB), you obtain a 25% discount rate on these costs. Nonetheless, one drawback is that Binance does not sustain purchasing crypto with routine cash like bucks or euros, which can be troublesome for some individuals.

Safety is incredibly crucial for any type of crypto exchange, and Binance had a significant hack in 2019 where over $40 million well worth of Bitcoin was swiped. Ever since, they have actually boosted their safety and security a whole lot. They currently have two-factor verification, a Secure Possession Fund for Users (SAFU) to cover any type of prospective losses from hacks, and they maintain a lot of the customer funds in freezer (offline) to safeguard them from cyberpunks.

An additional trendy attribute Binance provides is stop-loss and take-profit orders. These devices aid investors handle their threats and secure revenues. A stop-loss order instantly markets your cryptocurrency if the cost goes down to a particular degree, stopping larger losses. On the various other hand, a take-profit order markets your cryptocurrency when the cost gets to a particular degree, guaranteeing you protect your gains.

On The Whole, Binance is a terrific option for anybody thinking about trading cryptocurrencies. It’s a reduced charge crypto exchange, a large option of over 200 various cryptocurrencies, and solid safety and security procedures to maintain individuals’ funds secure. Whether you’re simply starting or you’re a skilled investor, Binance provides a trusted and effective system for all your crypto trading demands.

What is a quit loss?

A quit loss resembles having a safeguard for your crypto financial investments. It’s an order you established that instantly markets your cryptocurrency if its cost goes down to a particular factor. This aids safeguard you from shedding excessive cash if the marketplace instantly transforms versus you.

Consider it as a method to establish a limitation on just how much you agree to shed on a profession. If the marketplace cost strikes your quit degree, your crypto obtains offered instantly, so you do not need to fret about frequently keeping an eye on the marketplace. Making use of a SL is a clever transfer to take care of threat and maintain your financial investment technique on course, also when the marketplace is unforeseeable.

Just how to make use of a quit loss in crypto trading?

Making Use Of an SL when you’re trading cryptocurrencies can aid you take care of threats much better. Right here’s exactly how to do it, detailed:

- Pick crypto exchange: First, you require an account on a crypto exchange that allows you established quits, like Binance or Coinbase Pro. If you do not have an account, register and make it through any type of needed confirmations.

- Develop account and visit: When your account is established, visit with your information. Do not neglect to make use of two-factor verification (2FA) for added safety and security.

- Pick your crypto set: Head over to the trading location and choose both you wish to trade, like BTC/USDT if you’re trading Bitcoin for USDT.

- Locate the stop-loss: Seek the area where you can position stop-loss orders. It may be called “Quit Restriction” or “Quit Market”.

- Establish your SL cost: This is the important component. The quit cost is where your SL triggers. If Bitcoin goes to $50,000 and you do not wish to shed excessive if it goes down, you may establish your quit at $48,000.

- Pick limitation cost: If you’re doing a stop-limit order, you additionally require to establish a limitation cost. This is the least quantity you agree to market your crypto for after the quit is activated. Possibly place this at $47,500.

- Make a decision the quantity: Enter just how much crypto you wish to market if the quit loss hits. If it’s 1 BTC, simply go into “1 BTC”.

- Double-check and location your order: Examine all the information of your stop-loss order like the quit cost, limitation cost, and the quantity. Struck “Location Order” or “Send” to establish it up.

Utilizing it is a clever method to manage your professions without emphasizing excessive. Constantly change your orders based upon what the marketplace is doing and your very own convenience with threat.

Just how we examine and check quit losses

When we assess crypto exchanges, we ensure to extensively look into exactly how they manage quit loss and tracking SL orders. These are incredibly crucial devices for maintaining your financial investments secure.

Below’s exactly how we set about evaluating them:

- Do they have quit loss and tracking SL?

To Begin With, we examine if the exchange also provides both choices. Not every system has these, so it is very important to recognize that does and that does not.

- Just how very easy are they to make use of?

Following, we see exactly how very easy it is to establish these orders up. This implies:

- Mosting likely to the trading area

- Choosing a cryptocurrency to profession

- Establishing a SL order

- Readjusting the setups for a tracking SL

We desire it to be uncomplicated and easy to use.

- Do they function properly?

