On-chain information reveals the Bitcoin Supply in Earnings has actually taken a substantial hit complying with the collision the cryptocurrency has actually seen just recently.

Bitcoin Supply In Earnings Dropped To Around 81% Throughout The Collision

As clarified by an expert in a CryptoQuant Quicktake post, the most recent drawdown in the cryptocurrency has actually led to a section of the supply going undersea.

The on-chain sign of significance right here is the “Supply in Earnings,” which, as its name recommends, determines the portion of the overall distributing Bitcoin supply presently lugging some latent earnings.

This statistics jobs by experiencing the deal background of each coin in flow to locate what cost it was last relocated at. Thinking that this last deal of the coin was the last time it transformed hands, the cost at the time would certainly represent its present price basis.

Thus, if the present place cost of the cryptocurrency is more than this price basis, the coin might be taken into consideration to be to holding some earnings today. The Supply in Earnings builds up all coins satisfying this problem and computes what portion of the supply they offset.

Normally, a contrary statistics called the “Supply in Loss” keeps an eye on the remainder of the coins. Considering that the overall supply should amount to 100%, this last sign’s worth can likewise merely be discovered by deducting the Supply in Benefit from 100.

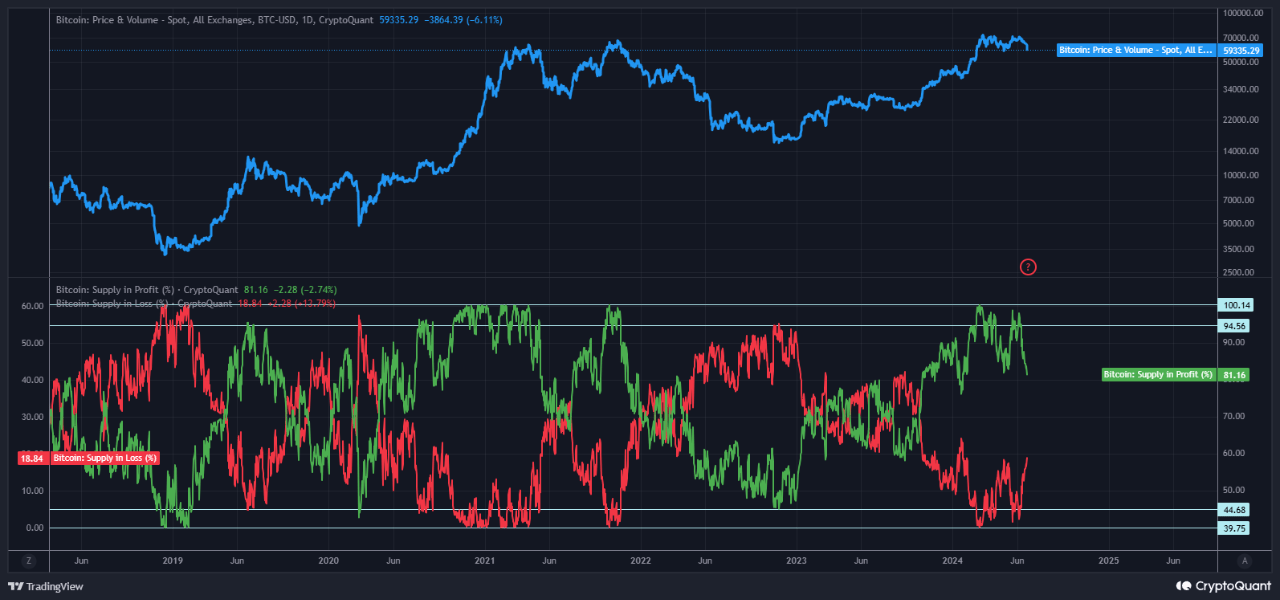

Currently, right here is a graph that reveals the pattern in both of these indications for Bitcoin over the last couple of years:

Appears Like the Supply in Earnings has actually been dropping in current days|Resource: CryptoQuant

As presented in the above chart, the Bitcoin Supply in Earnings has actually observed a sharp dive together with the most recent drawdown that the property’s cost has actually experienced.

At the most affordable factor of this collision, Bitcoin had briefly slid under $60,000, which had actually sent out the Supply in Earnings to around 81%. Normally, the Supply in Loss had actually all at once seen an increase to 19%.

” Currently, every little thing appears to be advancing generally, with the retracement complying with a common pattern,” keeps in mind the quant. “If the cost goes down a little bit extra, we prepare for that the revenue portion will certainly be up to the 70-76 variety.”

Currently, what’s the significance of this sign to the cryptocurrency’s cost? Statistically, the financiers in revenue are more probable to market than those lugging loss, so a huge quantity of owners remaining in the eco-friendly might increase the opportunity of a mass selloff happening on the market.

As a result of this factor, a cooldown in the Supply in Earnings can really be a favorable advancement for the cryptocurrency, as it recommends there are less possible vendors left.

Today, the sign’s worth is still fairly high for Bitcoin, however it ought to be kept in mind that throughout favorable durations, the statistics normally often tends to hug high degrees, so a decrease of the present level might be sufficient for the property to get to a base.

The reduced back in Might, for instance, likewise took place together with comparable degrees of Supply in Earnings. It currently stays to be seen whether the most recent worths of the sign will certainly likewise bring about an additional base for the cryptocurrency.

BTC Cost

Bitcoin has actually seen a small rebound given that its dive under $60,000 as the coin’s cost is currently back over $61,000.

The cost of the coin shows up to have actually experienced a dive over the last number of days|Resource: BTCUSD on TradingView

Included picture from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.