Bank of America Private Bank’s biennial survey of wealthy Americans disclosed a generational divide in the regarded biggest possibilities for possession financial investment and development.

” What we discovered was some raw distinctions in techniques to spending and frame of mind towards total investing,” Michael Pelzar, head of financial investments at Financial institution of America Private Financial institution, informed Yahoo Financing.

Marketing research firm Escalent evaluated 1,007 high-net-worth Americans in support of Financial institution of America Private Financial Institution. The participants, that were split right into a more youthful friend (ages 21 to 43) and an older friend (44 and older), had a minimum of $3 million in investable possessions besides their main house.

Below’s what Financial institution of America uncovered concerning the more youthful capitalists evaluated:

-

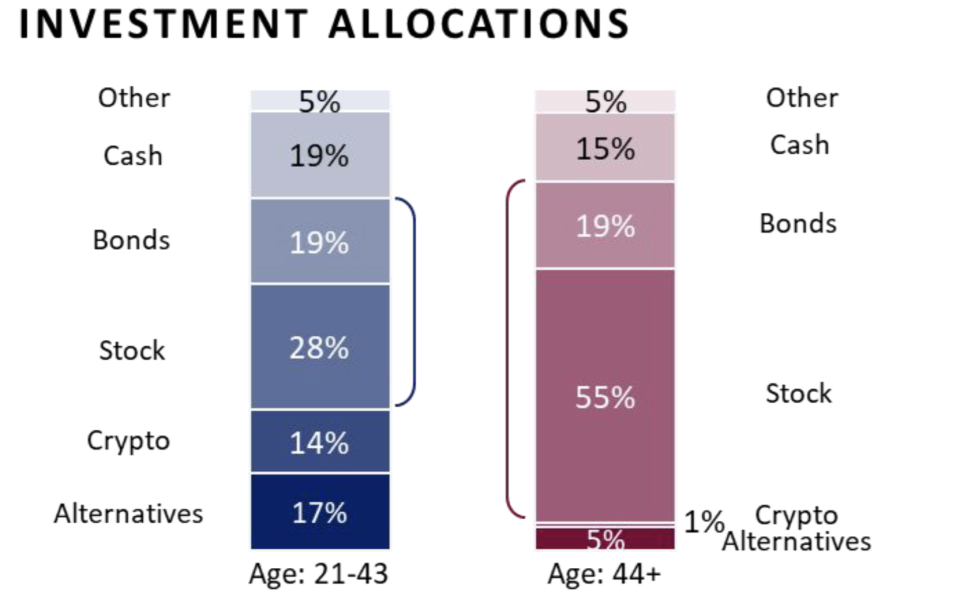

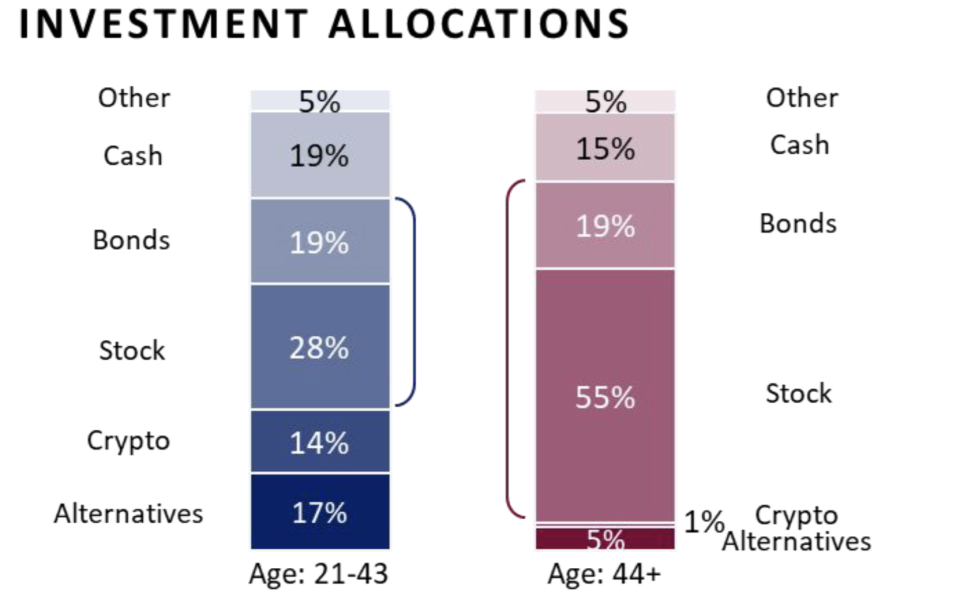

47% of the more youthful friend’s profiles are bought supplies and bonds. That’s a lot less than the older friend (74%).

-

Much more more youthful capitalists are bought different possessions than older capitalists, and mostly all of the more youthful friend (93%) claimed they prepare to designate even more to options in the following couple of years.

