Expert anticipates much less market chaos than at first been afraid as Mt. Gox starts payments to lenders in July 2024. This growth is crucial for the cryptocurrency market, which just recently saw considerable volatility.

When a leading Bitcoin exchange, Mt. Gox encountered personal bankruptcy in 2014, leaving hundreds of lenders in limbo.

Expert Quotes That Mt. Gox Creditors Will Offer Just 6,500 BTC

As the trustee introduced the start of payments, the marketplace reacted with a sharp decrease in Bitcoin costs, diving to $58,500. Bitcoin saw this degree for the very first time after May 3. Nonetheless, the rate swiftly recoiled to over $61,300, showcasing the strength of the crypto market.

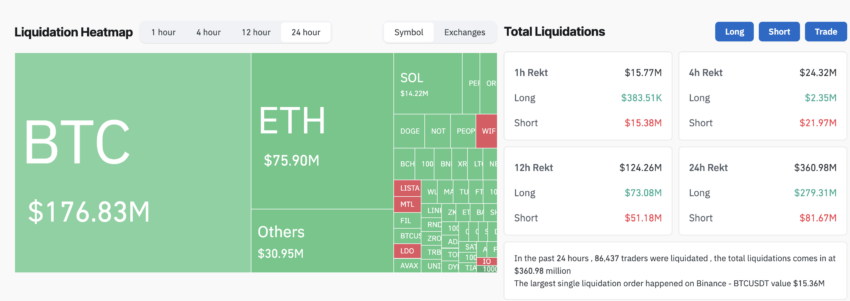

Regardless of the first panic that activated over $360 million in liquidations within 24-hour and proceeded discharges from Bitcoin ETFs, the stress and anxiety appeared brief.

Find Out More: Leading Crypto Bankruptcies: What You Required To Know

Alex Thorn, Galaxy’s head of research study, provides an evaluation that counters the pertinent market view. According to Thorn, the real effect of the Mt. Gox circulation on Bitcoin’s marketing stress could be overstated.

” Financial institutions have actually been embeded Mt Gox personal bankruptcy for 10+ years. Ultimately, Trustee states the in-kind circulation of Bitcoin and Bitcoin Money will certainly start in July. We assume less BTC will certainly be dispersed than individuals assume which it will certainly create much less Bitcoin offer stress than market anticipates,” Thorn explained.

He bases his evaluation on extensive testimonials of personal bankruptcy filings and conversations with lenders.

Historic information exposes that Mt. Gox shed roughly 940,000 BTC, recuperating just 15% (141,868 BTC). These properties, at first valued at around $63.9 million, have actually currently swollen in worth to around $9 billion because of Bitcoin’s rate boost. Regardless of the considerable capacity commercial, the problems of the payment could urge lenders to keep their properties instead of offer.

Thorn described numerous reasons that specific lenders could stand up to offering their recently gotten Bitcoin.

” A lot of these lenders are lasting Bitcoiners, very early adopters that are technically experienced and have actually formerly turned down hostile deals to liquidate their insurance claims for cash money,” henoted

Furthermore, the considerable resources gains on these properties would certainly indicate substantial tax obligations for those choosing to offer.

After reductions for very early payments, specific lenders will certainly obtain roughly 65,000 BTC. Furthermore, also if a portion, roughly 10%, of the 65,000 BTC dispersed to specific lenders were to be offered, this would certainly stand for simply 6,500 BTC going into the marketplace. This is much much less turbulent than market worries recommend.

Find Out More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

The Majority Of these BTC are readied to be transferred straight right into accounts at crypto exchanges like Sea serpent and Bitstamp, where the facilities is currently in position to deal with such deals effortlessly. At the same time, numerous others think that factors besides Mt. Gox’s redistribution panic have actually likewise added to Bitcoin’s dip.

” Bitcoin is the most effective alarm in markets today. This rate dump is most likely much less concerning Mt. Gox coins being offered and extra concerning some liquidity situation imminent that is spreading behind the scenes,” Marty Bent said.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to supply exact, prompt details. Nonetheless, viewers are encouraged to confirm truths individually and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.