Quarterly revenues outcomes are a great time to sign in on a business’s development, specifically contrasted to its peers in the exact same market. Today we are taking a look at Genesco (NYSE: GCO) and the most effective and worst entertainers in the shoes sector.

Prior to the development of the web, designs altered, however customers mostly purchased footwear by seeing regional brick-and-mortar footwear, division, and specialized shops. Today, not just do designs transform much more often as crazes take a trip via social media sites and the web however customers are additionally moving the means they acquire their products, preferring omnichannel and shopping experiences. Some shoes business have actually made collective initiatives to adjust while those that are slower to relocate might fall back.

The 8 shoes supplies we track reported a solid Q1; typically, profits defeat expert agreement price quotes by 4.1%. while following quarter’s income support remained in line with agreement. Supplies– specifically those trading at greater multiples– had a solid end of 2023, however 2024 has actually seen durations of volatility. Combined signals regarding rising cost of living have actually caused unpredictability around price cuts, however shoes supplies have actually revealed durability, with share rates up 8.8% typically considering that the previous revenues outcomes.

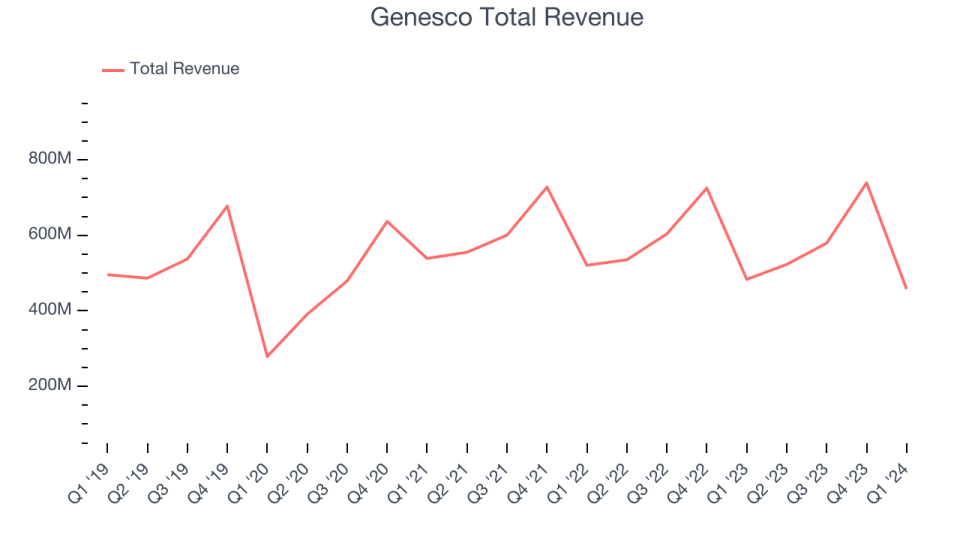

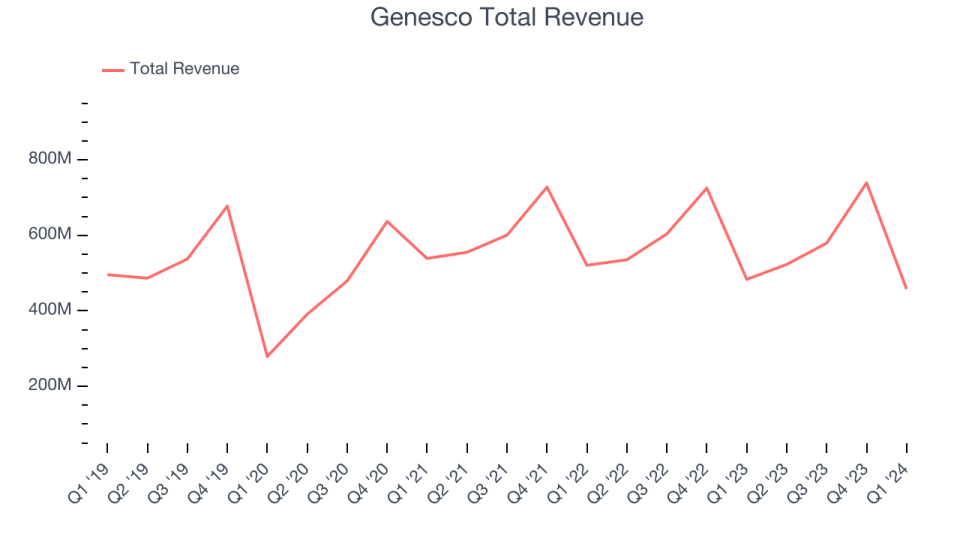

Ideal Q1: Genesco (NYSE: GCO)

Covering a wide variety of designs, brand names, and rates, Genesco (NYSE: GCO) markets shoes, garments, and devices via numerous brand names and banners.

Genesco reported profits of $457.6 million, down 5.3% year on year, covering experts’ assumptions by 2.7%. It was an excellent quarter for the business, with confident revenues support for the complete year and a strong beat of experts’ revenues price quotes.

Mimi E. Vaughn, Genesco’s Board Chair, Head Of State and Ceo, stated, “Versus proceeded headwinds in the operating setting, we implemented to our calculated strategy to supply leading and fundamental outcomes that led our assumptions, led by our Journeys company. With brand-new Journeys management in position, I am motivated by the grip we are seeing so far, as we function to significantly speed up the enhancement, boost our item varieties and improve the experience for our customers. In the meanwhile, our initiatives to decrease expenses and maximize our shop profile are causing a leaner, much more efficient operating version, which will certainly offer a wonderful revenue tailwind as our sales boost.”

The supply is down 7.7% considering that the outcomes and presently trades at $25.21.

Is currently the moment to acquire Genesco? Access our full analysis of the earnings results here, it’s free.

