Aerospace and protection firm AeroVironment (NASDAQGS: AVAV) will certainly be introducing revenues outcomes tomorrow after market hours. Below’s what capitalists must understand.

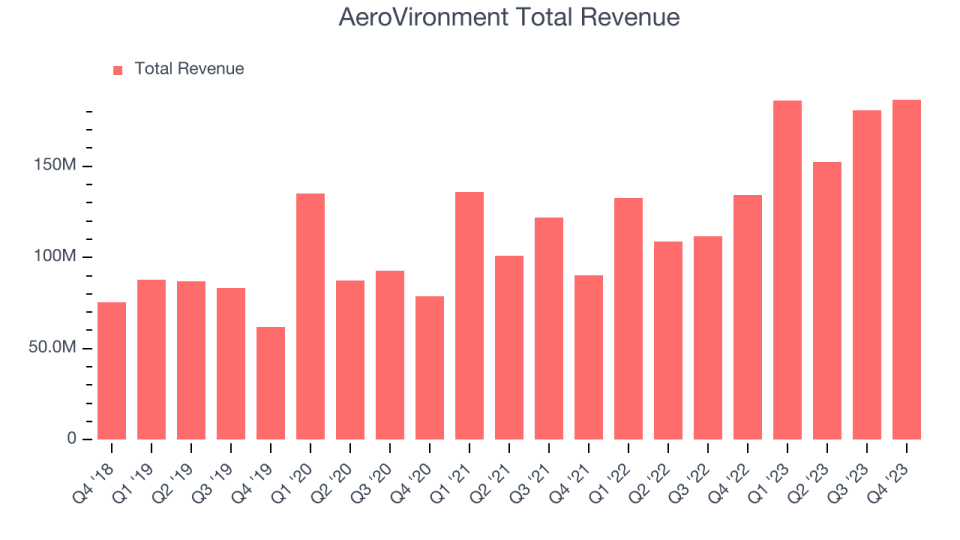

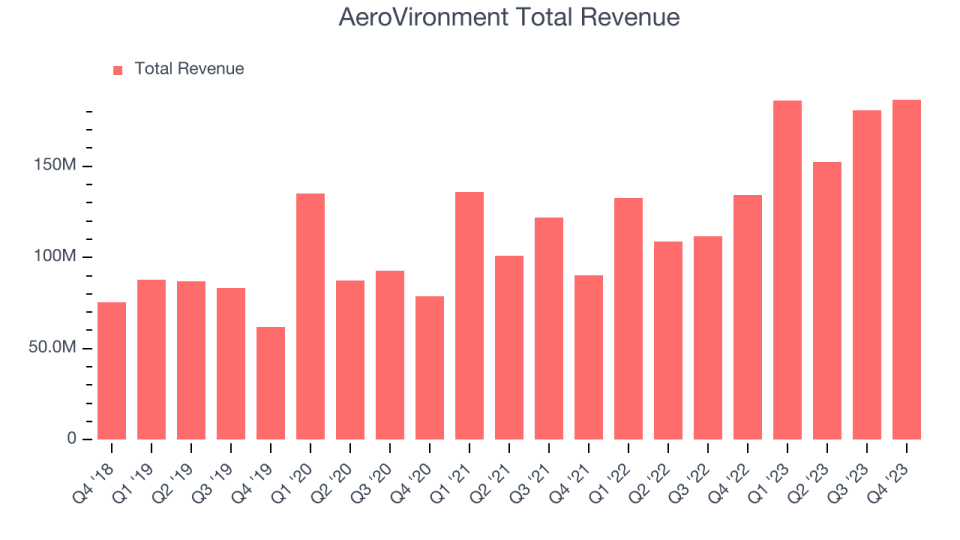

AeroVironment defeated experts’ profits assumptions by 8.4% last quarter, reporting incomes of $186.6 million, up 38.8% year on year. It was a really solid quarter for the firm, with an outstanding beat of experts’ revenues quotes.

Is AeroVironment a buy or offer entering into revenues? Read our full analysis here, it’s free.

This quarter, experts are anticipating AeroVironment’s profits to expand 1.6% year on year to $189.1 million, slowing down from the 40.3% rise it videotaped in the very same quarter in 2014. Readjusted revenues are anticipated ahead in at $0.21 per share.

Most of experts covering the firm have actually reconfirmed their quotes over the last thirty days, recommending they prepare for business to persevere heading right into revenues. AeroVironment has actually missed out on Wall surface Road’s profits approximates two times over the last 2 years.

With AeroVironment being the very first amongst its peers to report revenues this period, we do not have anywhere else to seek to obtain a mean exactly how this quarter will certainly untangle for aerospace and protection supplies.

Unless you have actually been living under a rock, it ought to be apparent now that generative AI is mosting likely to have a massive influence on exactly how big companies operate. While Nvidia and AMD are trading near to all-time highs, we choose a lesser-known (however still rewarding) semiconductor supply taking advantage of the surge of AI. Click here to access our free report on our favorite semiconductor growth story.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.