To ensure these attributes in fact function, we do some examination professions:

- Quit loss orders: We established SL orders at various rates to see if they activate properly when the marketplace strikes those rates.

- Routing orders: We established tracking quits with various tracking total up to examine if they comply with the marketplace and implement appropriately when the cost turns around.

- Are they precise?

Precision is vital. We contrast the implemented rates with the rates we readied to see if there are any type of huge distinctions. A little distinction may be fine as a result of market modifications, yet huge distinctions are a trouble.

- Can you tailor them?

We check out exactly how adjustable these orders are:

- Can you establish various kinds of quit losses, like taken care of or percentage-based?

- Exist progressed choices for even more control?

We favor systems that allow you tailor the order kinds.

- Do they upgrade in actual time?

We examine exactly how swiftly the system updates the condition of quit loss and tracking quits orders. Real-time updates are necessary so you constantly recognize what’s occurring with your professions.

- Just how do they carry out under various market problems?

We check these attributes under different market problems, consisting of high volatility, to see exactly how well the system deals with fast cost modifications. This aids us identify if the exchange’s order implementation system is strong.

By evaluating quit loss and tracking attributes, we guarantee that the exchanges we advise deal reputable and reliable devices for handling your professions and shielding your financial investments.

What is the most effective quit loss technique for crypto?

Ever before enjoyed your crypto financial investment decrease in worth and wanted you had a safeguard to capture it? That’s specifically what an SL can be– an economic safeguard that conserves you from huge losses throughout those wild market swings.

So, what’s the most effective SL technique to make use of when you’re trading cryptocurrencies? Allow’s dive in!

- Evaluate a portion

Among one of the most uncomplicated approaches is the portion quit loss. Right here’s the offer: you select a portion of your financial investment (like 5% or 10%) that you’re fine with shedding, and establish your SL order to sell your crypto if the cost visit that much. It’s basic and maintains points automated, so you do not need to enjoy the marketplace every secondly.

- Utilize a technological quit

For those that like a little bit much more evaluation, a technological SL might be your point. This technique includes making use of technological indications like relocating standards, assistance degrees, or resistance degrees to establish quits.

As an example, if the cost drops listed below a vital assistance degree, it may be an indication to establish a quit loss simply listed below that to stay clear of prospective larger decreases.

- Utilize a tracking quit

Wish to secure revenues while shielding versus losses? That’s where tracking quits enter into play. You established a SL at a particular portion listed below the marketplace cost, and it goes up with the cost.

So, if the cost increases, your quit loss increases as well, yet if the cost begins to drop, the SL remains in location and will certainly activate if the cost strikes that degree. It resembles having your cake and consuming it as well– you protect revenues and limitation losses.

- Integrate approaches

No policy claims you can not blend and match these approaches to match your trading design and objectives. You may make use of a portion SL for component of your financial investment and a technological SL for an additional component based upon various degrees of threat you agree to handle.

Integrating approaches can use even more nuanced control over your financial investments and can adjust to various market problems.

The very best technique for you relies on your threat resistance, financial investment dimension, and exactly how proactively you wish to handle your professions.

FREQUENTLY ASKED QUESTION

What is a great portion of quit loss in crypto?

An excellent portion for a quit loss in crypto is usually in between 5% to 10%, yet it relies on your threat resistance and trading technique.

Does Binance permit quit loss?

Yes, Binance permits SL orders, which you can establish making use of the stop-limit attribute.

Does Coinbase permit quit loss?

Yes, Coinbase Pro permits SL orders to aid handle your professions and reduce prospective losses.

Does Sea serpent have quit loss?

Yes, Sea serpent provides SL orders to aid safeguard your financial investments from considerable cost decreases.

Verdict

Discovering the ideal crypto exchange with quit loss and tracking attributes can be a game-changer for your trading technique. These devices imitate automated safeguard, shielding your financial investments and securing gains also when you’re not proactively trading.

Our group has actually carefully examined over 20 exchanges, assessing vital elements like simplicity of usage, precision, modification choices, and efficiency under various market problems. We have actually highlighted 5 leading exchanges that master offering these necessary attributes, making it less complicated for you to trade with confidence and successfully.

Whether you’re a novice or a skilled investor, making use of exchanges with durable abilities can aid you take care of threats and optimize your returns. Study our referrals and begin trading smarter today!

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.