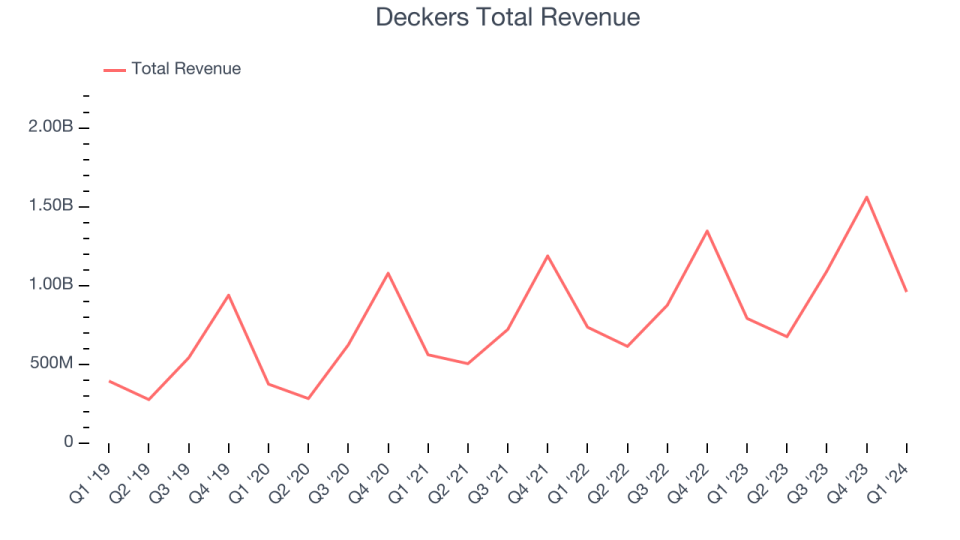

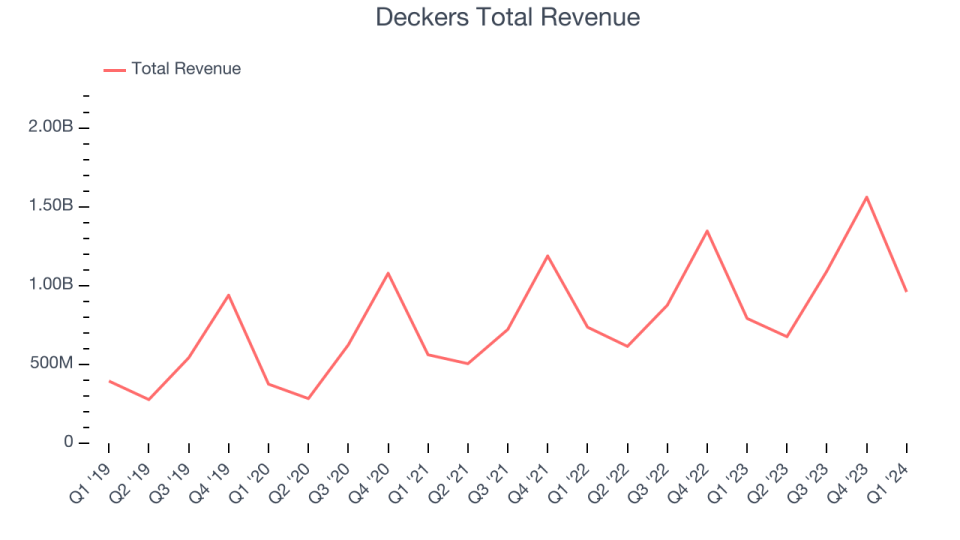

Deckers (NYSE: DECK)

Developed in 1973, Deckers (NYSE: DECK) is a shoes and garments corporation with a profile of way of living and efficiency brand names.

Deckers reported profits of $959.8 million, up 21.2% year on year, outshining experts’ assumptions by 8%. It was an extremely solid quarter for the business, with an excellent beat of experts’ continuous money income price quotes.

Deckers carried out the fastest income development amongst its peers. The supply is up 8.3% considering that the outcomes and presently trades at $980.

Is currently the moment to acquire Deckers? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Wolverine Worldwide (NYSE: WWW)

Established In 1883, Wolverine Worldwide (NYSE: WWW) is an international shoes business with a varied profile of brand names consisting of Merrell, Hush Puppies, and Saucony.

Wolverine Worldwide reported profits of $390.8 million, down 24.5% year on year, going beyond experts’ assumptions by 8.1%. It was an okay quarter for the business, with an excellent beat of experts’ revenues price quotes however a miss out on of experts’ operating margin price quotes.

Wolverine Worldwide provided the most significant expert approximates beat however had the slowest income development and slowest income development in the team. The supply is up 22.2% considering that the outcomes and presently trades at $13.95.