-

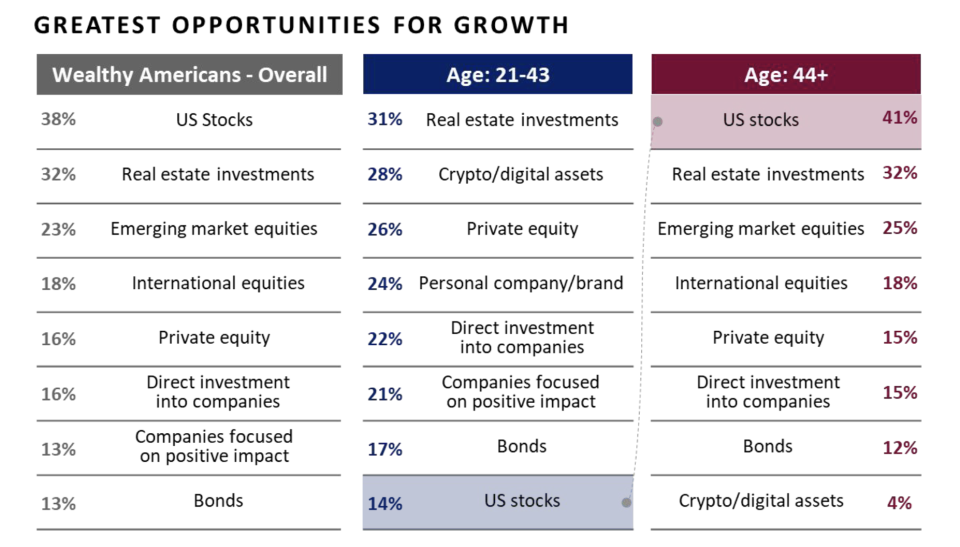

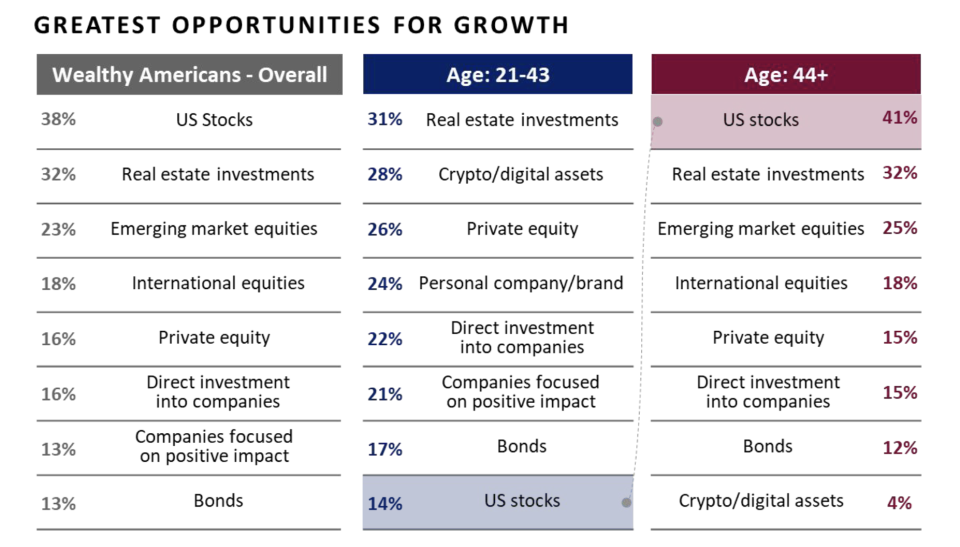

Virtually fifty percent (49%) of the young friend very own cryptocurrencies, and 38% revealed some rate of interest. Behind realty, this friend placed crypto as the leading location for possibility.

-

45% of the more youthful friend very own physical gold as a possession, and an additional 45% claimed they have an interest in having it.

Distinctions in economic expectations drove the differences in financial investment appropriations and where capitalists regard possibilities to be.

Significantly, over 70% of more youthful rich capitalists no more assume it’s feasible to attain above-average financial investment returns by spending solely in a mix of supplies and bonds. On the other hand, just 28% of older capitalists share that sight.

More youthful capitalists’ suspicion over standard financial investments comes as the stock exchange has actually torn greater in 2024. As Myles Udland created today, the S&P 500 (^ GSPC) is up 42% because the start of 2023, pacing an annualized price of return near 26%, or nearly 3 times the ordinary 10% annual return of the index in time.

Nevertheless, Pelzar saw this distinction in perspective as “rather easy to understand,” pointing out the disturbance the more youthful generation has actually experienced in their spending lives.

” The more youthful generation has actually seen in their investing lives 2 market accidents … and afterwards throughout the last couple of years, they have actually seen an enhancing relationship in between supplies and bonds,” Pelzar claimed. “Therefore that’s actually tinted their believing around just how they require to designate possessions in order to produce the returns they search for.”

The study disclosed that the more youthful friend concentrated their possession allowance on options, and numerous revealed strategies to designate much more to these financial investments in the following couple of years.

Pelzar claimed this predicted rise is “mainly reflective” of the more youthful friend’s ideas on the development possibilities in the marketplace. Due to the fact that several of the different possession courses are much less fluid, Pelzar claimed this indicates that the more youthful generation is taking a longer-term sight.

” You see a much various account in between those 2 various associates, and I assume that suggests lessons discovered or points we require to be considering in regards to the financial investment landscape moving forward,” he claimed.

Go here for comprehensive evaluation of the most recent stock exchange information and occasions relocating supply costs

Check out the most recent economic and organization information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.