United States Congressman Matt Gaetz has actually suggested a costs to make government revenue tax obligation payable utilizing Bitcoin.

The costs’s passing away will certainly be a substantial growth for crypto fostering, yet it will certainly additionally have implications for Bitcoin capitalists.

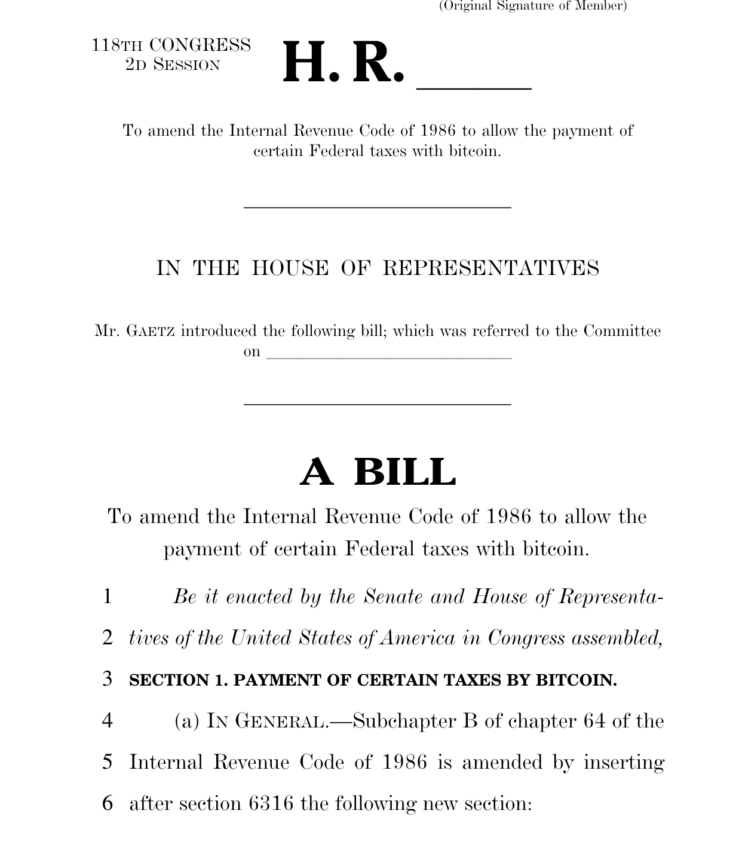

Matt Gaetz Suggests Bitcoin for Federal Earnings Tax Obligations

Florida Rep. Matt Gaetz desires the Internal Earnings Code of 1986 changed to ensure that Government revenue tax obligation comes to be payable in Bitcoin. The costs requires the Treasury to enable any type of tax obligation troubled a taxpayer to be paid with BTC.

In his disagreement, Gaetz sees this as a way to advertising development, raising effectiveness, and providing even more versatility to American people.

“[Treasury to] establish and carry out an approach to permit the repayment with Bitcoin of any type of tax obligation troubled a specific,” reviewed a passage of the proposed bill.

South Carolina Rep Nancy Mace sustains the costs, inclining it to progress her very own proposition on residential property possession.

” Okay hear us out: Utilize your Bitcoin to pay tax obligations with Representative Matt Gaetz’s costs, and secure a home loan with our crypto costs,” wrote Mace.

If it passes, it would certainly note a substantial stride in crypto fostering in the United States. Undoubtedly, it would certainly not just suggest an enormous adjustment in the present United States Treasury code yet additionally birth severe ramifications for Bitcoin capitalists. The federal government would certainly require to capitalize these holdings whenever it requires to resolve its expenditures, triggering supply shocks.

To place it in point of view, the overall quantity of Federal income tax paid by US taxpayers in 2023 was around $1.7 trillion. Thinking just a tiny portion of these people, state 1%, would certainly pay their tax obligations in Bitcoin, it would certainly equate to around $18 billion in Bitcoin provided to the federal government.

Nonetheless, presenting Bitcoin repayments for tax obligations would certainly call for clear governing standards and lawful structures to make sure conformity and avoid possible abuse of the system. Unpredictability or governing adjustments associated with tax obligation repayments in Bitcoin can additionally impact market view and BTC cost.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to supply precise, prompt info. Nonetheless, viewers are recommended to confirm truths individually and seek advice from an expert prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.