Read our full analysis of Wolverine Worldwide’s results here.

Caleres (NYSE: CAL)

The proprietor of Dr. Scholl’s, Caleres (NYSE: CAL) is a shoes business providing a series of designs.

Caleres reported profits of $659.2 million, down 0.5% year on year, disappointing experts’ assumptions by 0.8%. It was a strong quarter for the business, with confident revenues support for the following quarter and a slim beat of experts’ operating margin price quotes.

Caleres had the weakest efficiency versus expert price quotes amongst its peers. The supply is down 5.6% considering that the outcomes and presently trades at $34.6.

Read our full, actionable report on Caleres here, it’s free.

Nike (NYSE: NKE)

Initially offering Japanese Onitsuka Tiger tennis shoes as Blue Bow Sports, Nike (NYSE: NKE) is an international titan in sports shoes, garments, tools, and devices.

Nike reported profits of $12.43 billion, level year on year, exceeding experts’ assumptions by 1.1%. It was an okay quarter for the business, with a slim beat of experts’ operating margin price quotes.

The supply is down 3.6% considering that the outcomes and presently trades at $97.2.

Read our full, actionable report on Nike here, it’s free.

Sign Up With Paid Supply Capitalist Study

Assist us make StockStory much more valuable to capitalists like on your own. Join our paid customer study session and get a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.